|

| weblog/wEssays archives | home | |

|

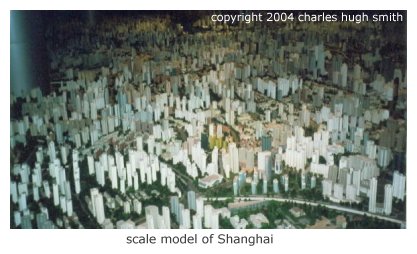

Can the U.S. Go Down and China Stay Up? (June 5, 2007) Is China "decoupling" from the U.S. economy such that it can prosper even as the U.S. sinks into debt-bubble-popping recession? Many think so, but I am skeptical. Let's start with knowledgeable reader Peter John Golda's observations about real estate speculation in China: I also confirm your theories regarding Chinese real estate. I investigated this in depth, with the help of my wife and relatives up there on the East-side as I was wanting to purchase some property there. The thing that scared me the most is something you did not really mention directly in your post. Apartments are being flipped at huge profit every 6 to 12 months, sure, but what is scary is that nobody is living in them. It's all 100% pure speculation on a scale that my mind is not even able to comprehend.

Peter also recommended Dreams Built on Sand: Investing in China Real Estate which lists eight significant (and under-reported) difficulties with real estate investing in China. Xinglongnite added this telling comment to the article: Land and property development has so far been one of very few successful businesses of the local governments and their powerful officials since the beginning of 10th 5-year planning period (2000 - 2005) --- imagine a gigantic entitlement program by a US state to grant unlimited land development and building rights to every local city council member, city manager, municipal judge, sheriff and deputy, and support them with abundant bank credit. The obvious end result would be a run-away property bubble. That is what the major cities in China are heading for.A bubble is a bubble regardless of its location or the nationality of its players. Lending is fast and loose in China, with tens of billions of risky loans being made to local governments and developers. The ability to service those loans, never mind pay them off, once the property bubble pops is virtually nil. As I have reported previously, the "middle-class" friends of our Chinese friends in Nanjing (we have a number of sets of Chinese friends, many of whom we have known for 15 years) already owned three "investment" apartments each even back in 2004. The bullish argument is: China needs 200 million new housing units, so all this building is "natural demand." The problem with this story is only a few tens of millions of wage earners can afford what's being built. A good two-wage family income is $600- $700 a month ( nurse and teacher) while the units being sold are $100,000+. Sure, once the price plummets to $30,000, there will be buyers, but guess what happens to the banking sector when all those bad loans are written off as uncollectible, and to new developments on the planning boards? The other bullish mantra is that the Chinese consumer will soon buy much of the output of its stupendous manufacturing base, so China no longer needs the U.S. consumer. On sheer numbers, this seems plausible, but if you look at reality, there is little evidence to support it. Consider this recent story in Businessweek: Cautious Consumers: The Chinese are on a spending spree, right? Not really. In fact, they're so tightfisted, Beijing is worried. But look beyond the headlines and you'll find that China's 1.3 billion people are actually buying relatively little. Although the mainland's population is four times that of the U.S., Chinese consumers last year spent just 12% of what Americans did, figures investment bank UBS (UBS ). And private consumption as a share of gross domestic product in China is falling, to less than 40% today from about 48% in 2000.That pretty much refutes every bullish argument being made about the sustainability of China's current bubblicious boom. It's important to recall that the majority of Chinese workers do not have a pension nor do they have medical insurance/coverage. The "iron rice bowl" of the pre-1978 era has largely been dismantled. So Chinese saving most of their earnings makes perfect sense. So what happens when the property/debt bubbles burst? Will Chinese investors and consumers be hurt? Will U.S. consumers be hurt when our slow-moving property bubble finally sags under its own weight? Of course they will; it's called the reverse wealth effect, and it works in every nation and era. Some thoughtful commentators believe Asia and Europe will grow so vigorously that they will replace the overburdened U.S. consumer as a buyer of all China's staggering output. But Europe is living off its own real estate bubble, just as we have in the U.S. As for Japan--like its EU export-dependent cousin, Germany, it's enjoying a boom based on selling machine tools and such to China's export machine. Should that export machine falter, then so too will Japan and Germany. Bottom line: when the only consuming/importing nation goes down (the U.S.), all the net exporters will have no one to sell to. You can't all be net exporters forever. In sum: the entire globe is living off of a debt /derivatives /lending bubble of epic proportions. When the global debt/ derivatives/ real estate bubble pops, there will be no safe ground. For more on this subject and a wide array of other topics, please visit my weblog. copyright © 2007 Charles Hugh Smith. All rights reserved in all media. I would be honored if you linked this wEssay to your site, or printed a copy for your own use. |

||

| weblog/wEssays | home |