Central Banks: From Coordination to Competition

January 22, 2018

This is one reason why I anticipate "unexpected" disruptions in the global economy in 2018.

The mere mention of "central banks" will likely turn off many readers who understandably have little interest in convoluted policies and arcane mumbo-jumbo, but bear with me for a few paragraphs while I make the case for something to happen in 2018 that will impact us all to some degree.

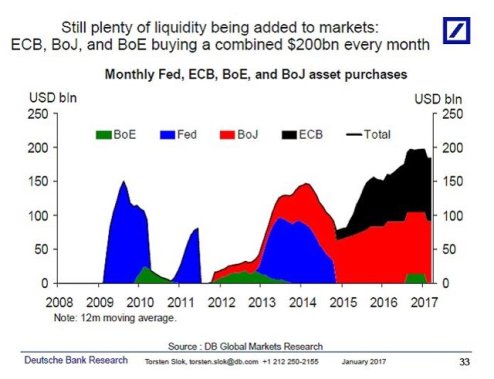

That something is the decay of the synchronized central bank stimulus policies that have pumped trillions of dollars, yuan, yen and euros into the global financial markets over the past nine years. Here are two charts that depict the "tag team" coordinated approach central banks have deployed: when one CB tapers its stimulus, another ramps up its money-creation/asset-purchases stimulus:

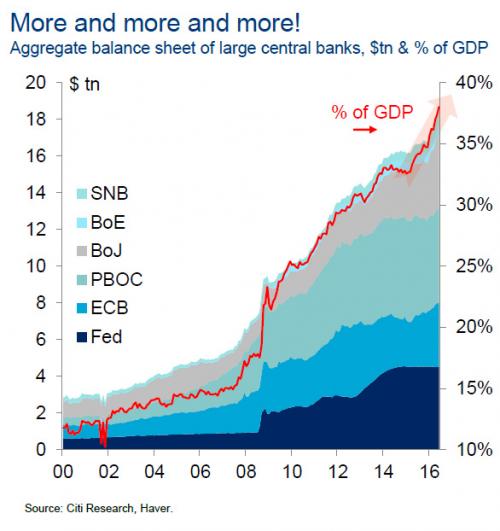

The balance sheets of all the primary central banks added together is astronomical:

This team effort is motivated by self-interest, of course; no one central bank can reflate the entire global economy, and yet that is the only way to reflate each nation/bloc's own economy, given the global connectedness of the modern economy.

But the threads of mutual self-interest are fraying. At this late stage in the credit cycle, the central banks must begin "tapering", i.e. diminishing and then ending their stimulus policies and eventually reducing their balance sheets by selling assets they bought in the stimulus phase (or simply stop replacing bonds they own that mature).

The Federal Reserve was first out of the gate in launching quasi-unlimited bond purchases, and it was the first central bank to cease stimulus (quantitative easing) and raise interest rates. It has now signaled that it will begin selling assets (i.e. stop replacing bonds that mature).

Those currencies/bonds that pay the highest interest (accounting for inflation, of will naturally attract global capital seeking a safe return above zero.

The net effect of this differentiation is that nations/blocs with near-zero yields will experience capital flight as money will flow to higher yields elsewhere.

The coordination of the stimulus phase will give way to nationalist self-interest in the tightening phase.

Those nations/blocs that need super-easy money and near-zero interest rates to keep their "growth" afloat will be drained of capital as capital goes to wherever it can earn more yield.

There's a further complicating factor: the relative strength of each nation's currency. This matters because as a currency appreciates, the issuing nation's exports cost more to buyers using their own currencies, and the nation with the appreciating currency loses the competitive edge of a cheap currency.

Since higher interest rates attract capital, they also tend to strengthen one's currency, as the relative value of currency is set by supply and demand: the more demand there is for the currency, the higher it goes relative the field of competing currencies.

There is a third factor as well: central banks need to reduce their balance sheets and raise interest rates, so they have some "policy accomodation" available to counter the next (and inevitable) recession/financial crisis.

The US has so far managed a hat-trick: it has raised interest rates a number of times, yet its currency, the US dollar, has lost over 15% of its value in 2017 compared to the Euro, which has gained 15+%.

There is a Darwinian twist to all this: any nation/bloc which manages to raise rates and end central bank stimulus without stifling its "recovery" or strengthening its currency to the point it hurts exports, and still be a global magnet for capital due to higher yields/rates, will have a substantial competitive advantage over its peers.

In effect, the self-interest that bound the central banks together in the stimulus phase reverses in the tightening/normalizing phase. Thus I anticipate a slow decay of central bank coordination and a rise of conflict/ competition, though this will of course be kept out of the media.

This is one reason why I anticipate "unexpected" disruptions in the global economy in 2018,

as the coordinated stimulus phase ends and the disruptive, messy, Darwinian phase of

tightening/ normalizing rates and balance sheets gathers momentum.

My new book

Money and Work Unchained is $9.95 for the Kindle ebook and $20 for the print edition.

Read the first section for free in PDF format.

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Yves V. ($5/month), for your marvelously generous pledge to this site -- I am greatly honored by your support and readership. |

Thank you, Juan D. ($5/month), for your wondrously generous pledge to this site -- I am greatly honored by your support and readership. |

|