What's Been Normalized? Nothing Good or Positive

November 20, 2019

What's been normalized are policies and cultural norms that seek to enrich and protect the few at the expense of the many.

When the initially extraordinary fades into the unremarkable background of everyday life, we say it's been normalized. Put another way, we quickly habituate to new conditions, and rationalize our ready acceptance of what was previously unacceptable.

Technology offers many examples of extraordinary advances quickly becoming normalized as we habituate to new devices and behaviors, but my focus today is on policies and cultural norms that were radical departures from accepted norms at their introduction but which are now accepted as "normal."

This normalization of extreme policies conceals the often equally extreme unintended consequences of the new policies and norms.

Let's start with two examples which have unleashed unintended consequences that have completely distorted markets: allowing pharmaceutical companies to advertise directly to "consumers" and allowing corporations to buy back their own shares. Each of these activities had been banned for self-evident reasons, yet were allowed in the neoliberal rush to deregulate industries without regard for the long-term consequences.

Now Big Pharma dominates advertising in late-night TV and various print publications, directing "consumers" to "ask their doctor about".... The ads all feature a comical parody of disclosure, with a fast-talking voice talent listing all the horrific side-effects as quickly as possible in the hopes "consumers" won't hear the real-world consequences of the oh-so-pricey med being promoted.

I've long mocked this Big Pharma profiteering via my parody ads for imaginary meds such as Delusionol:

Meanwhile, enabling corporations to buy their own stocks has incentivized borrowing billions to buy back shares, boosting the earnings per share even as sales and profits stagnated. This trick pushed shares prices higher, enriching managers and major owners.

Rather than invest in risky new products, corporate managers have enriched themselves by blowing billions on stock buybacks, distorting valuations while creating fabulous wealth for themselves and major shareholders while crippling the company with debt. (For an example, consider GE.)

More recently, central banks' ceaseless interventions to prop up market valuations have been normalized to the degree that what was once unimaginable-- central bank balance sheets in the trillions of dollars and outright purchases of trillions of dollars in mortgages, bonds and stocks--is now accepted as "normal."

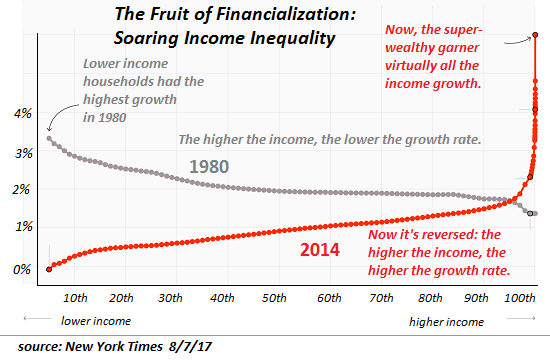

This flood of currency and credit has enriched private banks, financiers, super-wealthy families and corporations, vastly widening the wealth-income gap between the top 0.1% and the bottom 99.9% (see chart below).

The Federal Reserve's policy of giving trillions in low-cost credit to the super-wealthy in the absurd hope some tiny rivulets would trickle down to the bottom 99% has been revealed as the greatest engine of wealth-income inequality in modern history.

Unintended or not, this consequence cannot be "fixed" by issuing even more trillions to the financial Oligarchy. Rather, the Fed's favorite "fix" only makes the inequality more politically explosive.

Then there's the normalization of government-issued statistics that purposefully misrepresent reality for political purposes, with Exhibit #1 being the completely fabricated Consumer Price Index (CPI) inflation rate, which has been a laughable 2% or less for a decade while big-ticket expenses such as rent, healthcare, childcare and college tuition have registered in double-digit increases year after year.

An accurate admission of real-world inflation for the unprotected class would be political dynamite, so the corporate media plays along, announcing the Soviet-Propaganda like phony inflation numbers with a straight face.

The resulting loss of trust in government and institutions is eating away at the social contract and social order, with potentially disastrous consequences. There is no alternative (TINA) until the entire flim-flam collapses and takes the social order with it.

Guilty until proven innocent is another recent development. Completely fabricated charges are heavily promoted in the corporate media, based on outright lies, second-hand innuendo, unsubstantiated claims and carefully constructed narratives supported by thin tissues of cherry-picked tidbits.

A wide spectrum of alternative-media sites, progressive and conservative, have been gutted by just such guilty until proven innocent charges which are then instantiated in the platform monopolies of Twitter, Facebook and Google without any evidence or any avenue of redress / recourse.

That this is extra-legal suppression of free speech--who cares? The suppression of free speech that is politically inconvenient has now been normalized, hidden behind the faceless corporate monopolies of Twitter, Facebook and Google and the corporate media that insists non-approved websites are by definition fake news, an Orwellian reversal of their own role as Elitist purveyors of officially sanctioned fake news such as the bogus inflation rate, the bogus employment rate, and so on.

Put this in your pipe and smoke it: wealth and income inequality is driving social and political disorder on a global scale as the politically and socially disenfranchised are driven to extremes by extremely repressive policies that have been normalized, even as their unintended consequences stripmine the bottom 90% and fracture the social order.

What's been normalized are policies and cultural norms that seek to enrich and protect the few at the

expense of the many. Unfortunately for the few, the unintended consequences are bringing

down the entire status quo they depend on for their wealth and power.

My recent books:

Will You Be Richer or Poorer? Profit, Power and A.I. in a Traumatized World (Kindle $6.95, print $11.95) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 (Kindle), $12 (print), $13.08 ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print)

Read the first section for free (PDF).

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, William F. ($5/month), for your magnificently generous pledge to this site-- I am greatly honored by your support and readership. |

|