Do the Roots of Rising Inequality Go All the Way Back to the 1980s?

March 31, 2017

Unless we change the fundamental structure of the economy so that actually producing goods and services and hiring people is more profitable than playing financial games with phantom assets, the end-game of financialization is financial collapse.

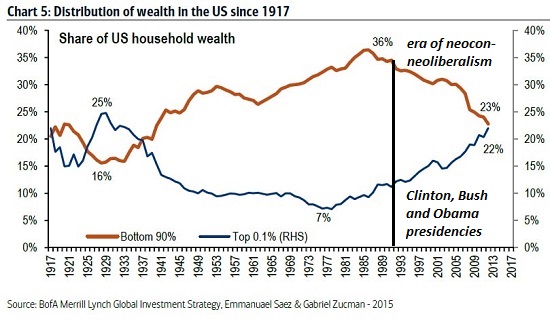

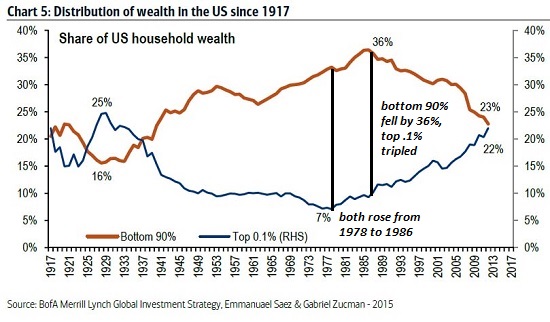

I presented this chart of rising wealth inequality a number of times over the past year. Do you notice something peculiar about the inflection points in the 1980s?

Correspondent W.S. noted that the inflection point for the top .1% (late 1970s) preceded the inflection point of the bottom 90% (around 1986): both increased their share of household wealth from 1978 to 1986, and then the share of the top .1% took off, essentially tripling from 8% to over 22%, while the share of the bottom fell precipitously from 36% to 23%.

(Note that the data stops at 2012; if we extend the trends to the present, the lines have certainly crossed and the share of the .1% now exceeds that of the bottom 90%.)

So what happened between 1978 and 1986? The first phase of the financialization of the U.S. economy. What is financialization? In a financialized economy, speculating with highly leveraged debt and exotic financial instruments is far more profitable than producing goods and services.

Financialization hollows out the productive assets of an economy by incentivizing leverage, debt, opacity, speculation, financial fraud, collusion and the perfection of crony capitalism, i.e. financial Elites' ownership of the government's regulatory and legislative bodies.

Here is another less pungent description via Wikipedia: "Financial leverage overrides capital (equity) and financial markets dominate traditional industrial economy and agricultural economics."

Here is my more formal definition:

Financialization is the mass commodification of debt and debt-based financial instruments collaterized by previously low-risk assets, a pyramiding of risk and speculative gains that is only possible in a massive expansion of low-cost credit and leverage.

Another way to describe the same dynamics is: financialization results when leverage and information asymmetry replace innovation and productive investment as the source of wealth creation.

I describe the dynamics in What's the Primary Cause of Wealth Inequality? Financialization (March 24, 2014)

Correspondent W.S. submitted commentary and references this 2005 book Financialization and the World Economy:

In the US "total credit market debt divided by GDP was about 1.5 from 1961 to 1981. It accelerated rapidly in the decade of the 1980s - from 1.6 in 1981 to 2.3 in 1989 - as the federal budget deficit soared, hostile takeovers and leveraged buyouts loaded corporations with debt, and household borrowing increased. Corporate and household borrowing raised indebtedness further in the 1990s; by 2001 the debt to GDP ratio was 2.8, almost double the ratio in the Golden Age. Moreover, average real interest rates have been much higher in the neoliberal era than they were in the three decades that preceeded it.

W.S. Also referenced FINANCIALIZATION OF THE ECONOMY and added this commentary:

While “bloated” conglomerates were linked by some to the sluggish performance of the American economy in the 1970s, for corporate raiders they presented a get rich quick opportunity via the “market for corporate control” (Manne 1965). Outsiders could buy the firm from its existing shareholders, fire its managers, and sell off the parts for a quick profit.

After the election of Ronald Reagan in 1980, this became possible on a grand scale due to relaxed antitrust guidelines, changes in state antitakeover laws, and financial innovations that enabled raiders to get relatively short-term financing on a large scale (Davis & Stout 1992). Within a decade, nearly one-third of the Fortune 500 largest industrial firms had been acquired or merged, often resulting in spinoffs of unrelated parts, and by 1990 American corporations were far less diversified than they had been a decade before (Davis et al 1994).

The other thing that happened in the mid-1980s was computer technology became cheap enough and powerful enough to start replacing human labor on a wider scale. Spreadsheets such as Excel became accessible to small business, and the desktop publishing combo of the Apple Macintosh and laserprinters revolutionized the cost structure of marketing.

The rise of the Internet (coupled with cheap memory and processing power) further fueled the productive expansion of digital technologies. As I describe in my book Get a Job, Build a Real Career and Defy a Bewildering Economy, these tools-- which are now ubiquitous and inexpensive--enable one person today to equal the output of what once took four people to produce in the late 1980s.

In effect, labor entered an era of dynamic over-supply just as healthcare costs began to rise, making it more costly to hire workers. Some skills and trades remain scarce and thus well-paid, but as a generalization it became cheaper and more efficient to replace increasingly expensive human labor with increasingly inexpensive and powerful software and digital tools.

Unless we change the fundamental structure of the economy so that actually producing goods and services and maximizing opportunities for people is more profitable than playing financial games with phantom assets, the end-game of financialization is financial collapse.

Recent podcasts/video programs:

Deep State Fractures Under Populist Revolution (TruNews, 37:27)

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

Check out both of my new books, Inequality and the Collapse of Privilege ($3.95 Kindle, $8.95 print) and Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle, $8.95 print). For more, please visit the OTM essentials website.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Gary R. ($50), for your splendidly generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Larry D. ($25), for your supremely generous contribution to this site -- I am greatly honored by your support and readership. |

Discover why I’m looking to retire in a SE Asia luxury resort for $1,200/month. |