|

| weblog/wEssays archives | home | |

|

How the Housing Bubble/Credit Bubble Will Pop (June 20, 2007) This Week's Theme: Context When 2008 rolls around and the U.S. economy is sinking with frightening momentum into a bottomless quagmire, you'll be glad you read this entry. Why? Because you anticipated every step of the implosion and warned your friends who were still floating complacently down that river in Egypt (de-nial). In keeping with our theme of context, let's begin by noting that the proper context for the housing bubble is the all-encompassing global credit bubble which has inflated every asset class. With this fundamental firmly in mind, let's follow Deep Throat's advice from the classic film All the President's Men Let's first dispense with "the real estate market". Yes, supply and demand and housing starts and zillow.com and neighborhood sales and all the other market stuff play a part in the coming implosion, but all that noise is more a sideshow than the Main Event. Why? Follow the money. The main event is the credit market, because if you can't borrow money, or can only borrow it at a premium and under tight conditions, then how many houses are for sale in your neighborhood or the median price paid, etc. shrink to near-meaningless. Real estate sales and valuations depend solely on credit. Everything else is secondary. Next, let's dispense with the notion that the implosion of housing-based lending can be "quarantined" and won't affect the economy. The reason is that mortgage-backed securities, and the CDOs and other derivatives which have been piled in untold trillions onto them, are one leg of an increasingly wobbly three-leg stool. The second leg is so-called "junk bonds" and other commercial paper (which has ballooned to astounding levels--see chart), and the third is government bonds in all their flavors. Once the MBS leg snaps, the entire debt stool collapses.

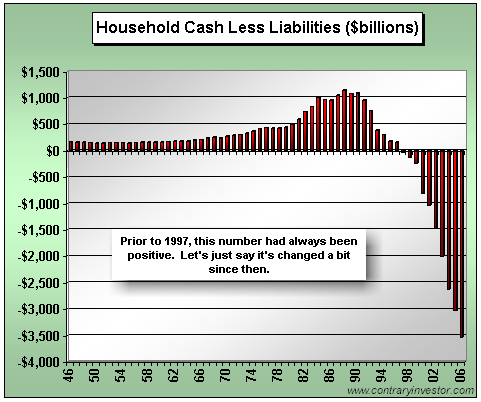

Third, let's note the critical role real estate ownership, sales and high valuations play in funding local and state governments. Government at all levels is about 25% of the U.S. economy, though in many locales it's more like a third. As mortgage rates rise and credit tightens, real estate sales fall, cutting transfer taxes; as prices fall, homeowners demand lower assessment values, further reducing tax revenues. And as frequent contributor Harun I. noted in submitting this link, local governments desperate for property tax payments are rushing the foreclosure process, dumping the foreclosed (and often trashed) home back on the lenders or builder, who then has to pay the taxes themselves before they can even auction the property off to a new buyer: Hundreds delinquent on taxes: In the Village I No. 2 district, between 5 and 6 percent of homes are delinquent while about 14 percent are late in Fairview Village. In Patterson, the delinquent taxes make up 16.43 percent of what residents in the subdivisions owe.Let's say you're a lender or builder on the edge of bankruptcy. (Yes, there are many more than you might imagine. Please see Aaron Krowne's Mortgage Lender Implode-O-Meter site for more.) You suddenly get hundreds of overdue property tax bills to pay, in cash, before you can even put the distressed houses on the auction block. Might these hundreds/thousands of property tax bills be the straw that breaks the lender's back? Believe me, the bills in California are humongous; multiply $10,000+ a year by thousands of foreclosed McMansions and you come up with some serious money due the local governments. And who, pray tell, will pay the tax lien when the lender (owner of last resort) goes belly-up? Sure, the bankruptcy court will pay the liens, but only if there's enough money left to do so. But what if the lender is well and truly stripped of cash/assets? Then what? The local government eats the taxes due--unless they try to collect in escrow when a new owner buys the property. This may work if you're talking about a $500,000 property with a $10,000 tax bill, but what happens if the process drags out, and the tax bill grows ever larger? The net proceeds from the eventual sale (assuming a buyer can be found) might well be most or all of the proceeds, leaving the holder of the mortgages with a mere fraction of the principle and none of the interest. But isn't the value of all those trillions in mortgage-backed securities based solely on the income streams generated by mortgages? What's their value if those streams dry up? That's right, the value of those MBS and all the derivatives downstream drops--a lot. And when that happens, a credit contraction or crisis occurs. For an excellent description of exactly how this can unfold, I reprint (with permission) a commentary by Karl Denninger, proprietor of the insightful Market Ticker and several other sites. I think people have been trying like hell to keep the credit market bombs quiet, and they succeeded - until this evening, when it came out that Merrill seized $400m worth of Bear's Hedgie bonds.To summarize: Say I'm a pension fund manager seeking higher yield (alpha) so I buy $100 million tranch of a mortgage-backed security, which a rating agency has, in its infinite wisdom, rated AA. My fund isn't allowed to buy less than AA, so everyone's happy. Until the underlying mortgages slip into default. Oops, the income stream is drying up. Now what? Well, there's no market for this security-- no "mark to market"--so I can hide my little mistake in the portfolio, keeping the $100 million value on it (and not coincidentally, my job). But alas, all good things come to an end, and when the rating on the MBS is dropped to BB, I have to sell it--or try to sell it. A frenzied calculation is made. Hmm, it seems the open-market value of this risky security is $5 million, tops. Not only do I lose my job, but the pensioners depending on the fund growing and producing income are in for a shock. The fund just plummeted in value and can no longer meet its pension obligations. Sorry, folks; I was just seeking alpha. Let's check the quarantine. Foreclosed homeowners: financially destroyed. Bankrupt lenders and all their employees: ditto. Local government: facing sharply reduced tax income. Since 80% of local government costs are for employees, then the only choice is lay-offs. Pension funds: income and value drop, causing pensioners to accept cuts or current employees to pony up much higher contributions--or both. Credit markets: in full panic, new loans and mortgages made only to the very lowest-risk, premium customers--in other words, a big chunk of potential home buyers can't borrow money at any price. And let's not forget how precariously perched the U.S. household is on the threshold of insolvency:

I'd say the quarantine was a failure, as the disease seems to be spreading like wildfire. There's one last critical context: the Treasury.

As I have endlessly explained, the Treasury's job is not to keep mortgage rates low; that's up to the bond market. The Treasury's job is to sell government debt via bonds--at whatever the market demands. As I have said many times, there is no Plan B. If no buyers take the bonds off the Treasury's hands at 5%, then they raise the yield until buyers appear. So everyone who is absolutely sure interest rates will drop as the economy plummets is off the mark. Rates might drop, if there's a panic "flight to quality" to Treasuries. But if there is no longer hundreds of billions in easy money sloshing around the world--i.e., the credit contraction is global, and there is no reason to think it won't be--maybe there won't be enough cash laying around to fund our government's enormous appetite for deficits/more debt. That thought is completely alien to a market which assumes the world will forever be awash in cash seeking a return. But when the credit markets turn, and fear replaces panic, then cash dries up--not just cash for mortgages, but even for Treasuries. Since there is no Plan B to fund the government debt, rates will rise, regardless of the impact on the U.S. housing market. The U.S. housing market is a sideshow; the main event is the global credit market. If you found value here, perhaps you'd like to Your readership is greatly appreciated with or without a donation. For more on this subject and a wide array of other topics, please visit my weblog. copyright © 2007 Charles Hugh Smith. All rights reserved in all media. I would be honored if you linked this wEssay to your site, or printed a copy for your own use. |

||

| weblog/wEssays | home |