|

| weblog/wEssays archives | home | |

|

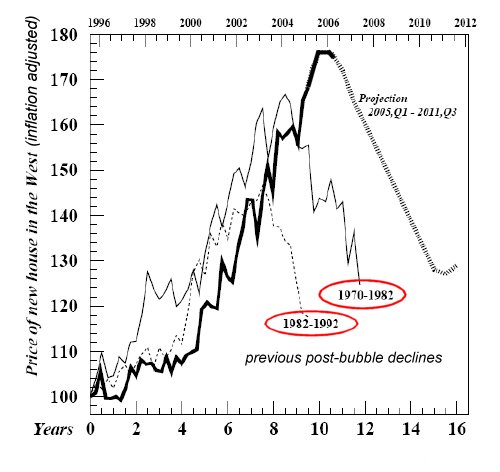

The Subprime Mess: A Personal Account (March 26, 2007) First let me thank P.W. ($5), C.M. ($30), S.V. ($10), S.H. ($30), J.D. ($5), K.C. ($12), R.H. ($20) and T.R. ($5) for their generous donations. I've listed all contributors at the bottom of the page to reflect my ongoing gratitude. I received the following personal account from J.M. about the demise of their subprime mortgage and impending loss of their home. We all know this is an increasingly common story. I have illustrated this account with an actual mortgage ad I scanned last year--the key phrase in the ad is "It's almost impossible not to qualify!"--and a graph of the probable shape of the housing bubble decline. I suspect this chart might be generous, as my own past analyses suggest a full retrace to 1996 prices is entirely possible. (Please see the "Housing Bubble Watch" entries in 2005-6 archives).

Here is J.M.'s unfortunate story: I happened to catch the Senate Banking hearing last night on C-SPAN and I am writing as one of the unfortunate homeowners caught in this Subprime nightmare. I thought I heard mention of assistance being offered to help homeowners stay in their homes and I am seeking some assistance if there is any assistance being offered. I am days, possibly weeks (if I am lucky) away from eviction from my home which I have owned for less than 2 years. I have filed for bankruptcy protection and my life is in shambles; no money, credit trashed, savings gone, low paying job . . . a mess.  Before I begin my own response, I'd like to reprint another reader's suggestion for

a topic, which can be expressed as one of personal responsibility:

Before I begin my own response, I'd like to reprint another reader's suggestion for

a topic, which can be expressed as one of personal responsibility:

Got a topic suggestion for you. Why do we now reward the losers as a society? Didn’t buy insurance? That’s ok, gov will make it up. Made a poor financial decision? That’s ok, gov will make it up. Spent 10 years on college loans to get a degree in anthropology and wonder how you are going to pay that back? Don’t worry, gov will make it up. Meanwhile, those of us who make smart decisions, save our money, live cheap, etc. continue to pay more and more in taxes to make up for the people who made poor decisions. And of course, the poor decision people never have to face the consequences.My response to J.M. was more or less as follows. Buck up--many of us have been wiped out financially and we recovered by keeping our expenses lower than our income and saving money for a few years. I too am 53, and am paying down debt and accumulating savings/assets in order to buy real estate at bargain prices in the 2011-2014 timeframe. My income is low (though I'd be delighted for it to rise) and I pay horrendous self-employment taxes, humongous health insurance premiums and astonishingly high property taxes, even though we bought this property 15 years ago. The self-employed among you are very likely nodding your head saying, "Me too!" The list of "entitlements" forgone to be self-employed is long, but to those of us who choose this path the trade-off is worth it. So, no complaints. But next time you want to complain about taxes, try paying 13% of your net right off the top for Social Security. Then pay the Fed and State taxes, the property taxes, the local taxes, and see how much is left. Amen, Brothers and Sisters, it isn't much. Many hardworking people were wiped out in the Great Depression, as were many wealthy people. Both types survived and eventually prospered. I knew guys who'd lost it all in the 1959-61 downturn. Many people were wiped out in the 1981-83 recession (me being one of them). Others were wiped out by the dot-com bubble bursting in 2002-2001. I know many stories of honest, hardworking people sinking their entire 401K retirement nestegg into the NASDAQ right near the top, and having their savings from decades of labor wiped out. In other words, getting wiped out financially is part and parcel of capitalism. This may sound brutal to those of you with a certain ideological bent, but business and investing is and will always be Darwinian. I also suggested that a bailout wouldn't work because the discrepancy between J.M.'s income and expenses was simply too great. Over the course of just a few years, the discrepancy would total tens of thousands of dollars. This is what is called "Putting good money after bad." In other words, when you make a poor financial investment, you just have to exit the position, and learn from your mistake. I think it's also important to be honest that buying a house in those circumstances was a form of speculation--speculation that income would quickly rise to meet expenses, and that the house would rise in value fast enough to pay the mortgage with equity extraction. Like many speculations, this was a long shot, and it didn't come in. As someone who's been burned with margin (borrowing against stocks in one's portfolio) and the inevitable margin calls, I know the appeal of speculative fevers "when everybody is else is making money effortlessly." (Note: I don't use margin anymore, though judging by statistics that total margin debt now exceeds its peak in 2000, not everyone agrees that it's risky.) I also told J.M. that I may not be the best person to ask, because compared to the loss of one's health or mental health, then financial losses just don't seem that bad--and I speak from experience in all three categories, as no doubt do many of you. I'm also very upbeat about being 53, and don't think being 60 is that old. So working 7 years and saving money and clearing a bankruptcy doesn't seem too onerous to me. I like working and have no expectation of retiring, and no desire to retire per se. Even retiring at 75 would be OK with me, and that's 22 years away. A lot can happen--and be saved--in 22 years. So in all sincerity, J.M., as someone who's on occasion been down to less than $100 to my name, who's lost all his money and been left in debt on two occasions, I reckon the lesson learned is worth the loss, and you can bounce back in short order if you simply keep expenses lower than income--whatever that may be. I have a sneaking suspicion that many readers of this site have experienced financial travails in the past, and overcome them with hard work, some ingenuity and a bit of creative scrimping and saving. I know this because financially successful people contribute gardening and other tips to save money and eat healthier on a regular basis (see entries on March 21 and 24 below) not because they have to but because it's what they value. And though it may sound sappy to those who've never been wiped out, I personally found periods of loss to be great learning experiences. And I don't mean some brief period of modest poverty in youth, I mean losing hundreds of thousands and selling off my house to make good on debts incurred by my business--serious hurt and serious money. But I paid off my debts--a close thing, until we got a contract which allowed us to make a few bucks--and exited stage left with the moral satisfaction that no one ever lost money in trusting us or doing business with us. Since one of my many jobs was property manager, I also reassured J.M. that with some positive personal references, she'd be able to find a small landlord with dogs (or who likes dogs) who would rent to her, regardless of bankruptcy. Landlords just want a responsible, quiet tenant, and if you can show some evidence that you're that person, you'll always find a landlord willing to rent to you--in my experience. As for the institutions which failed to rein in this rampant excess of lending, and the companies which profited from selling subprime and Alt-A loans--of course there will be no redress. The menagerie has left the barn, and closing the barn door now--to the accompanying moral indignation of politicos who stood by doing nothing back in 1996-2002, when they could have made a difference--will accomplish next to nothing. In other words, politics as usual. I am a poor dumb writer who continues to learn from losses, financial and otherwise. Would I trade the wisdom gained for the riches lost? No, for without wisdom the riches will always be lost sooner or later. So what happens to those who will lose their houses? I suggest, with all due respect for the pain of financial losses, that they will declare bankruptcy, learn a lot from their mistakes, and move on to better decision-making in the future. I don't think there is any other way to go about rebuilding one's prospects, and I say this as someone who has lived through both the loss and the rebuilding. But if you're down on your luck, then by all means, keep your money to eat and enjoy everything here for free. Your readership is greatly appreciated with or without a donation. For more on this subject and a wide array of other topics, please visit my weblog. copyright © 2007 Charles Hugh Smith. All rights reserved in all media. I would be honored if you linked this wEssay to your site, or printed a copy for your own use. |

||

| weblog/wEssays | home |