|

| weblog/wEssays archives | home | |

|

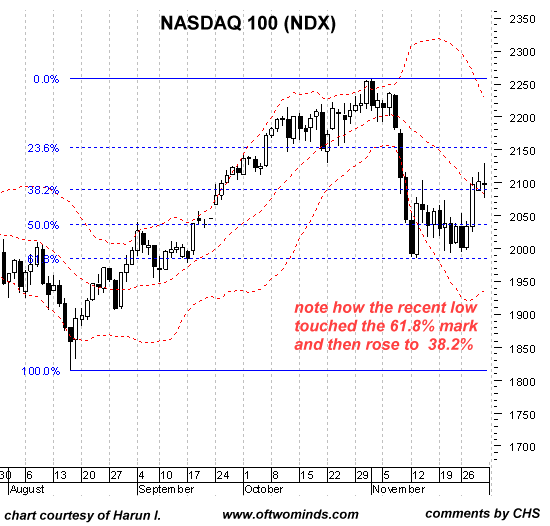

Trends and Countertrends (December 5, 2007) Now that the headlines are filled with doom and gloom about housing and the U.S. economy, I am a stock market Bull. What?! Does that mean I really think the economy is healthy and all the negatives will magically vanish? No, it just means I respect trends and countertrends. Here's the key illusion to get past: that any market cares about fundamentals. Housing did not double and triple in a decade based on fundamentals of supply and demand-- it tripled on speculative fever. Ditto for every bubble in every era. Demand for petroleum did not suddenly exceed supply in the past 3 months, causing oil to shoot from $70/barrel to $98/barrel--it was driven up by speculators/managers buying oil futures. Markets respond to sentiment, not fundamentals. And whether we like it or not, the human mind prefers habits of thought. One habit is a desire for change and novelty and a distaste for calm. Thus markets tend to swing from negative sentiment (fear/anxiety) to positive (greed/euphoria). Like our brethren species the rat, we habituate quickly to what works. The rat soon learns the blue button issues a food pellet and the red one triggers an electric shock. In a similar manner, with the exception of a brief period in 2001-2002, investors and speculators have been amply rewarded for "buying on the dips." Betting against the market can be rewarding during brief countertrends/reversals, but since the emergence of the Great Bull Market in 1982, 25 years ago, buying on the dips as been rewarded as regularly as hitting the blue button for a food pellet. Along with many others, I have been posting for several years now about the structural problems in the U.S. and global economies, focusing on the inevitable crumbling of the global housing bubble. All of this remains true, but the markets march to different drummers-- other traders and the mad swirl of sentiment. As soon as everyone everywhere is spouting doom and gloom, the market will surge up. And just as predictably, when everyone is singing the everlasting praises of the economy, then the market is poised for a vicious decline. It's called contrarian investing, and it simply mirrors human psychology. Isn't the economy sliding into a prolonged recession? Yes. Won't that eventually effect the stock market? Yes. But the long-rewarded habit of buying on the dips will take a few years to be behaviorally modified; only after several years of repeated losses will speculators/investors hesitate from buying on the dips. 25 years is a long time; most traders/investors cannot recall what a Bear Market feels like because they weren't trading 30 years ago. One thing traders have long noticed is that certain points act as strange attractors in stock charts. That is, prices tend to move up and down to these points. Sometimes the attraction is as simple as a round number; as legendary stock trader Jesse Livermore noted 80 years ago, a stock nearing $100 will almost certainly exceed $100 for absolutely no reason other than the attraction of that big round number. (Ditto for gold, etc.) Another set of attractors can be found in Fibonacci numbers. Here is a short-term chart of the NASDAQ 100 (NDX) courtesy of frequent contributor Harun I. which illustrates the peculiar but useful attraction of "Fibos":

Interestingly, the long-term Fibonacci 38.2% extension on the NDX lies around 2,300-- meaning that there are purely technical reasons for suspecting that level will act as an attractor, drawing the NDX up to a new high at 2,300, regardless of the lousy fundamentals of the U.S. and global economies. This kind of analysis tends to keep us honest as investors by calling our assumptions into question. Is there a guarantee than the NASDAQ 100 will shoot up to a new high at 2,300? Of course not, but the possibility should be considered. Thank you, Richard S., ($10), for your kind contribution to this humble site. I am greatly honored by your readership and support. All contributors are listed below in acknowledgement of my gratitude. For more on this subject and a wide array of other topics, please visit my weblog. copyright © 2007 Charles Hugh Smith. All rights reserved in all media. I would be honored if you linked this wEssay to your site, or printed a copy for your own use. |

||

| weblog/wEssays | home |