|

| weblog/wEssays archives | home | |

|

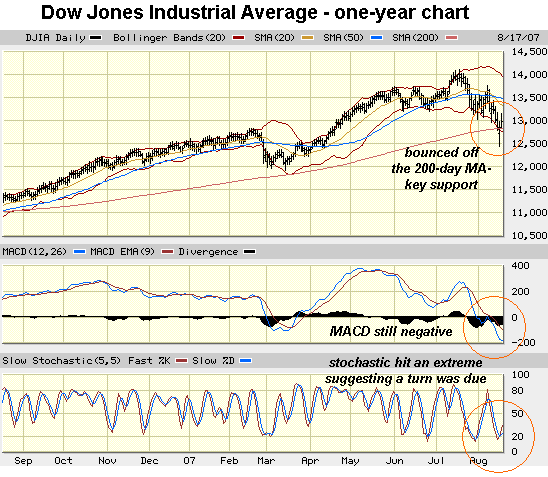

Bear Market Bounce (August 17, 2007) Many astute traders sensed a near-term capitulation/bottom yesterday. If we have entered a long-term Bear market in real estate and stocks, such wild retraces/"dead-cat bounces" are par for the course, as this chart from the last Bear market in 1966-1982 reveals:

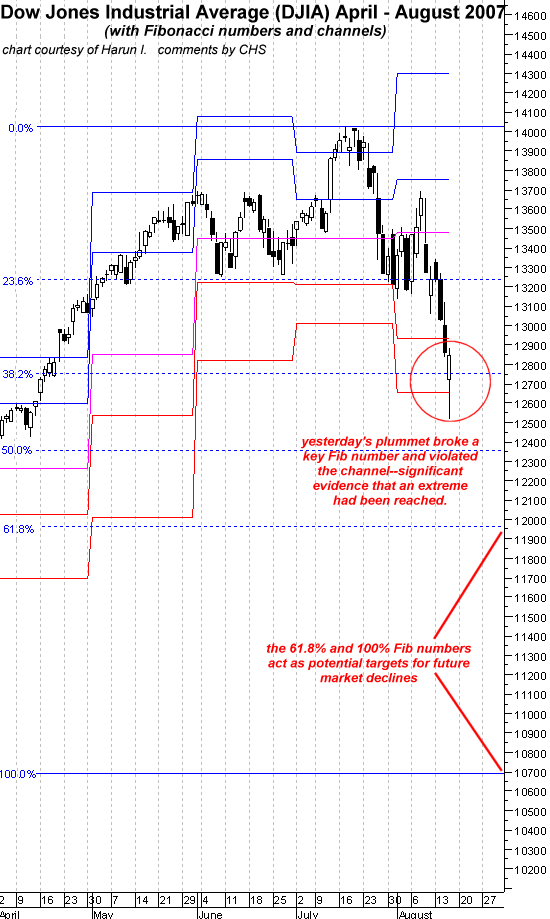

Note the wild swings down as reality hit the market with heavy splashes of cold water, and equally wild bounces as periods of euphoria/"good news" like today's Fed cut mask the cold reality. Such volatility offers astute traders huge opportunities to make money--hence it behooves us to look for tops and bottoms of such swings in pyschology. Frequent contributor Harun I. was kind enough to send in a chart of the Dow Jones Industrial Average (DJIA) with Fibonacci numbers and channels. (Note that the full chart was truncated by me to fit the space limitations of this page.)

Note that yesterday the market hit a key Fibonacci number (38.2%) and violated its lower channel. These actions suggested a near-term bottom was likely--not guaranteed, but likely, as no market, Bull or Bear, goes up or down in a straight line. In this one-year chart, we can see that the DJIA also bounced hard off a key level of support: the 200-day moving average.

Additionally, the stochastic indicator had hit an extreme "oversold" level which generally signals a bounce/turn/retracement. Thank you, Mary Jo S. ($50), for your extremely generous donation to this humble site. I am greatly honored by your support and readership. All contributors are listed below in acknowledgement of my gratitude. For more on this subject and a wide array of other topics, please visit my weblog. copyright © 2007 Charles Hugh Smith. All rights reserved in all media. I would be honored if you linked this wEssay to your site, or printed a copy for your own use. |

||

| weblog/wEssays | home |