When Everything from Bat Guano to Quatloos Is Soaring, Speculative Euphoria Has Reached an Extreme

July 8, 2019

The more extreme the speculative euphoria, the greater the risks of a reversal.

One sentence sums up the speculative euphoria gripping markets: January and June of this year are the only months in the last 150 which have seen all assets post a positive total return. (Zero Hedge)

When every asset from bat guano to quatloos is soaring, the current speculative frenzy has reached extremes. We all know the quasi-religious faith driving the euphoria: central banks will push all assets higher as they pursue extremes of "easing."

In other words, asset valuations don't need to make any sense; just buy now and you'll be rewarded with guaranteed gains thanks to central banks. This strategy has worked exceedingly well for 10 years, so why won't it work for another decade?

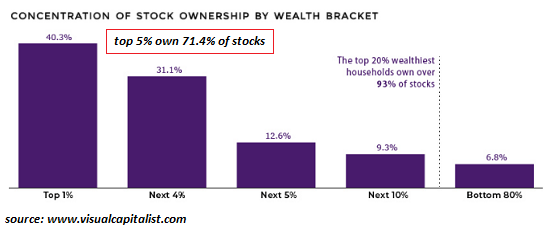

Put another way: central banks have created a speculative monster. The public cover for central bank easing has always been to "stimulate growth" in the real economy, but the real effect has been to concentrate the newly issued currency and leverage ("money") in the few hands that own most of the speculative ("risk on") assets. This pool of new money has been augmented by cheap credit for global corporations, enabling management to buy back trillions of dollars of stock, thereby enriching stock holders and those collecting stock options as part of their management compensation.

Those reaping billions of dollars in asset gains will not tolerate any reduction in central bank largess. This is the monster the Federal Reserve and other central banks have created: a monster that wields tremendous political power due to its immense wealth and equally potent market power. Any extended sell-off panics the politicos, pundits and peons alike, as everyone has bought into the cargo-cult fiction that a soaring market somehow helps the 95% who own zero or trivial amounts of speculative assets.

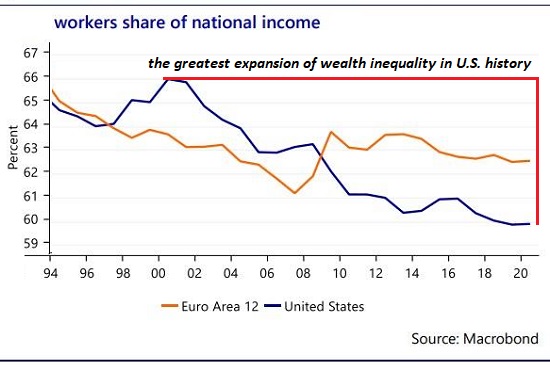

As this chart shows, soaring markets don't trickle down to labor's share of the economy. No matter how high stocks rise, Uber drivers are still scraping by unless they get a generous tip from a Unicorn-went-public millionaire.

Stocks owned by what's left of the middle class are locked up in IRAs, 401ks and other retirement accounts, so the owners have to hope the speculative bubble won't burst before they have a chance to start withdrawing their retirement funds.

The more extreme the speculative euphoria, the greater the risks of a reversal. As Lao Tzu observed, the way of the Tao is reversal, and a fever-pitch extreme of speculative euphoria makes an equally extreme decline inevitable as gargantuan asymmetries unwind.

Until that moment arrives, the confidence of everyone buying bat guano futures, quatloos, stocks, bonds, etc. will be very high, as they trust the Speculative Monster must be fed regardless of the cost.

But speculative extremes eventually reverse, regardless of the monster's agonizing screams.

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic

($6.95 ebook, $12 print, $13.08

audiobook):

Read the first section for free in PDF format.

My new mystery

The Adventures of the Consulting Philosopher: The Disappearance of Drake

is a ridiculously affordable $1.29 (Kindle) or $8.95 (print);

read the first chapters

for free (PDF)

My book

Money and Work Unchained is now $6.95 for the Kindle ebook and $15 for the print edition.

Read the first section for free in PDF format.

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com. New benefit for subscribers/patrons:

a monthly Q&A where I respond to your questions/topics.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Tim B. (60), for your marvelously generous contribution to this site-- I am greatly honored by your steadfast support and readership. |

|