The Everything Bubble and Global Bankruptcy

March 26, 2023

The resulting erosion of collateral will collapse the global credit bubble, a repricing/reset that will bankrupt the global economy and financial system.

Scrape away the complexity and every economic crisis and crash boils down to the precarious asymmetry between collateral and the debt secured by that collateral collapsing. It's really that simple.

In eras of easy credit, both creditworthy and marginal borrowers are suddenly able to borrow more. This flood of new cash seeking a return fuels red-hot demand for conventional assets considered "safe investments" (real estate, blue-chip stocks and bonds), demand which given the limited supply of "safe" assets, pushes valuations of these assets to the moon.

In the euphoric atmosphere generated by easy credit and a soaring asset valuations, some of the easy credit sloshes into marginal investments (farmland that is only briefly productive if it rains enough, for example), high-risk speculative ventures based on sizzle rather than actual steak and outright frauds passed off as legitimate "sure-fire opportunities."

The price people are willing to pay for all these assets soars as the demand created by easy credit increases. And why does credit continue increasing? The assets rising in value create more collateral which then supports more credit.

This self-reinforcing feedback appears highly virtuous in the expansion phase: the grazing land bought to put under the plow just doubled in value, so the owners can borrow more and use the cash to expand their purchase of more grazing land.

The same mechanism is at work in every asset: homes, commercial real estate, stocks and bonds: the more the asset gains in value, the more collateral becomes available to support more credit.

Since there's plenty of collateral to back up the new loans, both borrowers and lenders see the profitable expansion of credit as "safe."

This safety is illusory, as it's resting on an unstable pile of sand: bubble valuations driven by easy credit.

We all know that price is set by what somebody will pay for the asset. What attracts less attention is price is also set by how much somebody can borrow to buy the asset.

Once the borrower has maxed out their ability to borrow (their income and assets-owned cannot support more debt) or credit conditions tighten, then those who might have paid even higher prices for assets had they been able to borrow more money can no longer borrow enough to bid the asset higher.

Since price is set on the margin (i.e. by the last sales), the normal churn of selling is enough to push valuations down. At first the euphoria is undented by the decline, but as credit tightens (interest rates rise and lending standards tighten, cutting off marginal buyers and ventures) then buyers become scarce and skittish sellers proliferate.

Questions about fundamental valuations arise, and sky-high valuations are found wanting as tightening credit reduces sales, revenues and profits. Once the "endless growth" story weakens, the claims that bubble prices are "fair value" evaporate.

As defaults rise, lenders are forced to tighten credit further. The first tumbling rocks are ignored but eventually the defaults trigger a landslide, and the credit-inflated bubble in asset valuations collapses.

As valuations plummet, so too does the collateral backing all the new debt. Debt that appeared "safe" is soon exposed as a potential push into insolvency. When the bungalow doubled in value from $500,000 to $1 million, the trajectory of valuation gains looked predictably rosy: every decade housing prices went up 30% or more. So originating a mortgage for $800,000 on a house that looked to be worth $1.3 million in a few years looked rock-solid safe.

But the $1 million was a bubble based solely on easy, abundant, low-cost credit. When credit tightens, the home is slowly but surely repriced at its pre-bubble valuation ($500,000) or perhaps much lower, if that value was merely an artifact of a previous unpopped bubble.

Now the collateral is $300,000 less than the mortgage. The owner who made a down payment of $200,000 will be wiped out by a forced sale at $500,000, and the lender (or owner of the mortgage) will take a $300,000 loss.

Given the banking system is set up to absorb only modest, incremental losses, losses of this magnitude render the lender insolvent. The lender's capital base is drained to zero by the losses and then pushed into negative net-worth by continued losses.

The collateral collapses when bubbles pop, but the debt loaned against the now-phantom collateral remains.

This is the story of the Great Depression, a story that's unloved because it calls into question the current series of credit-inflated bubbles and resulting financial crises. So the story is reworked into something more palatable such as "the Federal Reserve made a policy error."

This encourages the fantasy that if central banks choose the right policies, credit bubbles and valuations detached from reality can both keep expanding forever. The reality is credit bubbles always pop, as the expansion of borrowing eventually exceeds the income and collateral of marginal borrowers, and this tsunami of cash eventually pours into marginal high-risk speculative vebtures that go bust.

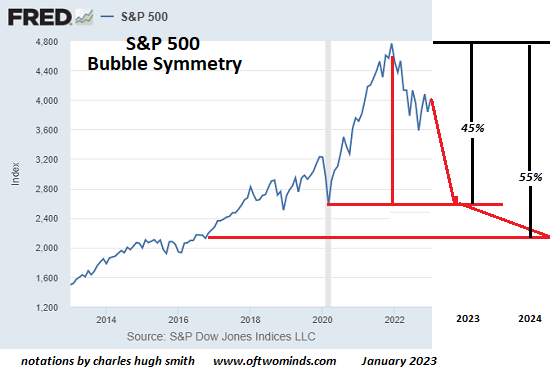

There is no way to thread the needle so credit-asset bubbles never pop. Yet here we are, watching the global Everything Bubble finally start collapsing, guaranteeing the collapse of collateral and all the debt issued on that collateral, and the rabble is arguing about what policy tweaks are needed to reinflate the bubble and save the global economy from bankruptcy.

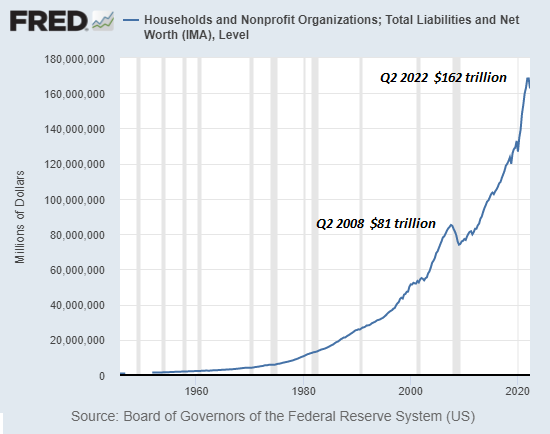

Sorry, but global bankruptcy is already baked in. Too much debt has been piled on phantom-collateral and income streams derived from bubble assets rising (for example, capital gains, development taxes, etc.). The asymmetry is now so extreme that even a modest decline in asset valuations/collateral due to a garden-variety business-cycle recession of tightening financial conditions will trigger the collapse of The Everything Bubble and the mountain of global debt resting on the wind-blown sands of phantom collateral.

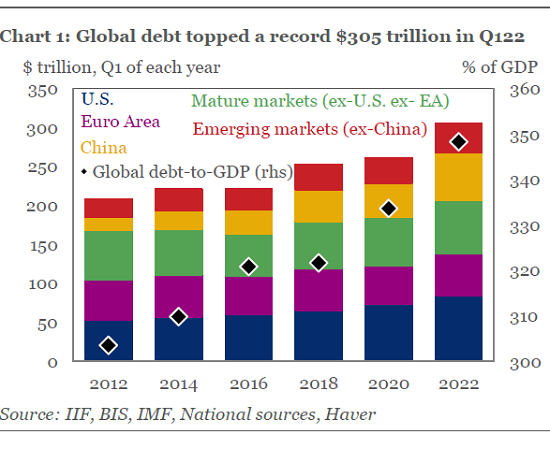

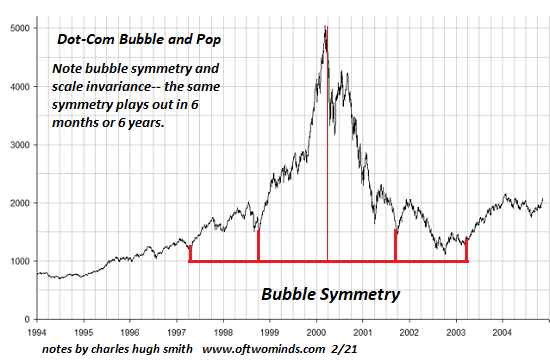

There are persuasive reasons to suspect global debt far exceeds the official level around $300 trillion, most saliently, the largely opaque shadow banking system. When assets roughly double in a few years, bubble symmetry suggests that valuations will decline back to the starting point of the bubble in roughly the same time span.

The resulting erosion of collateral will collapse the global credit bubble, a repricing/reset that will bankrupt the global economy and financial system.

New Podcast:

Turmoil Ahead As We Enter The New Era Of 'Scarcity' (53 min)

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Margaret S. ($54), for your monumentally generous contribution to this site -- I am greatly honored by your support and readership. |

Thank you, Stephen F. ($5/month), for your marvelously generous contribution to this site -- I am greatly honored by your support and readership. |

|