|

| weblog/wEssays archives | home | |

|

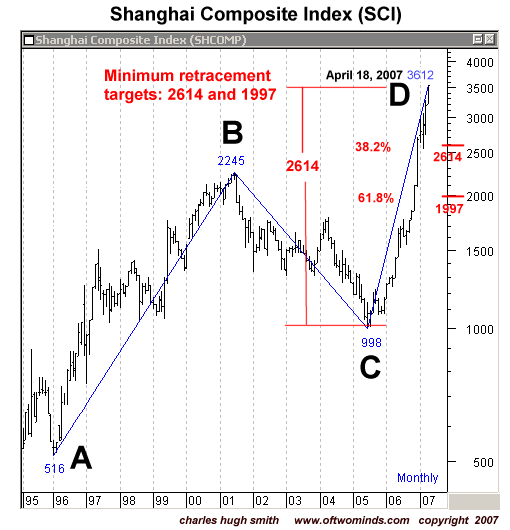

A Stock Operator's Intuition (April 20, 2007) At reader/analyst Harun I.'s recommendation, I just read Reminiscences of a Stock Operator While I hesitate to summarize such a rich source of stock market wisdom, it's worth noting that Livermore observed price data (the ticker) and gleaned patterns from price data alone which tipped him off to probable future movements. He was also a firm believer in "don't fight the tape," i.e. don't bet against a trend. His basic trading strategy was to identify the general market trend and then ride it up or down for all it was worth. But he also relied on his intuition to identify when a trend was about to change direction. Though he reported that he couldn't pin down the proximate cause of his strong feeling, he nonetheless acted on his sense that the top or bottom was in. This intuition enabled him to buy into the market just before the trend changed direction, maximizing his profit. At the risk of making a fool of myself (yet again), my intutition is the stock market is on the edge of breaking down. How far it will drop I won't even guess, but we can establish Fibonacci-derived targets. Let's start with the bubblicious Shanghai Composite Index, which just fell 4.5%:

Livermore noted that stocks tend to rise to round numbers. Is it just coincidence that the Dow Jones Industrial Average just topped 12,800, and the Shanghai Index clicked above 3,600? But having reached that summit--some 26% higher than a mere 6 weeks ago--how much juice is left? Enough to reach 3,700, or 4,000? I think not. I've noted how the SCI has traced a classic A-B-C-D move (one leg up, a retrace, then a larger upleg) and is thus poised for a major retracement. Fibonacci targets suggest a minimum 1,000 point drop with a 1,600 drop also a likelihood. Since everyone is suddenly aware that inflation could be an issue in China (Gosh, I thought inflation was vanquished globally, forever!), let's look at a chart of the U.S. 10-year bond overlaid with China's dollar reserves.

We have to ask: is there any connection between China's massive buying of dollars and the low interest rate the U.S. has enjoyed? Virtually everyone agrees (or admits) that China's stupendous buying--hundreds of billions per year, and over $130 billion in the past 3 months alone--have suppressed U.S. interest rates. Now the trillion-dollar question: is this sustainable? And if not, what happens when China stops buying? My intuition is that interest rates are going to rise, not drop, as is widely expected. Why? Just look at this chart and ask, how many more dollars will China need to buy to keep suppressing the U.S. interest rate? Another half-trillion a year? What else could China be buying with its reserves? China's foreign reserves balloon (BBC News) China's foreign exchange reserves, 1977-2006 My nephew Ian sent me this article from the New York Times which provides one explanation for why China may decide $1.2 trillion is enough: they don't need to prop up the U.S. dollar/debt/consumer any longer: China Leans Less on U.S. Trade (free registration required) And resource analyst/contributor U. Doran sent in this link to another New York Times story in which a leading U.S. economist basically begs Asia to sell dollars and invest the money in something productive, like their own people and economies: Lawrence H. Summers, the former Harvard president, Tells Asia to Sell the Dollar If you look at the bond yield, you will note that the current rate of 4.6% aligns with a peak in the "stairstep down" as yields fell. I have drawn some blue lines from the next few peaks, which are now targets for the long painful climb up. How high will yields (and thus interest rates) rise? I won't hazard a guess. But as Jesse Livermore taught us: the way to make a fortune is identify the trend and ride it--in this case, up. For more on this subject and a wide array of other topics, please visit my weblog. copyright © 2007 Charles Hugh Smith. All rights reserved in all media. I would be honored if you linked this wEssay to your site, or printed a copy for your own use. |

||

| weblog/wEssays | home |