|

| weblog/wEssays archives | home | |

|

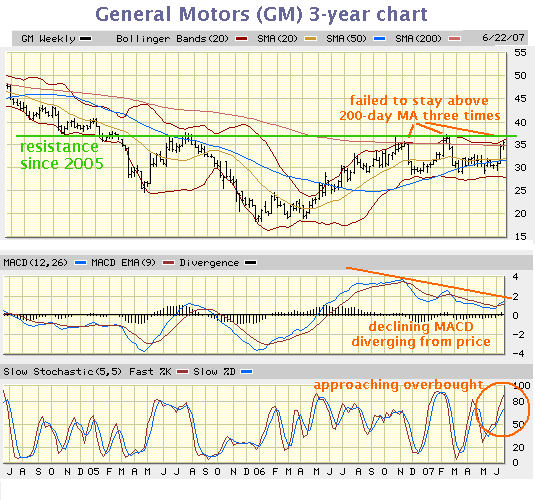

The 9 Biggest Mistakes Investors Make (June 26, 2007) A certain investment service has been buying full-page ads in major U.S. newspapers touting their free report, The 8 Biggest Mistakes Investors Make. Ha, I sneer at their mere 8, and handily trump them by offering The 9 Biggest Mistakes Investors Make. 1. Investors purchase stocks, bonds or real estate in the months of January, February, March, April, May or June. 2. Investors purchase stocks, bonds or real estate in the months of July, August, September, October, November, or (horrors) December. 3. Investors base their decisions on investment newsletters hyped in full-page ads or on the "financial" TV channels rather than on their own analysis. 4. Investors rely on "hot tips" from blogs and websites rather than sweat through their own analysis. (Yes, blogs like this one) 5. Investors confuse goateed raving lunatics providing free entertainment in the form of "investment advice" on TV with trustworthy expertise. 6. Investors buy Kraft Foods (ticker KFT) because they like Cheez-Whiz, e.g. "buy what they know." 7. Investors obsess over high-falutin' math (standard deviations, etc.) and obtuse technical signals (The Titanic Signal, etc.) while ignoring the most basic formula of investing: Hope + Greed + Ignorance + Fear = Losses. 8. Investors focus on the "buy" button but forget to hit the "sell" button until it's too late. 9. Investors actually give credence to investment banks and buy-side analysts' recommendations--for instance, the recommendation yesterday to "buy General Motors." Now this must be right, because it comes from Goldman Sachs, right? Goldman Sachs analyst Robert Barry upgraded General Motors (GM) to buy from neutral in what he described as a "tactical trading call." He also raised his price target on the shares to $42 from $29. GM's stock price "implies little to no downside and potentially large upside from the real possibility concessions end up even larger than what is priced in," he said in a note to clients.Count me skeptical, but even though this analyst from the fine firm which provided us our current Treasury Secretary says there is "little to no downside" in GM, let's look at a simple chart:

"Little to no downside"? I guess a drop from $37 to $20 doesn't count? A target of $42, when $37 has been ironclad resistance since early 2005? What alternative Universe does this analyst think GM inhabits? Never mind that a purely technical view suggests this stock is a beautiful short (i.e. primed to drop significantly)--take a gander at the MACD divergence, if you will--what about the fundamentals of the company's business? Is the consumer in fine fettle and raring to take on even more auto loan debt? Does GM have a profitable small-car line as gasoline retrenches at $3/gallon on its way to $4/gallon? Do they manufacture a hybrid lines of vehicles to compete with Toyota and Honda? Is there any published analysis which proves modest "concessions" from the UAW will transform an essentially bankrupt corporation (its pension and retiree healthcare liabilities far exceed its assets) into a viable firm? Allow me to sumamrize: there is absolutely no technical reason to believe GM is heading to $42, and much evidence it's heading to $20, if not $ .20. There is absolutely no evidence that GM is not a technically bankrupt company heading for formal bankrupty in the next recession (scheduled to begin in October 2007). Yet here we have "reputable analysts" from "reputable firms" (gag!) telling suckers, I mean "retail investors," to gamble their hard-earned money on a high-risk bet. Why? Probably so Goldman Sachs and its big clients can distribute/dump/unload their doomed shares of GM onto poor suckers naive enough to believe their "recommendation" isn't purely self-serving. Is there no shame? None whatsoever. Caveat emptor, Baby. Let the buyer beware. NOTE: At the time of posting this entry, I did not have any position in GM. However, I did profitably buy puts on the stock the last time it hit $36. That is disclosure, not advice. EXTRA SPECIAL BONUS NOTE: "The Titanic Signal" is a fabrication/satire. It is my invention. Oh, and by the way, it's flashing a huge gleaming red "sell". For more on this subject and a wide array of other topics, please visit my weblog. copyright © 2007 Charles Hugh Smith. All rights reserved in all media. I would be honored if you linked this wEssay to your site, or printed a copy for your own use. |

||

| weblog/wEssays | home |