Collapse, Part 5: Things Fall Apart

June 26, 2015

It is impossible to wean an economy that relies on debt and leverage for its "growth" of excessive debt and leverage.

As noted earlier in this series, collapse is not an event, it's a process, a process we experience as things fall apart. The phrase famously appears in William Butler Yeats' 1919 poem, The Second Coming:

Turning and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

Why do things fall apart? I have addressed a number of dynamics in the first four essays of this series, but there are many more expressed in Yeats' few brief lines.

1. Magical thinking dominates all discussions. The truth, being too fearful to contemplate, is sidelined in favor of magical thinking:

-- we can grow our way out of debt by expanding debt

-- if we simply print enough money, we can pay for everything we want

-- a miraculous new technology (insert current example) will provide limitless energy/food at near-zero cost

-- if we tweak the system with some minor reforms, all the big problems will go away

-- new technology always creates more jobs than it destroys

and so on.

2. Same as it always was: politics was always corrupt, humans have always been greedy, etc.--in other words, today's problems are no different from those of the past, which we handled without major difficulty. The possibility that today's extremes of financialization and political decay might actually be quantitatively and qualitatively different from the past 50 years is dismissed.

3. The political and financial Elites have lost touch with the citizenry. The falcon cannot hear the falconer, for the Elites have withdrawn into protected circles of privilege with little contact with the rest of us. Since all is well within these circles of wealth and power, all must be well in the system as a whole.

And if it isn't, the solution is to withdraw even deeper into circles of privilege and cast off in a luxury lifeboat, leaving the citizenry to muddle through on the doomed Titanic.

4. Things stop working well or stop working, period. The causes are many: inefficiency born of self-interest and historical habit, loss of accountability, The Ratchet Effect, Bureaucratic Complexity, diminishing returns, unproductive friction--the list is long.

The net result is things don't work well even when stupendous sums are thrown at them. Flush with the tax revenue bounty of a gargantuan bubble in housing and tech start-ups, the city and county of San Francisco now has an annual budget of $9 billion--a sum greater than the budgets of many states, all to serve a population of about 850,000.

One would be forgiven for assuming all the essential systems of a metropolis would be working smoothly, greased with an astonishing $9 billion. (It wasn't that long ago--the late 1990s--that San Francisco's budget was a mere $3 billion.)

But citizens aren't experiencing the system as working well. Lapses in public services tax San Franciscans’ patience:

Two weeks ago, we asked City Insider readers what they think of the fact that San Francisco’s budget hit a whopping $9 billion a year — more than the budgets of at least 10 states.

Now that more taxes are pouring into city coffers than ever before, do residents think they’re getting their money’s worth?

We were surprised by the deluge of e-mails, which continue to roll in, and the very vehement responses. Every single person who wrote had valid complaints, and not one thought city services were up to snuff for one of the richest cities in the world.

“One thing is for sure,” wrote Philip Snyder, a retired inspector for the Department of Public Health who lives North of the Panhandle. “If money was blood, San Francisco would make Dracula look like a mosquito.”

What happens when the budget declines by $1 billion in a run-of-the-mill recession? Right now, magical thinking reigns supreme, and the idea that bubbles need only stop expanding to trigger a business-cycle recession isn't in many minds. But recessions do happen, and those following explosive bubbles tend to be deeper than the average, so a $1 billion drop in tax revenues is to be expected.

In the same vein, the state of California, also flush with revenues from these same bubbles, has a "rainy day fund" of $3.46 billion and an annual budget of $117 billion. In previous recessions, state revenues drop by $10 to $20 billion--meaning the rainy day fund is woefully inadequate.

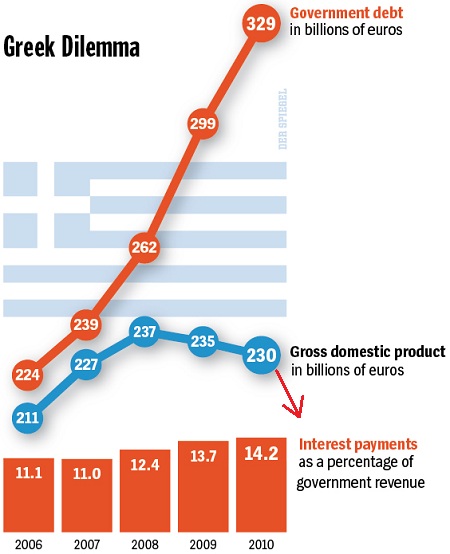

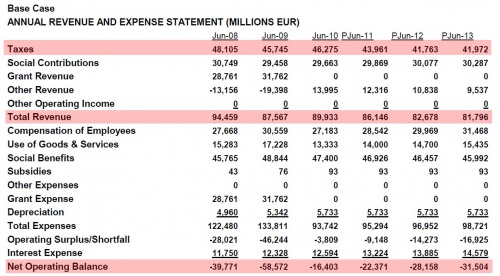

Here is the budget reality in Greece:

These budget numbers are dated--the current figures are much worse.

The European Status Quo is expending the last dregs of its legitimacy and cash defending its financial Elites. It is impossible to "reform" a Status Quo whose foundation is kleptocracy, just as it is impossible to wean an economy that relies on debt and leverage for its "growth" of excessive debt and leverage: financialization isn't a feature of the economy, it is the economy.

Things fall apart for systemic reasons that are deeply intertwined; minor policy tweaks and printing more money are simply expressions of magical thinking.

Of related interest:

500 Million Debt-Serfs: The European Union Is a Neo-Feudal Kleptocracy

In a Dysfunctional Status Quo, Reform Triggers Collapse

The Cycle of Dependency and the Atrophy of Self-Reliance

The Three Ds: Delegitimization, Definancialization, Deglobalization

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Carey W. ($10), for your most welcome generous contribution to this site-- I am greatly honored by your support and readership. |