|

| weblog/wEssays archives | home | |

|

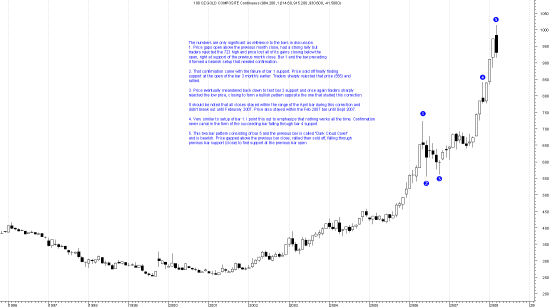

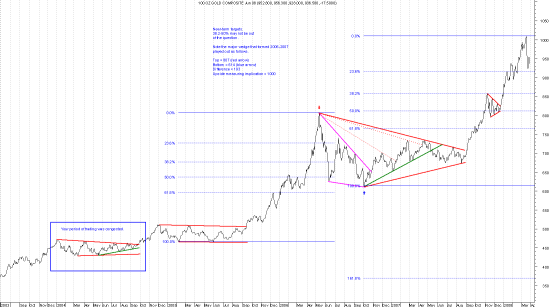

A Look at Gold (April 2, 2008) As longtime readers know, one of the goals here at oftwominds.com is to present perspectives which might aid the average wage earner/investor in their quest to retain the purchasing power of whatever assets/money they possess. Owning gold and/or other precious metals have been one successful way to do so, as we have shown via charts of the Dow Jones Industrial Average priced in gold. Priced in gold, the U.S. stock market averages have suffered enormous declines even as they reached "new highs" in nominal prices. So much for "stocks are cheap." Nonetheless, it is possible to lose money when buying gold and/or gold stocks, a fact I have unfortunately proven repeatedly. To help us understand where the price of gold is in terms of technical analysis, I asked frequent contributor Harun I. for some charts and commentary. I reported to him that I had lost money buying gold in late 2004 when it was under $500, and thus the note on one of these charts referring to that time frame. At the time, it was extremely frustrating to be losing money, as gold traded sideways for long, grinding months. Yet clearly, holding through that period of congestion certainly paid off later. Still, it would have been a more successful strategy to buy gold at its near-term low rather than buy it high and watch it slide for the better part of a year. Here are the charts. For greater clarity they are posted in full size (approximately 1600 pixels) which does require some scrolling. We think it's worth the exra effort. Just click on the smaller images below to open the full-sized charts. Harun made these general comments on the charts and gold. Additional technical comments can be found on the charts.

Hopefully these charts will help even the most bullish investors understand corrective phases.

Thank you, Harun, for your insights on gold. Please re-read the "HUGE GIANT BIG FAT DISCLAIMER" below to refresh your memory that everything here is free of charge and is not offered as advice, nor should it construed as advice.

NOTE: contributions are humbly acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency. Thank you, Lynn C. ($50), for your extremely generous contribution to this humble site via check. I am greatly honored by your support and readership. All contributors are listed below in acknowledgement of my gratitude.

HUGE GIANT BIG FAT DISCLAIMER: Nothing on this site should be construed as investment advice or guidance. It is not intended as investment advice or guidance, nor is it offered as such. It is solely the opinion of the writer, who is NOT an investment counselor/professional. All the content of this website is solely an expression of his personal interests and is posted as free-of-charge opinion and commentary. If you seek investment advice, consult a registered, qualified investment counselor (As with any other professional service, confirm their track record and referrals). For more on this subject and a wide array of other topics, please visit my weblog. copyright © 2008 Charles Hugh Smith. All rights reserved in all media. I would be honored if you linked this wEssay to your site, or printed a copy for your own use. |

||

| weblog/wEssays | home |