The Next Domino to Fall: Commercial Real Estate

March 7, 2017

Unless the Federal Reserve intends to buy up every dead and dying mall in America, this is one crisis that the Fed can't bail out with a few digital keystrokes.

Just as generals prepare to fight the last war, central banks prepare to battle the last financial crisis--which in the present context means a big-bank liquidity meltdown like the one that nearly toppled thr global financial system in 2008-09.

Planning to win the next war by assuming it will be a copy of the last confict is an excellent strategy for losing the next war. The same holds true for the next financial crisis: reckoning that it will be a repeat of 2008 is an excellent way to be caught completely off-guard.

Crises may rhyme, but they don't repeat. The next Global Financial Meltdown won't start in subprime mortgages--that sector has been wiped out, written down, or passed on to the poor tax-donkey taxpayers.

The next crisis also won't arise on money-center banks, either. Central banks have figured out how to bail out the banks, and have rebuilt the bank balance sheets by stripping hundreds of billions of dollars in interest from savers.

(Sorry, widows and orphans--your interest income had to be transferred to the big banks. We're sure you understand why the banks are more important than you are as you enjoy yet another meal of canned beans and saltine crackers.)

The central banks and state treasuries around the globe may be confident they can bail out the banks, but what if the next domino to fall isn't a bank? What if it is a "safe, high yield asset" held by institutional owners such as pension funds, insurance companies and REITs (real estate investment trusts)?

What if the next crisis isn't a spot of bother caused by excessive leverage, but a systemic collapse of collateral as an entire sector--retailers holding millions of square feet of bricks-and-mortar store space--falls off a cliff?

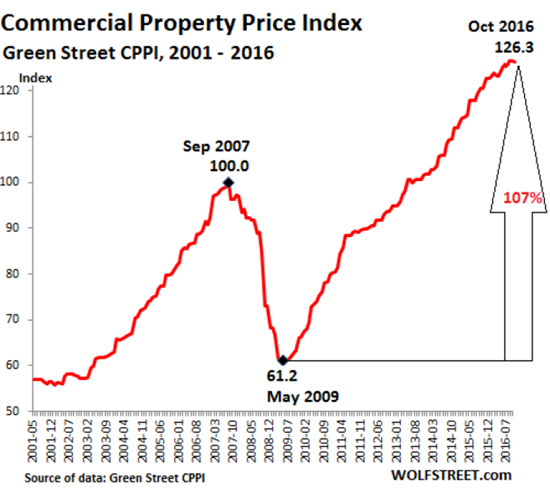

Consider this chart of sky-high commercial real estate (CRE) valuations...

and this photo of a decimated major mall...

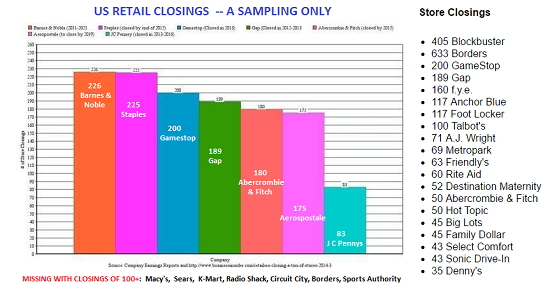

and this partial list of retail closures, some due to bankruptcy, others due to downsizing, and others that claim to be downsizing but are actually the initial stages of liquidation.

Talk about an overvalued market set up for a fall. It isn't just malls becoming empty retail wastelands--it's Corporate America shifting to flex-work and work-at-home, slashing the need for floor after floor of costly business-park office space.

It's about restaurants moving to smaller spaces as they move to serving more meals via delivery services.

Commercial real estate is grossly overbuilt in retail and office space. Combine sky-high valuations with cratering demand and billions in short-term CRE loans that must be rolled over into new loans, and we don't have a liquidity crisis, we have a collateral crisis-- the assets supporting the debt are no longer worth the loan balance.

Unless the Federal Reserve intends to buy up every dead and dying mall in America, this is one crisis that the Fed can't bail out with a few digital keystrokes. Gordon T. Long and I discuss this brewing crisis and its potentially devastating consequences in our program Is Retail CRE The Next Financial Implosion? (YouTube)(34:12).

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

Check out both of my new books, Inequality and the Collapse of Privilege ($3.95 Kindle, $8.95 print) and Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle, $8.95 print). For more, please visit the OTM essentials website.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Steve W. ($50), for your superbly generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Casey W. ($10/month), for your outrageously generous contribution to this site -- I am greatly honored by your support and readership. |

Discover why Iím looking to retire in a SE Asia luxury resort for $1,200/month. |