Millennials Are Abandoning the Postwar Engines of Growth: Suburbs and Autos

April 12, 2017

Where's the growth going to come from as the dominant generation makes less, borrows less, spends less, saves more and turns away from long commutes, malls and suburban living and abandons the worship of private vehicles?

If anything defined the postwar economy between 1946 and 1999, it was the exodus of the middle class from cities to suburbs and the glorification of what Jim Kunstler calls Happy Motoring: freeways, cars and trucks, ten lanes of private vehicles, the vast majority of which are transporting one person.

Ol' 55 (freeway cars and trucks) (written by Tom Waits, performed by The Eagles)

The build-out of suburbia drove growth for decades: millions of new suburban homes, miles of new freeways, sprawling shopping malls, and tens of millions of new autos, trucks, and SUVs, transforming one-car households into three vehicle households. Then there was all the furnishings for those expansive new homes, and the credit necessary to fund the homes, vehicles, furnishings, etc.

Now the Millennial generation is turning its back on both of these bedrock engines of growth. As various metrics reveal, the Millennials are fine with taking Uber to work, buying their shoes from Zappos (return them if they don't fit, no problem), and making whatever tradeoffs are necessary to live in urban cores.

Simply put, the natural progression of this generation is away from suburban malls, suburban home ownership and the car-centric commuter lifestyle that goes with suburban homeownership.

Saddled with insanely high student debt loads imposed by the rapaciously predatory higher education cartel, Millennials avoid additional debt like the plague. Millennials have relatively high savings rates. As for a lifetime of penury to service debt--hey, they already have that, thanks to their "I borrowed $100,000 and all I got was this worthless college degree" student loans.

Consider the secondary effects of these trend changes. If Millennials are earning less and already carrying heavy debt loads, who is going to buy the Baby Boom's millions of pricey suburban McMansions. The answer might be "no one."

If vehicle sales decline, all the secondary auto-related sales decline, too. Auto insurance, for example.

Furnishing a small expensive urban flat requires a lot less furnishings than a 3,000 square foot suburban house. What happens to sales of big dining sets and backyard furniture?

As retail malls die, property taxes, sales taxes and payroll taxes decline, too. Many cheerlead the notion of repurposed commercial space, but uses such as community college classes pay a lot less per square foot than retail did, and generate little in the way of sales and payroll taxes.

Financial losses will also mount. Valuations and property taxes will decline, and commercial real estate loans based on nose-bleed valuations and high retail lease rates will go south, triggering significant financial-sector losses.

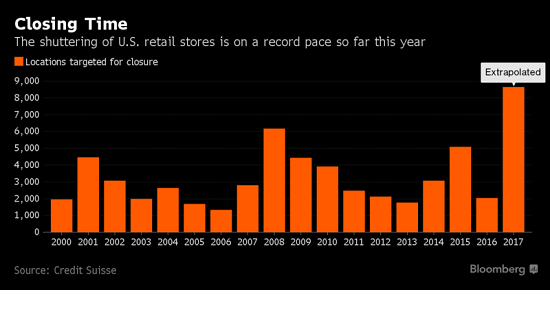

Retail is already shrinking fast. Look at the store closings--the 2017 number already exceeds the post-financial crisis surge in 2008:

Where's the growth going to come from as the dominant generation makes less, borrows less, spends less, saves more and turns away from long commutes, malls and suburban living and abandons the worship of private vehicles? Toss in the convergence of technology (i.e. a mobile phone does everything) and the answer is growth is being replaced by DeGrowth.

Gordon Long and I explore these topics in our latest video program, MILLENNIALS: A Menacing Metamorphosis:

YouTube link

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

Check out both of my new books, Inequality and the Collapse of Privilege ($3.95 Kindle, $8.95 print) and Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle, $8.95 print). For more, please visit the OTM essentials website.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Elizabeth N. ($25), for your wondrously generous contribution to this site -- I am greatly honored by your support and readership. |

Thank you, Richard M. ($5/month), for your superbly generous pledge to this site -- I am greatly honored by your support and readership. |

Discover why Iím looking to retire in a SE Asia luxury resort for $1,200/month. |