|

| weblog/wEssays archives | home | |

|

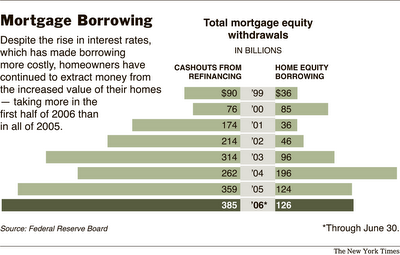

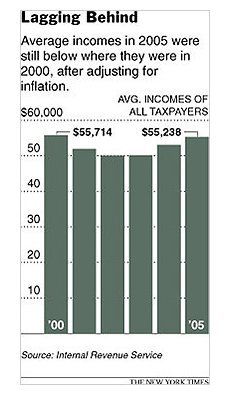

Financial Worry, Health, and the Reverse Wealth Effect As Housing Pops (December 12, 2007) It's been said that the difference between childhood and adulthood is financial worry. Children are of course troubled by family insecurity, but the gnawing weight of financial distress really eats away at the responsible adult(s). As you have probably surmised, I know because I've been under extreme financial duress all too many times. (That goes with being self-employed in cyclical industries.) But financial worry can also arise from "death by a thousand cuts"-- small reductions in income and small cumulative increases in expenses which slowly work to bring household balance sheets into worrisomely negative territory. The greatest source of stress is the loss of a loved one, followed closely by combat, divorce, the loss of one's job/livelihood/home/business, serious injury/illness and moving, i.e. "pulling up stakes and starting over." Unfortunately, the last three are intertwined with financial losses and worry. We all know financial distress is highly stressful, and that chronic stress is a killer. Though this is hardly news, it is also largely ignored; thus The San Francisco Chronicle's recent feature on the topic was most welcome: Stress makes us depressed, fat, sick - and we do it to ourselves. It may be difficult for younger people who have only known prosperity and shallow, brief recessions like 1991 to know just how wrenching a "real recession" like those of 1973-74 and 1981-82 can be. I vividly recall the headline in 1973 announcing that General Motors was laying off 100,000 workers that weekend. In 1982, unemployment was officially over 10%, and unofficially about 15%. In recent years, most of the unemployed soon find some kind of paying work; in a "real recession" jobs dry up almost completely and so the unemployed stay unemployed. Since there is about 130 million jobholders in the U.S., a 10+% unemployment rate would mean 13 million people were out of work. Most of those laid off will experience financial worry--as will their dependents. Let's consider all the feedback loops which are starting to reinforce each other. 1. Housing and the Reverse Wealth Effect. Since a house is the largest asset in most American households, any rise or decline in the home's value has a profound effect on our deepest sense of financial well-being. When our house appreciates, it makes us feel wealthier, hence the name for this phenomenon, "The Wealth Effect." When people feel confident in their financial future, they tend to spend freely. But the Wealth Effect has a flip side, called "The Reverse Wealth Effect". When housing declines in value, people feel poorer, even when the decline has no measurable effect on their actual income or bank balances. But in this era of "debt-based prosperity," the house was not just a reservoir of psychological well-being but a source for cash, extracted via refinancing or HELOCs (home equity lines of credit). Now, the drop in housing valuations has a very direct and measurable impact on household bank balances and spending because, as the cliche goes, "the home equity ATM is closed." Here are two charts which depict the vast equity extraction of the past seven years:

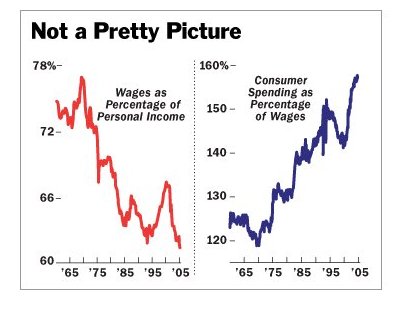

2. As housing and equity extraction decline, so will consumer spending, leading to recession. As this

chart shows, wages have been essentially flat, so where will the money come from to

replace equity extraction? The stock market? Most households have little exposure to

the markets, except in their pension funds, 401K and IRAs.

2. As housing and equity extraction decline, so will consumer spending, leading to recession. As this

chart shows, wages have been essentially flat, so where will the money come from to

replace equity extraction? The stock market? Most households have little exposure to

the markets, except in their pension funds, 401K and IRAs.

3. As the stock market succumbs to lower profits and a recessionary economy, then pension and retirement funds will take a hit. Public and private workers alike have enjoyed outsized returns in their pension/retirement funds for 25 years. All the pension plans are now predicated on outsized returns continuing indefinitely. Yet history suggests Bull Markets don't last forever, and there is virtually no awareness that pension plans may actually suffer losses rather than 7%-15% annual appreciation. The net result is a decline in income, for workers will be required to begin contributing, or contributing more, to pension plans as pay-outs exceed investment income. 4. Government "junk fees" and taxes are rising, reducing consumer income. Have you noticed that the parking ticket which used to be $10 a few years ago is now $30? This may sound too trivial to mention, but then add in the 1%-of-gross-receipts "city business license," the $300/year "rebuild our libraries" bond tacked on your property tax bill, the "fire extinguisher inspection fee" and dozens of other "junk fees" for things which government used to pay for out of property, sales and income taxes, and it starts adding up. I pay thousands of dollars a year in these "junk fees"--licenses, fees and property tax surcharges which were once paid for by the regular assessed property taxes and sales and income taxes. Cities have increased the costs of parking tickets, vehicle fees, business licenses and the like to harvest more revenue without "raising taxes." If you're paying more for "fees," the net result is the same: your disposable income goes down, tax revenues go up. Is a "fee" not a "tax"? It's orwellian to say "no" when the citizenry is captive; either pay the absurd $30 parking ticket or we impound your vehicle. Next thing you know, there will be a $10 "processing fee" for your library card. 5. Mortgage re-sets will reduce the incomes of millions of households. The plan to "save" 500,000 subprime borrowers from onerous re-sets is all in the news, but millions of non-subprime mortgages will be re-setting for households which can afford the higher mortgage payments--but it will certainly reduce their disposable income. 6. As consumer spending declines, millions of jobs will have to be cut to preserve profitability. No CEO earns a $100 million stock option "compensation package" if the corporation's stock tanks and profits turn into losses. Labor is the highest cost for all American businesses, large and small, and just about the only way to slash expenses significantly is reduce headcount, i.e. lay off the highest paid, least productive employees. Bullish apologists claim "business investment" will save the day, but the world is awash in excess capacity for virtually everything except oil and commodities like platinum. The global ramp-up to industrialize China is much farther along than the Bulls are willing to concede. China has been industrializing for 25 years already, and some leveling off would be natural. To claim that the U.S. economy can put 10 million people laid off in a consumer recession to work making stuff to sell to China, India and Europe is quite a stretch, given that exports are less than 10% of the U.S. economy while consumer spending is 70%. 7. The costs of borrowing and servicing existing debt is rising. As "risk" is re-set in the global financial system, the costs of borrowing and servicing existing loans is rising, regardless of what the Fed does with the Fed Funds Rate. This is true not just for housing but for business as well. In just one example, consider this Wall Street Journal story: Mortgage Pain Hits Prudent Borrowers: Some of the costs of cleaning up the mortgage crisis are beginning to affect people who pay bills on time and avoid excessive debt. A new fee from Fannie Mae comes as interest rates are heading up and increases in insurance costs.8. As lay-offs increase, more households lose medical insurance. Since there are already 40 million uninsured citizens in the U.S., what's another 10-20 million? Perhaps one difference is these households were middle-class, at least they were until one of the primary wage-earners lost his/her job. If you're a civilian worker in the U.S., you know the drill: your spouse's medical benefits may be either poor ("fake" coverage) or non-existent. He or she might be a contract employee, or self-employed, or working at a non-profit or small business which provides no coverage. If the wage earner with the "good" health plan gets laid off, the family loses coverage. If you're self-employed, you know how expensive healthcare insurance is: any family policy under $1,000/month is considered reasonable. Sure, if you're 23 and single you can buy a cheap plan, but if you're middle-aged with kids, it's hard to get coverage for less than $800/month. If a small business falters in a recession, the proprietors may have to choose between keeping the house and feeding the kids or maintaining health insurance. You know what goes--the coverage. 9. As recession takes its toll on the nations' households, stress increases and health declines. Nobody thought the economy could decline in early 1929, or in 1969, either. people who have grown accustomed to their house rising in value and their stock or pension stake rising like clockwork every year will encounter financial stress they are unprepared for if a family wage earner is laid off. Though I cannot list any statistics to back this up, an informal survey suggests that an extraordinary number of middle-class households are already experiencing severe financial worry--that is, they're barely keeping their heads above water as it is. Any shock--an unexpected medical bill, an elderly parent requiring financial aid, job loss or mortgage re-set--can push the household over the edge into insolvency and bankruptcy.  It wasn't always this way. Wages rose faster than expenses, and people

were more prudent with their finances, saving more and choosing modest vehicles and houses.

It seems incredible that so many people are stretched to the limit in "good times," and so

unprepared for "seven lean years" or indeed, any financial reversal.

It wasn't always this way. Wages rose faster than expenses, and people

were more prudent with their finances, saving more and choosing modest vehicles and houses.

It seems incredible that so many people are stretched to the limit in "good times," and so

unprepared for "seven lean years" or indeed, any financial reversal.

This is how a reversal of the wealth effect, financial worry and health are intertwined and feeding back into each other. It is worrisome on many levels, for people without medical insurance often don't receive any care except emergency room treatment, which is typically too late to address the underlying causes or chronic conditions. It's possible that some people will become disabled by financially-induced stress-related diseases, further impoverishing the family. Without healthcare, the condition will go untreated. As people fall out of the job market, the family loses its middle-class perks like medical coverage. As expenses like mortgage re-sets rise, income falls, and any lay-off could trigger the loss of the home. On top of the high-stress loss of livelihood/job/business, the family may also be forced to "pull up stakes and start over again"--sometimes a welcome escape but stressful nonetheless. When the economy's cheerleaders wave their pom-poms, they never consider the reinforcing nature of the negative forces listed above. Yet in the real world, they are tightly linked: being laid off triggers loss of health coverage which then impacts the family's health and even the breadwinners' ability to work. Financial strain, if it lasts long enough, can cause once-stable households to break up or lose the family home--even a home with equity and a fixed-rate mortgage. Those of you who lost your jobs or businesses in 1981-82 and had to relocate to start over know what I'm talking about; and with medical coverage many times more expensive now that it was then (in real inflation-adjusted terms), starting over and reclaiming a middle-class lifestyle after the decimation of a lengthy recession will be that much harder. Thank you, Louis M., ($25), for your generous contribution to this humble site. I am greatly honored by your readership and support. All contributors are listed below in acknowledgement of my gratitude. For more on this subject, or to access the full content and archives, please visit the Of Two Minds weblog. copyright © 2007 Charles Hugh Smith. All rights reserved in all media. I would be honored if you linked this wEssay to your site, or printed a copy for your own use. |

||

| weblog/wEssays | home |