FOMO Is Loco

May 21, 2021

We can also posit a general rule that those who inherit wealth and succumb to FOMO are eventually

less wealthy while those who are wealthy and take a pass on FOMO / hoarding at the top of the

manic frenzy increase their wealth.

Judging by the panic buying of everything from homes to yachts to lumber futures, it seems the

world has run out of everything except newly issued central bank trillions, and so the logical

response is FOMO (fear of missing out) and hoarding: buy everything you can get your hands on

today lest it become unavailable or more expensive tomorrow.

FOMO is wonderful for sellers and profiteers who can jack up prices and enjoy bidding wars

during the panic buying.

FOMO and hoarding are instinctual behaviors to shortages, perceived and real. There's nothing

quite like the surge onto the last bus or train of the day when transport is scarce. Cash becomes

trash when you need whatever is scarce and you're afraid you won't be able to get it at any price.

All this is rational when the threat of what happens if you miss out is existential.

As in, not getting in a boat means you drown, not getting some water means you die of thirst, etc.

But is not being able to buy a new pleasure craft or home in a desirable area really the same?

It feels the same way to the individuals caught up in the frenzy of FOMO, but

FOMO and hoarding feel the same whether the scarcity is real or perceived, and the emotions triggered

by scarcity are urgently intense: if I lose this bidding war, my life is over, etc.

On a lesser but still painful level, we don't like losing or being left behind as the circus

leaves town. If you've ever been bumped from an airline flight or been unable to get on

that last train, watching all the shiny happy people board the aircraft while you're left in

the fetid terminal with the janitorial crew is not a warm and fuzzy feeling.

There's another intense emotion that comes into play a bit later: buyer's remorse.

The bidding war arouses an excitement quite unlike other forms of engagement, and the euphoria

of winning feels like the jackpot is yours, ripped from the greedy grasp of the undeserving

at the last moment.

Then the euphoria fades and the sick realization that you're on the hook for hundreds of thousands

of dollars sinks in. At this point regret that one forgot the rational, calculating part of

the mind and dashed head-long into the "last seat on the lifeboat / last roll of toilet paper"

FOMO / hoarding.

One of my rules is to consider what benefits those at the top of the wealth-power pyramid.

If we consider the case for hyper-inflation, for example, it's difficult to make a case for

hyper-inflation benefiting those who own the majority of the nation's financial assets, i.e. the

top 0.5%. Yes, the super-wealthy can move all their wealth into gold and bitcoin, but this requires

sacrificing the income from all the assets that were sold to escape hyper-inflation.

Wouldn't it be cheaper and easier to just call a friend or three and make it known that

hyper-inflation doesn't work for you? Needless to say, it also doesn't work for the bottom

99.5% whose earnings spiral down the drain in hyper-inflation.

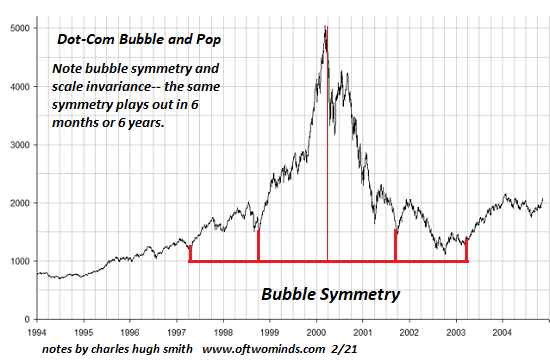

We can also posit a general rule that those who inherit wealth and succumb to FOMO are eventually

less wealthy while those who are wealthy and take a pass on FOMO / hoarding at the top of the

manic frenzy increase their wealth, as they anticipate a symmetric deflation in most of the

FOMO / hoarding price spikes.

In other words, it's worth pondering the possibility that cash won't always be trash, and that

overbidding by $400,000 to get "the last house in Cape Cod" overlooked the

possibility that it wasn't actually the last house and that suitable alternatives might be

remarkably less expensive in a year.

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

My new book is available!

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

20% and 15% discounts (Kindle $7, print $17,

audiobook now available $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Podcasts:

Salon #43: History shows again and again how nature points out the folly of men...

Covid Has Triggered The Next Great Financial Crisis (34:46)

My COVID-19 Pandemic Posts

My recent books:

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic

($5 (Kindle), $10 (print), (

audiobook):

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake

$1.29 (Kindle), $8.95 (print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print)

Read the first section for free (PDF).

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Gary C. ($5/month), for your superbly generous pledge to this site -- I am greatly honored by your support and readership. |

Thank you, Paul B. (5 euros/month), for your splendidly generous pledge to this site -- I am greatly honored by your support and readership. |

|