Hey Fed, Explain Again How Making Billionaires Richer Creates Jobs

May 7, 2021

Despite their hollow bleatings about 'doing all we can to achieve full employment',

the Fed's policies has been Kryptonite to employment, labor and the bottom 90%--and most especially

to the bottom 50%, the working poor that one might imagine most deserve a leg up.

As wealth and income inequality soar to new heights thanks to the Federal Reserve's policies

of zero interest rates, money-printing and financial stimulus, the Fed says its goal is to create

more jobs. Really? OK, let's look at how the Fed's doing with that.

I've assembled a chart deck to display the consequences of Fed policies on debt, wealth

inequality and employment. Recall what Fed policies actually do:

1. Zero interest rate policy (ZIRP) destroyed the low-risk return on savings and money market funds,

stripping everyone not in the Fed-privileged rentier-speculator-financier class of

safe, real returns on capital.

2. Zero interest rate policy (ZIRP) lowered the cost of speculation by financiers and corporations

but left the interest rates paid by the working poor for credit cards, auto loans and student loans

at extortionate rates.

3. QE--quantitative easing--creates trillions of dollars out of thin air to buy U.S. Treasury bonds,

enabling no skin in the game

federal spending and funneling trillions of dollars of nearly free money

into the soft greedy hands of the rentier-speculator-financier class,

not into the real economy.

4. Both ZIRP and QE incentivized borrowing low-cost billions to speculate in assets, inflating

unprecedented debt-leverage-driven assets bubbles which have now infected every asset class:

The Everything Bubble.

Here is the Fed policy in a nutshell: working, saving and prudent investing--you get nothing. You're

already rich, borrow huge sums and leverage up speculative bets--you win big. Recall that

the rentier-speculator-financier class has no skin in the game because the Fed

and other agencies rush in to bail out all their losing bets, while the bottom 99.9% are left

to twist in the wind should they foolishly follow the billionaires into risky bets.

In the world the Fed has created, work is for chumps, the way to get rich is borrow, leverage

and speculate.

Note that this chart deck is from the Federal Reserve database except for one chart from

the Washington Post.

So what are the consequences of Fed policies on debt, wealth

inequality and employment? Let's have a look.

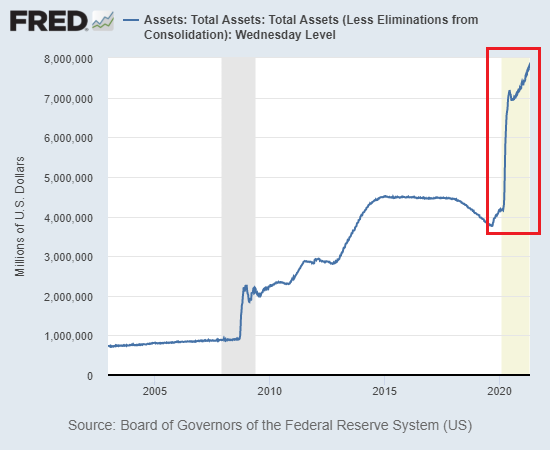

The Fed balance sheet, i.e. money it creates out of thin air: a near-vertical line up.

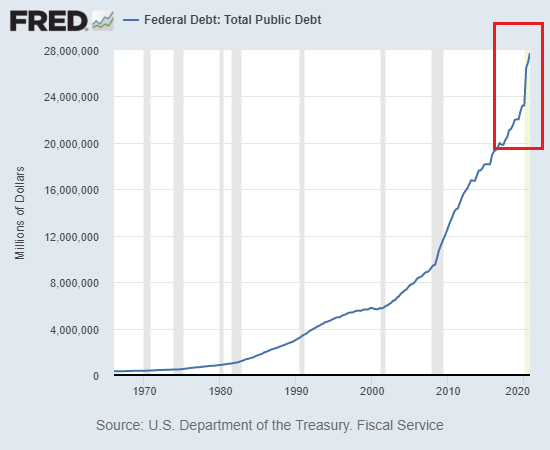

Federal debt, i.e. money borrowed by selling Treasury bonds: a near-vertical line up.

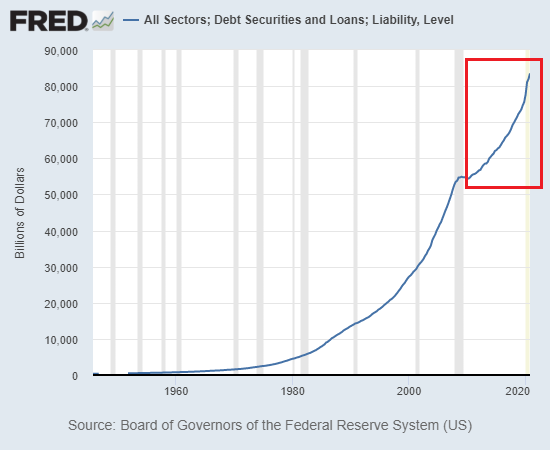

Total debt, i.e. what the Fed encourages everyone to do--borrow more!: a near-vertical line up.

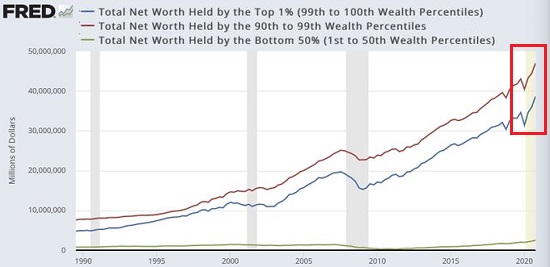

Net worth of the top 1% and top 90% to 99%: massive increases since 2009 and more recently,

a moonshot higher. The bottom 50%, meanwhile, is flatlined near zero.

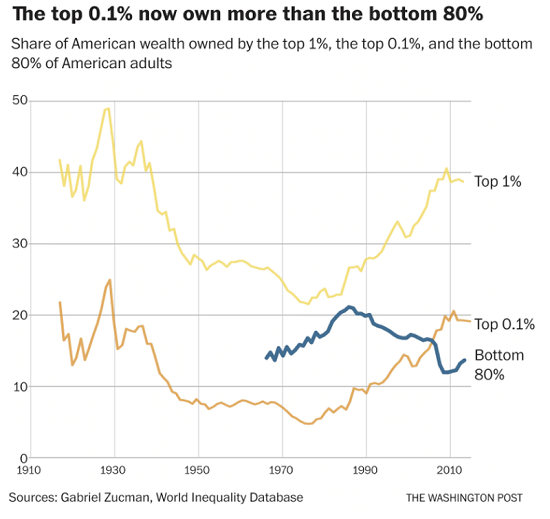

Thanks to the Fed, the top 0.1% own more wealth than the bottom 80%.

Thanks to the Fed. the rentier-speculator-financier class has done very well, the top 90-99%

have ridden the Fed's coattails nicely, but the bottom 80% have been left in the dust. Good job,

Fed!

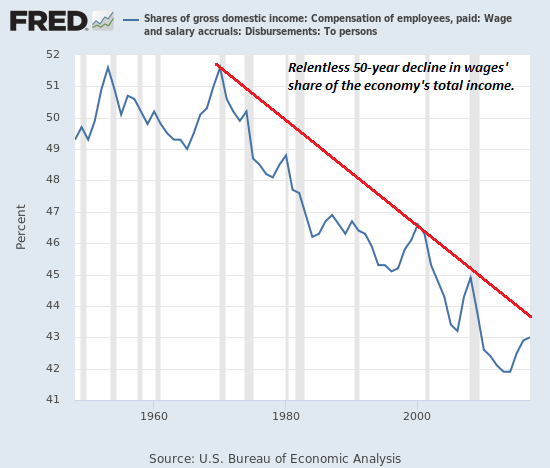

While the Fed printed and distributed trillions to the rentier-speculator-financier class,

labor's share of the economy has been in a free-fall. Working is for chumps, gambling with

Fed money is for winners. And if you lose, the Fed bails you out. The Fed casino is the place to be

for guaranteed winnings--if you're already rich, of course.

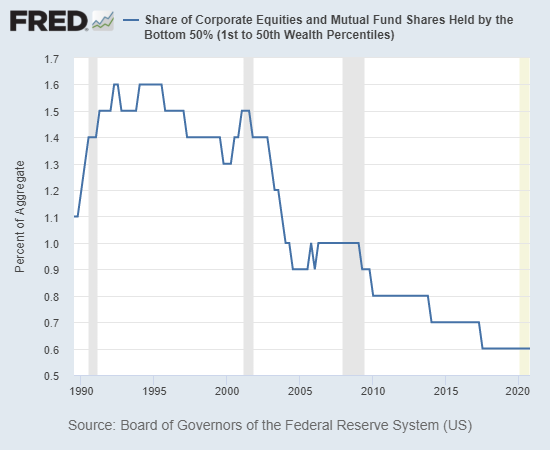

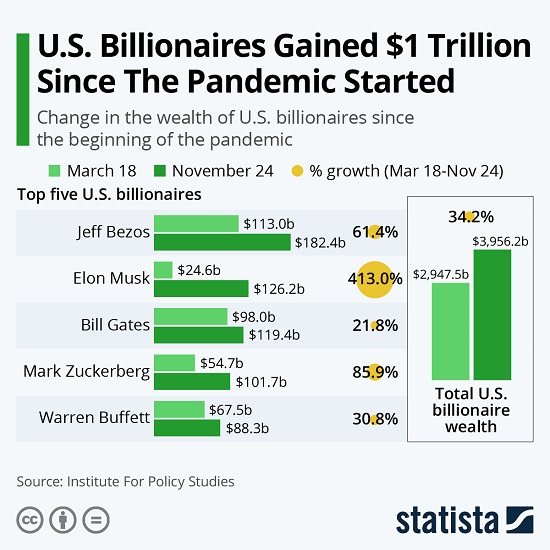

The Fed's policies are all based on the trickle-down theory that when billionaires get richer,

some magic pixie-dust miraculously drifts down to the bottom 50%. Oops. The bottom 50% lost

ground while the billionaires reaped billions. Gosh, I wonder why the financial media

bows down and worships the Fed as living gods.

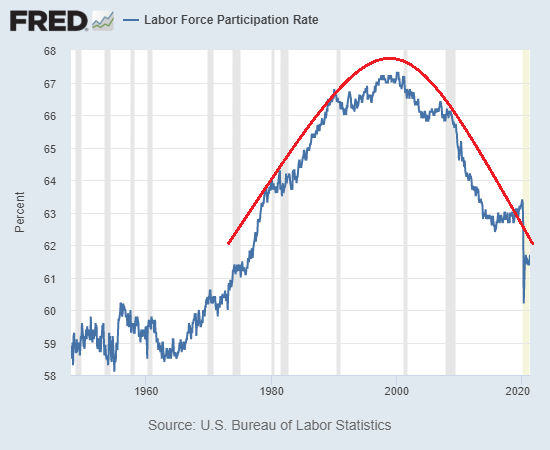

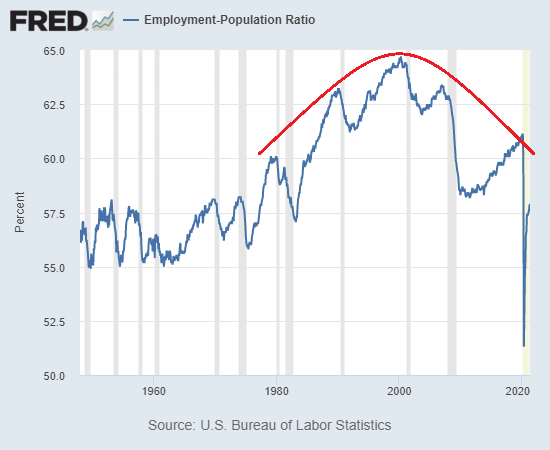

Since the Fed is doing all this wealth creation in the top 0.1% to create jobs, let's look at

the labor participation rate, the percentage of the labor force which is employed in some

fashion. Hmm, that topped out in 1999 and has been in a freel-fall since.

The percentage of the population that's employed has a very similar pattern, topping out

in 1999 and then dropping to new lows every time the Fed's speculative bubbles pop.

Despite their hollow bleatings about doing all we can to achieve full employment,

the Fed's policies has been Kryptonite to employment, labor and the bottom 90%--and most especially

to the bottom 50%, the working poor that one might imagine most deserve a leg up.

So Fed governors, lackeys and apologists, please explain again how making billionaires

richer creates jobs, fosters employment and benefits the bottom 90%. If the Fed was actually

attempting to bolster the income and wealth of the laboring class, it has failed miserably by

every meaningful metric. If, on the other hand, Fed policy was always aimed at further enriching

the top 0.1%, top 1% and corporations, then the Fed has reached the pinnacle of success.

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

My new book is available!

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

20% and 15% discounts (Kindle $7, print $17,

audiobook now available $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Podcasts:

Salon #43: History shows again and again how nature points out the folly of men...

Covid Has Triggered The Next Great Financial Crisis (34:46)

My COVID-19 Pandemic Posts

My recent books:

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic

($5 (Kindle), $10 (print), (

audiobook):

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake

$1.29 (Kindle), $8.95 (print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print)

Read the first section for free (PDF).

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, David K. ($200), for your beyond-outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Daniel E. ($4.50), for yet another most generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

|