|

| weblog/wEssays archives | home | |

|

Beneath the Surface, Part IV: Commodities, Gold, the Dollar and The Wealth Effect (November 30, 2006) We turn once again to invaluable contributor Harun I. for two telling charts: the Dollar-Gold ratio and the Dollar-Commodity ratio. For a brief introduction to their import, here are Harun's comments: Every time I look at these charts I wonder how any reasonable economist could state with a straight face that there is a wealth effect. Against gold and commodities, the dollarís purchasing power has plummeted at a mind boggling rate and somehow CNBC doesnít think anything is wrong. Why havenít they put up any of our charts on their screens and discussed their implications?"The wealth effect" is the cherished notion that rising property or equity values embue the giddy owner-consumer with a godlike sense of spending power due to his/her rising fortune. (And the best part, of course, is that all that extra wealth is free, i.e. unearned.) What these charts reveal is that, priced in actual goods (commodities like oil and sugar) or in a commodity which maintains its value in all currencies (gold), the Average Joe has suffered a stupendous loss of real wealth, i.e. buying power.

Even taking into consideration the rise (in dollars) of real estate and the stock market, the average American has still not kept pace with either gold or commodities. The rise in net worth priced in dollars has not even offset the decline in wealth priced in real goods and gold.

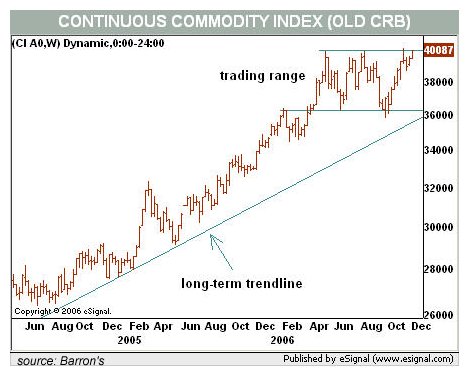

This may help explain why Americans have borrowed hundreds of billions of dollars from their declining home equity just to maintain their lifestyle, and why increasing numbers of Americans feel more financially insecure than they did five year ago. There is little wonder why they feel poorer when you gaze at these charts. They are poorer. Last but not least, let's consider the popular notion that commodity prices are falling. Oh really? Not according to this chart, which reveals that commodities--even with the 25% decline in crude oil prices--are poised to break out to new highs:

These charts reveal that there is a major divergence between wealth as measured in dollars--what the pundits crow about--and wealth in terms of purchasing power. Americans are far poorer than they were a mere five years ago, before the dollar lost a third of its value and gold and commodities began their ascent. Are you catching on to the deception here? It's similar to the "new Dow high" deception; adjusted for inflation and the declining value of the dollar, the stock market is far from its highs, and Americans have collectively become vastly poorer, even as we borrow billions from foreign investors every day to keep our fabulous deficit lifestyle afloat. Do chickens come home to roost? Yes, they do. And the cheerleader rah-rah Bull Market pundits will rue the day. For more on this subject and a wide array of other topics, please visit my weblog. copyright © 2006 Charles Hugh Smith. All rights reserved in all media. I would be honored if you linked this wEssay to your site, or printed a copy for your own use. |

||

| weblog/wEssays | home |