Maintaining the Illusion of Stability Now Requires Ever-Greater Extremes

July 10, 2015

This much-needed re-set to an economy that serves the many rather than the few is what the Powers That Be are so fearful of.

On the surface, everything still looks remarkably stable in the core industrial economies. The stock markets in Japan, Germany and the U.S. are only a few percentage points off their highs, and we're constantly assured that inflation no longer exists and official unemployment is low.

In other words, other than the spot of bother in Greece, life is good. Anyone who signs on the dotted line for easy credit can go to college, buy a car or house or get another credit card.

With more credit, everything becomes possible. With unlimited credit, the sky's the limit, and it shows.

Europe is awash with tourists from the U.S., China and elsewhere, and restaurants are jammed in San Francisco and New York City, where small flats now routinely fetch well over $1 million.

In politics, the American public is being offered a choice of two calcified, dysfunctional aristocracies in 2016: brittleness is being passed off as stability, not just in politics but in the economy and the cultural zeitgeist.

But surface stability is all the status quo can manage at this point, because the machine is shaking itself to pieces just maintaining the brittle illusion of prosperity and order.

Consider what happened in Greece beneath the surface theatrics.

1. Goldman Sachs conspired with Greece's corrupt kleptocracy to conjure up an illusion of solvency and fiscal prudence so Greece could join the Eurozone.

2. Vested interests and insiders gorged on the credit being offered by German and French banks, enriching themselves to the tune of tens of billions of euros, which were transferred to private accounts in Switzerland at the first whiff of trouble. When informed of this, Greek authorities took no action; after all, why track down your cronies and force them to pay taxes when tax evasion is the status quo for financial elites?

3. If Greece had defaulted in 2010 when its debt was around 110 billion euros, the losses would have fallen on the banks that had foolishly lent the money without proper due diligence or risk management. This is what should have happened in a market economy: those who foolishly lent extraordinary sums to poor credit risks take the resulting (and entirely predictable) losses.

4. But since the big European banks that were on the hook for the 110 billion in bad debt were highly leveraged (estimates are 30 to 1), then a mere 5% loss in their capital would render them insolvent--a Lehman Moment of cascading defaults that the European leadership could not allow, as not only would their cronies lose fortunes but they would lose power when the fragile house of cards they'd constructed collapsed.

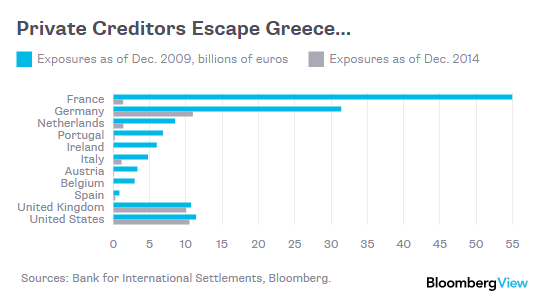

Here is the debt in 2009--mostly owed to private banks and bondholders:

5. The status quo's solution: transfer all the private bank debt to the taxpayers of the Eurozone members and loan Greece another 200+ billion euros in exchange for the illusion of reform and a squeezing of average Greek households to pay the interest due on the ballooning debt.

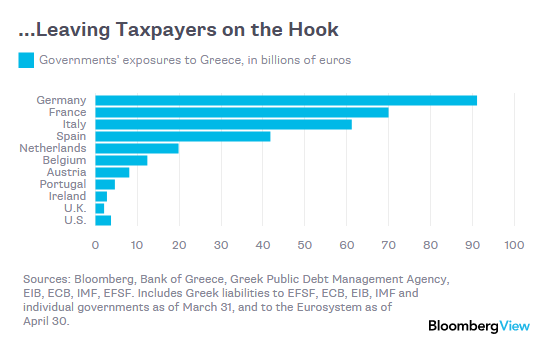

Here is the debt in 2015--almost all was shifted onto the backs of Eurozone taxpayers:

6. Five years later, the debt has exploded to 340 billion euros, triple the debt that should have been written off in 2010 when it became clear Greece could not pay the debt down or even service the interest payments.

7. Five years of austerity and suffering by the Greek people have all been for naught, as the entire euro system is untenable, the debt cannot be paid and the simulacra reforms did nothing to change the power structure or the corrupt, dysfunctional status quo in the country.

8. To maintain the surface illusion of stability for five years, the Powers That Be tripled the debt, vastly increased the risk of default and the damage a default would unleash, and caused undue suffering above and beyond the costs of default and a return to a national currency--a re-set that, if undertaken when it became clear there was no way the debt could be paid in 2010, would already be over and done.

This re-set, while painful in the short-term, is the only mechanism available to force reforms on a self-serving kleptocracy and rid the economy of a dependence on unsustainable credit expansion.

This much-needed re-set to an economy that serves the many rather than the few is what the Powers That Be are so fearful of, for it is the few who garner most of the gains of a corrupt, fully financialized neofeudal system and it is these few who fund the election campaigns of the politicos who are so desperate to maintain the perquisites of the Financial Nobility.

Austerity is meted out to debt-serfs while those at the top transfer tens of billions to their private accounts.

There are variations of this basic flow of income from serfs to the nobility, of course; stock market bubbles are inflated by authorities, insiders sell, sell, sell as credulous banana merchants and wage-earners buy, and then when the bubble bursts, these same authorities ban selling by the small-fry bagholders.

But this is not real stability; it is a brittle simulacrum of stability, an illusion that has required the status quo to pursue extremes of policy and debt that are intrinsically incapable of yielding stability.

In effect, the status quo has greatly increased the system's vulnerability, fragility and brittleness--the necessary conditions for catastrophic collapse--all in the name of maintaining a completely bogus facade of stability for a few more years.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Mickey B. ($200), for your outrageously generous contribution to this site-- I am greatly honored by your steadfast support and readership. |