What Poisoned America?

February 18, 2021

America's financial system is nothing more than a toxic waste dump of speculation, fraud,

collusion, corruption and rampant profiteering.

What Poisoned America? The list of suspects is long: systemic bias, special interests

dominating politics, political polarization, globalization and the offshoring of productive capacity,

over-regulation, the rise of rapacious cartels and monopolies, Big Tech's gulag of the mind,

the permanent adolescence of consumerism, permanent global war, to name a few.

The question boils down to this: what problems cannot be addressed by the status quo?

Most of the

ills listed above can be addressed with existing mechanisms of governance and adaptation. For example,

consider systemic bias. The U.S. Armed Forces have demonstrably led the way in dramatically reducing

systemic bias via performance-based advancement. The rest of America would do well to copy these

organizational improvements.

Many of the other ills could be addressed within current systems of governance--antitrust, etc.

The two that appear impervious to reform are 1) soaring wealth-income-power inequality and 2)

the dominance of special interests. In both cases, the corporate foxes are guarding the

hen house, so any reforms with real teeth are watered down to PR by those reaping the vast majority

of the financial gains. Corporate profits are in the billions while you can buy elected officials'

cooperation for mere millions. There is no way to get around that asymmetry.

I would propose an even deeper systemic poison: zero-interest yield on capital. For a variety

of reasons, the yield on capital is either zero or less than zero if we factor in inflation.

We now earn (heh) 0.1% on our cash while inflation is somewhere between the "official" rate of

3% and more real-world measures between 5% and 10%.

This is a significant change from the days when savings (in savings and loans institutions)

earned 5.25% by regulation.

While ordinary capital earns nothing (or less than zero), the capital and income of the top 0.01%

has rocketed to unprecedented levels. This vast asymmetry is poisoning America, and the financial

system, from the Federal Reserve on down, is incapable of addressing it other than making it even more

distorted and destructive by doing more of what's failed spectacularly.

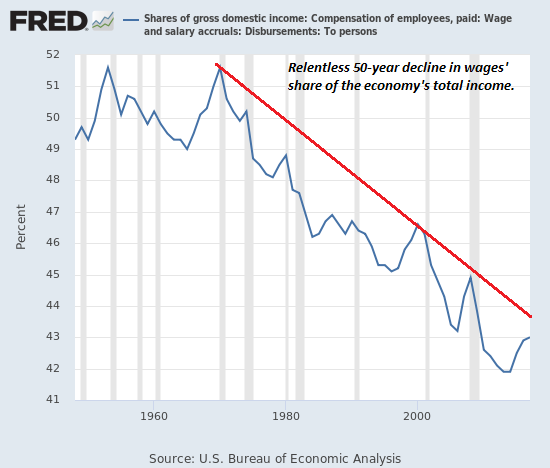

To understand why yields on capital have fallen to zero while wealth-income has flowed to the

top elites, we need to look at wages share of the economy and capital's share of the economy.

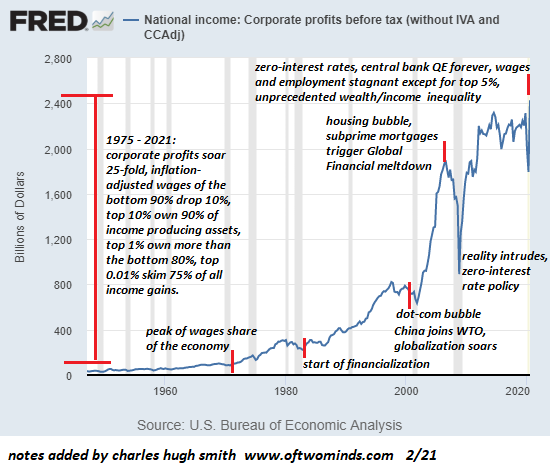

Wages share (i.e. labors' share) has been falling for the past 45 years, while corporate profits

and the wealth of America's top tier has soared. (see chart below)

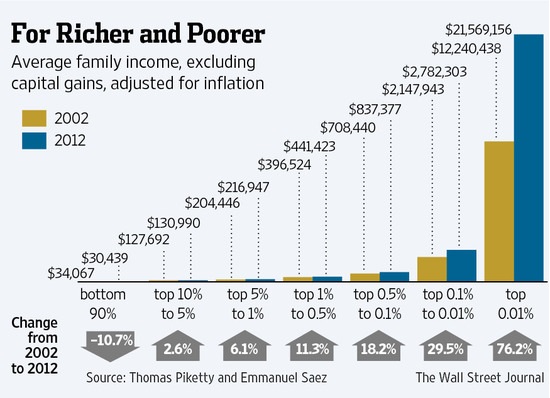

It is not coincidence that as interest rates fell to zero the wealth and income of the top 0.01%

soared while ordinary wage income fell 10% when adjusted for the purchasing power of the earnings.

A recent report prepared by the RAND Corporation,

Trends in Income From 1975 to 2018, documents that $50 trillion

in earnings has been transferred to owners of capital from the bottom 90% of

American households in the past 45 years.

What happens when the purchasing power of the earnings of the bottom 90% declines for decades?

(Even high-earners such as doctors have experienced a decline in the purchasing power of their earnings

since 1975.) Households cannot borrow as much money as they once could because their earnings

simply don't go as far; there is less disposable income to support more debt service.

What happens when corporate profits skyrocket as jobs are offshored and corporations arbitrage

all the goodies of globalization? The corporations don't need to borrow as much money as they

have trillions in profits to work with.

In other words, demand for credit stagnates while at the same time, the Federal Reserve has flooded

the economy with near-zero rate credit. Demand has stagnated along with wages while supply has

rocketed into the trillions thanks to unprecedented central bank credit creation.

The reason why central banks have slashed rates

to zero is obvious: if the bottom 90% can't borrow more money at 5% to consume more goods

and services, they can certainly borrow more

at 1.5% because the interest part of their monthly payment drops significantly.

And sure enough, crushing rates to near-zero has triggered refinancing/housing bubbles and generated

high auto-truck sales based on a few dollars down and 1.9% auto financing.

In other words: as the purchasing power of wages has relentlessly declined, the "fix" is to

substitute debt for earnings. The fact that eventually stagnating earnings cannot support

more debt at any rate of interest is inconvenient, so it's been ignored.

Zero-interest rates has played out differently in Corporate America: since capital is so cheap

to borrow, why not borrow a few billion dollars at 1.5% and use the money to buy back shares of the

company's stock, which generates a hefty 10% annual increase in the share price? Indeed, why not?

And why not use that cheap capital to automate tasks to reduce costly American labor and move even

more staff overseas to low-wage nations? Indeed, why not? Maximizing profits demands it, and the

near-zero cost of capital incentivizes it.

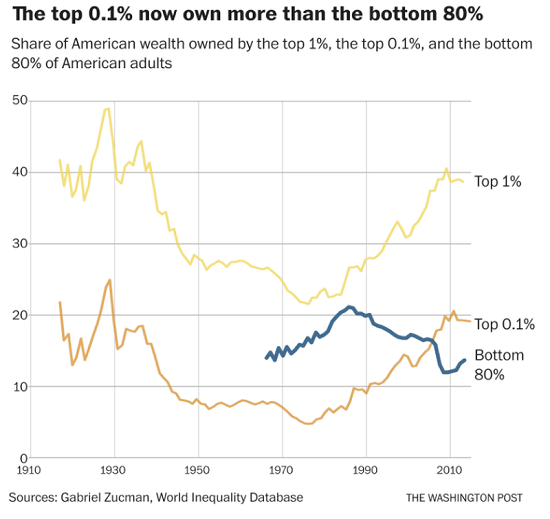

The net result of near-zero yields on capital? The top 0.1% own more wealth than the bottom 80%.

Roughly 75% of all income gains have gone to the top 0.01%.

This extreme asymmetry has poisoned American society and its economy. This immense distortion

in the cost of capital can best be understood by asking: what happens when a resource is free?

The answer is that it's squandered. But the squandering is only part of the problem.

Consider what happened when air and water were "free". Both the air and water became toxic

waste dumps, and American rivers infamously caught on fire. The same is true of "free" capital:

America's financial system is nothing more than a toxic waste dump of extreme speculation, fraud,

collusion, corruption and rampant profiteering.

The rivers are on fire but the Federal Reserve's plan remains the same: keep the cost of

capital at "free" so the extremes of speculation can run to failure. The run to failure

will be as extreme as the asymmetries that have poisoned America.

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

My new book is available!

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

20% and 15% discounts (Kindle $7, print $17,

audiobook now available $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Podcasts:

Local and Decentralised Economies: The Start Of A New Environmentalism (54 min)

AxisOfEasy Salon #37: The Tension Between Nation State Conformity and Network State Cacophony (51 minutes)

My COVID-19 Pandemic Posts

My recent books:

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic

($5 (Kindle), $10 (print), (

audiobook):

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake

$1.29 (Kindle), $8.95 (print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print)

Read the first section for free (PDF).

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Kim J. ($10/month), for your outrageously generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Kienly H. ($5/month), for your marvelously generous pledge to this site -- I am greatly honored by your steadfast support and readership. |

|