We Do These Things Because They're Easy: Our All-Consuming Dependence on Debt

July 14, 2017

A world in which "we do these things because they're easy" has one end-state: collapse.

On September 12, 1962, President John F. Kennedy gave a famous speech announcing the national goal of going to the moon by the end of the decade. ( JFK's speech on going to the moon.) In a memorable line, Kennedy said we would pursue the many elements of the space program "not because they are easy, but because they are hard."

Our national philosophy now is "we do these things because they're easy"-- and relying on debt to pay today's expenses is at the top of the list. What's easier than tapping a line of credit to buy whatever you want or need? Nothing's easier than borrowing money, especially at super-low rates of interest.

We are now totally, completely dependent on expanding debt for the maintenance of our society and economy. Every sector of the economy--households, businesses and government--all borrow vast sums just to maintain the status quo for another year.

Compare buying a new car with easy, low-interest credit and saving up to buy the car with cash. How easy is it to borrow $23,000 for a new $24,000 car? You go to the dealership, announce all you have to put down is a trade-in vehicle worth $1,000. The salesperson puts a mirror under your nose to make sure you're alive, makes sure you haven't just declared bankruptcy to stiff previous lenders, and if you pass those two tests, you qualify for a 1% rate auto loan. You sign some papers and drive off in your new car. Easy-peasy!

Scrimping and saving to pay for the new car with cash is hard. You have to save $1,000 each and every month for two years to save up the $24,000, and the only way to do that is make some extra income by working longer hours, and sacrificing numerous pleasures--being a shopaholic, going out to eat frequently, $5 coffee drinks, jetting somewhere for a long weekend, etc.

The sacrifice and discipline required are hard. What's the pay-off in avoiding debt? Not much--after all, the new auto loan payment is modest. If we take a 5-year or 7-year loan, it's even less. By borrowing $23,000, we get to keep all our fun treats and spending pleasures, and we get the new car, too.

At the corporate level, it's the same story: borrow a billion dollars and use it to buy back shares. Increasing the value of the corporation's shares by increasing profit margins and actual value is hard; boosting the share price with borrowed money is easy.

It's also the same story with politicians and the government: cutting anything is politically painful, so let's just float a bond, i.e. borrow money to pay for what was once paid out of tax revenues: maintaining parks, repaving streets, funding pensions, etc.

This dependence on expanding debt for maintaining the status quo is a global trend. Debt is exploding in China in every sector, and the same is true in other nations, developed and developing alike.

Borrowing more money from the future is easy, painless and requires no trade-offs, sacrifices or accountability--until the debt-addicted economy collapses under its own weight of debt service and insolvency. People keep repeating various versions of the story that "debt doesn't matter" because "future growth" will outgrow the skyrocketing debt, or inflation will make it all manageable, or that central banks will do whatever it takes to make sure everyone has enough money to service their debt burdens: negative interest rates, helicopter money, etc. etc. etc.

We want to believe in financial magic because we want things to remain easy. Borrowing from the future is easy, making sacrifices and being accountable is hard.

But eventually the cost of servicing even low interest-rate debt squeezes spending, eventually capital tires of chasing negative interest-rate bonds, eventually lenders realize that leverage has skyrocketed along with the debt and risk is piled up like dry tinder in a drought-weakened forest.

Central banks realize they can't even limit the expansion of their balance sheets without triggering a panic that would collapse all the debt-based contraptions and manipulated markets they've held aloft with limitless liquidity.

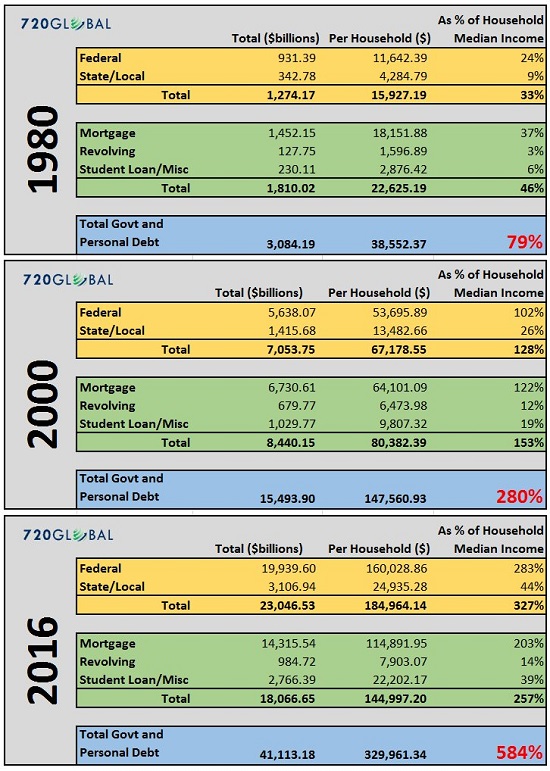

If you believe that going from a total debt burden (government and personal debt) per household being 79% of median household income to debt per household being 584% of median household income doesn't matter and will have no consequences, you believe in magic. Unfortunately, thinking something will be easy forever and have no consequences is not the same as the real world of skyrocketing debt and leverage having no consequences.

A world in which "we do these things because they're easy" has one end-state: collapse.

Believing that debt has no consequence, that the status quo is permanent, that all the

promises based on soaring debt can be paid--it's all an appealing fantasy,

magical thinking at its most enchanting. Believe these fantasies at your own risk.

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

Check out both of my new books, Inequality and the Collapse of Privilege ($3.95 Kindle, $8.95 print) and Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle, $8.95 print, $5.95 audiobook) For more, please visit the OTM essentials website.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Lyn G. ($50), for your outstandingly generous contribution to this site -- I am greatly honored by your support and readership. |

Thank you, Carolyne D. ($50), for your monstrously generous contribution to this site -- I am greatly honored by your support and readership. |

Discover why Iím looking to retire in a SE Asia luxury resort for $1,200/month. |