A Market Crash and Recession Are Bullish, Not Bearish

February 10, 2026

This isn't "Capitalism," it's Model Collapse ushering in the inevitable conflagration.

Thank you, Richard C. ($70), for your massively generous subscription

to this site -- I am greatly honored by your support and readership.

Thank you, Bill ($7/month), for your magnificently generous subscription

to this site -- I am greatly honored by your support and readership.

Thank you, Buppa68 ($7/month) for your superbly generous subscription

to this site -- I am greatly honored by your support and readership.

Thank you, Catatonic ($7/month) for your splendidly generous subscription

to this site -- I am greatly honored by your support and readership.

One of the most peculiar hyper-normalized hallucinations about "Capitalism" is that markets and the economy "should always go up" and if they don't, something is terribly wrong and somebody better do something to fix it.

Remarkably, this hyper-normalized hallucination is the exact opposite of real-world "Capitalism," which relies on the periodic clearing of excesses of debt, leverage and speculation as its essential mechanism of self-correction and adaptation. If these are stripped out, "Capitalism" fails as a system.

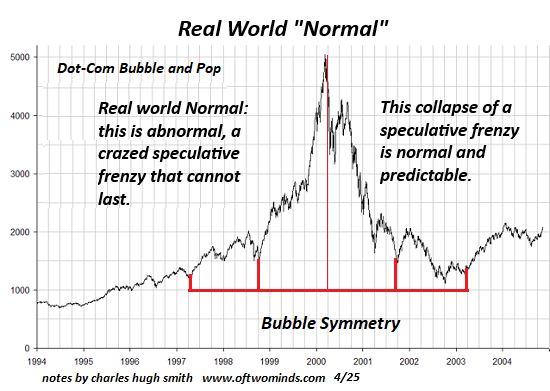

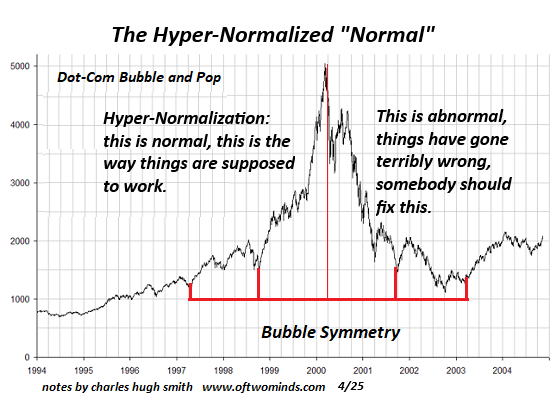

The two charts of the NASDAQ stock index below illustrate the astounding divide between a real-world understanding of "Capitalism" and the hyper-normalized hallucination of always goes up "Capitalism."

Various justifications are trotted out to support the "markets and GDP should always go up" narrative:

1. There's always a Bull Market somewhere. In other words, the market and "growth" are always going up somewhere, and so rotating out of flat sectors into growing sectors enables markets to always go up.

2. The economy can no longer survive a market crash or recession, and so we can't allow either to happen. Spoiler alert: If the market and economy cannot survive self-correction, then "Capitalism" as a system has already failed.

3. The Federal Reserve has mastered the art of manipulating--oops, I mean managing--the market and economy via adjusting the dials of liquidity, stimulus, money supply, cost of credit, etc. As a happy result of their god-like financial powers, markets and GDP will never go down again, barring an alien invasion or asteroid strike.

These justifications overlook the need for systems to self-correct self-reinforcing excesses that reflect the inevitable self-reinforcing human emotions: greed / confidence and doubt / fear: soaring markets generate demand for more credit and leverage to boost higher risk gambles which in the euphoria of the bubble are perceived as guaranteed to win rather than guaranteed to fail.

Given that the core functions of capitalism require feedback that correct / clear excesses, these justifications are incoherent. Dynamic systems such as capitalism don't remain in a steady state; they are constantly in motion, and humanity's herd instinct and built-in attraction to windfalls will inevitably generate the madness of crowds which then generate excesses of borrowing, leverage, risk and speculation, all of which must be reset via market crashes and recessions.

If corrective market crashes and recessions are not allowed (via ever higher stimulus, moral-hazard backstops of the biggest gamblers, etc.), then the system becomes increasingly brittle and dependent on hallucinations such as "markets can always go up, and so they should always go up."

Actually, excesses must be wiped out to enable markets and economies to reset organically rather than kept aloft by centrally organized manipulation. The forest fire analogy explains this: routine, periodic fires burn off the deadwood that piles up in a forest, clearing space for new growth. If these healthy fires are suppressed, the deadwood (debt, leverage, speculation, moral hazard) reach dangerous extremes: when a fire finally ignites, the conflagration consumes the entire forest.

This is how markets clear excesses of speculation and risk: they crash 80% and reset over a period of years. Though the crash is naturally viewed as disastrously bearish by those absorbing the losses, it's ultimately bullish for the economy and market, as suppressing the self-correction generates system collapse.

This is how the incoherent, system-failure hallucination views this bullish process: quick, do more of what crippled the system to maintain the illusion that "Capitalism" is "markets always go up."

This isn't "Capitalism," it's Model Collapse ushering in the inevitable conflagration.

My new book Investing In Revolution is available at a 10% discount ($18 for the paperback, $24 for the hardcover and $8.95 for the ebook edition).

Introduction (free)

Check out my updated Books and Films.

Become

a $3/month patron of my work via patreon.com

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.