|

| weblog/wEssays archives | home | |

|

The Unintended Consequences of the Housing Bubble Bursting (December 10, 2007) As the housing bubble pops with a reverberating shockwave heard round the world, we can be sure the players who inflated it did not intend or anticipate the ramifications now unfolding. Just as the teenagers racing down the cliffside highway with bellies full of alcoholic beverages did not intend to lose control of their vehicle and plunge off the cliff to their deaths, the mortgage brokers, investment bankers and their partners-in-fraud, the rating agencies, did not really intend to bring down the entire economy. Yet this is indeed the "unintended consequence" of the housing bust. Let's consider two "unintended consequences" which are emerging as the housing and mortgage-derivative markets break through the safety barrier and descend in a slow-motion cliff-dive. 1. As risk is "re-priced" higher, the cost of borrowing will rise. Frequent contributor Albert T. explains: The problem with the bailout is that it devalues money by diluting the weighted average of money outstanding through bailing out people/firms whom shouldn't have got it. Ergo, stupid banks who took stupid risks and stupid borrowers. While we won't notice it right away, when the rate freeze is in effect in actuality it will reprice all new risk with a higher implied rate to compensate for the future freeze possibility, hence we will all pay higher rates to subsidize the current "crack addicts". (emphasis added-CHS)Albert sent in this link Homeowner bailout is a lousy idea (John Markman, MSM Money) and called attention to the following excerpt as evidence of another kind of risk repricing is already underway: "Indeed, everywhere you look now is evidence that the subprime-debt crisis is morphing and expanding like a creature in a horror movie. Just this week, we learned from hearings in Congress that strapped credit card companies such as Capital One Financial (COF) and Bank of America (BAC) had begun to soak customers by jacking up interest rates on balances for the slightest changes in their credit profiles."In other words: since lenders now know the government may "freeze" the rates they've charged customers, they'll be re-pricing those rates higher to compensate for that possibility. If the government might step in and freeze the rates I am charging my customers, then it behooves me to raise rates on all customers now, not just the riskiest ones because, well, it's not longer a "risk-free world." The government might freeze all interest rates, or "low-risk customers" might soon become "poor-risk."  How does this re-pricing hurt the economy? Since borrowing is the grease which

lubricates the entire economy, re-pricing risk means higher borrowing costs for everyone--

regardless of Fed-Speak or the Fed dropping the Fed Funds Rate.

How does this re-pricing hurt the economy? Since borrowing is the grease which

lubricates the entire economy, re-pricing risk means higher borrowing costs for everyone--

regardless of Fed-Speak or the Fed dropping the Fed Funds Rate.

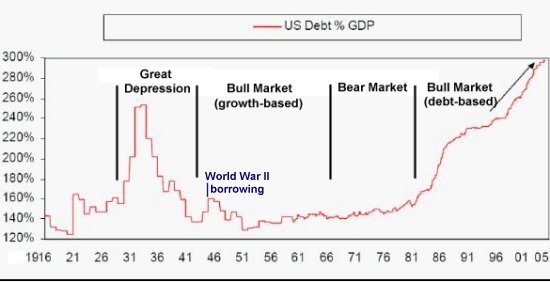

This chart reveals how the ratio of mortgage debt to disposable income has risen far above the last housing bubble top in 1990. Simply put: people are spending more on debt service and this has reduced their remaining disposable income. The rubber band of debt service has already been stretched to extremes unseen in 30 years; so the question becomes, how much more can the rubber band be stretched before it snaps? Just to refresh our awareness of how critical debt/borrowing is to our current "prosperity," take a look at this chart:

2. As non-U.S. investors realize they have been handed hundreds of billions in losses, they will be wary of buying more U.S. debt. We are already hearing that the market for SIVs, CDOs and MBS (mortgage backes securities) is dead, over, gone, dried up, history. And just to refresh our awareness of how debt-based derivatives like CDOs and credit swaps have grown, look at this chart:

How dependent is the U.S. on foreign/non-U.S. buyers of debt? Very. The standard number

tossed around is the U.S. needs to offload $2 billion a day onto non-U.S. investors just to

keep the U.S. debt/borrowing/spending machine humming.

How dependent is the U.S. on foreign/non-U.S. buyers of debt? Very. The standard number

tossed around is the U.S. needs to offload $2 billion a day onto non-U.S. investors just to

keep the U.S. debt/borrowing/spending machine humming.

But now, as this article from the San Francisco Chronicle details, we have ripped off our non-U.S. investor friends and are busily shredding all evidence of fraud --even though we all know every step of the housing bubble, from appraisals to mortgage funding to securitizing of the mortgages to the rating agencies' "AAA stanp of approval" on those securitized loans was riddled with "wink-wink-nudge-nudge" fraud: MORTGAGE MELTDOWN Interest rate 'freeze' - the real story is fraud But unfortunately, the "freeze" is just another fraud - and like the other bailout proposals, it has nothing to do with U.S. house prices, with "working families," keeping people in their homes or any of that nonsense.I can hear it all now--as no doubt you can, too. The non-U.S. pension or township or sovereign fund, realizing its supposedly "safe" U.S.-based investments are now worth 50% or 20% or perhaps 0% of the purchase price, now go to New York and hire a razor-sharp law firm to force the investment bank which sold them the garbage to buy it back, based on the fraud which permeates the entire pool of mortgages and debt. But oh my gosh, we didn't know it was fraudulent. Proving fraud, after all the emails have been deleted and the hard-drives crushed and the paper trails shredded will be very difficult, indeed. The "innocent" bankers will point to the rating agencies like Moodys, who will point to the mortgage underwriters and brokers, who will point to the originators and the appraisers, who will promptly declare bankruptcy or point to the realtors who forced them to support inflated valuations. And after all the attorneys' fees have been deducted from the paltry settlements reached years from now, there will be pennies left for the non-U.S. investors. We all know how this works because we've seen the play before in the aftermath of the dot-com debacle: investors lose $200 million due to fraud, the company settles for $11 million, the attorneys take $5 million for their work and the investors get a whopping 3% compensation. So how does this massive, seamless, trillion-dollar fraud hurt the U.S. economy? Just ask what happens when non-U.S. players tire of getting ripped off or become wary of "AAA low-risk" U.S.-based debt. What happens is this: when non-U.S. buyers of new debt vanish, then the great debt-churn-spending machine that is the U.S. economy grinds to a halt--or at least loses $700 billion a year in non-U.S. funding. Anyone who is an investor (as opposed to a "pusher" who needs to "fund the junkie's habit" so he can afford to buy more "product", i.e. the central banks of China and Japan) will turn away from U.S. debt (other than Treasuries) in complete disgust. Ask yourself this: if a national government might arbitrarily "freeze" or lower the interest rate being paid on a security, thereby lessening its value, how anxious are you to buy more of that nation's debt? If you do, you'll want a hefty risk-premium to compensate you for the unknown risks that the government will gerrymander your return in order to placate their banker buddies and restive domestic voters. Bottom line: as risk rises, so do borrowing costs. As non-U.S. investors shun new U.S. commercial and mortgage debt, those markets dry up. Since debt can no longer be sold to unwary non-U.S. "marks" (suckers), then who's left to fund $5 trillion in new mortgages? Essentially bankrupt U.S. banks? Negative-equity U.S. households? Negative savings rates Americans? If this sounds bleak, please consider this chart:

Thank you, Eugenio M., ($10), for your generous contribution to this humble site. I am greatly honored by your readership and support. All contributors are listed below in acknowledgement of my gratitude. For more on this subject and a wide array of other topics, please visit my weblog. copyright © 2007 Charles Hugh Smith. All rights reserved in all media. I would be honored if you linked this wEssay to your site, or printed a copy for your own use. |

||

| weblog/wEssays | home |