|

| weblog/wEssays archives | home | |

|

Ugetsu: Greed Is Not Good (May 23, 2007) This Week's Theme: Why The Truth Can't Be Told One of the great pleasures of studying another culture in depth--its language, geography, history, literature, food and film--is the discovery of universal truths through a different lens.  With that flourish, I introduce the 1954 Japanese film

Ugetsu

With that flourish, I introduce the 1954 Japanese film

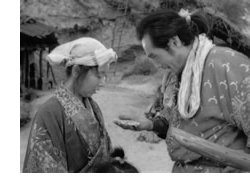

UgetsuOne reason is the movie's haunting visuals (in glorious black and white); once you've seen the film a few times, you may be hard-pressed to pick your favorite sequence; mine is the two "heroes" deathly quiet voyage across the mist-bound lake. But the deeper reason why this is such a compelling and unforgettable movie is its unerring depiction of the destructive force of human greed. Greed is a "standard-issue emotion, human being 1.0"--we all know the sensation of desiring wealth, power and prestige. What's changed is that where greed was once a Mortal Sin, it is now an unalloyed Good Thing. Just for your review, here are the seven deadly/mortal/cardinal sins: It doesn't take a theology student to note the over-arching theme of greed/unlimited desire for more than one's fair share in this list; what is pride but the desire to display the results of your greed? What is envy but thwarted greed? What is lust but sexual greed? What is gluttony but greed for food? Just how greedy has our culture become? Item 1 for the prosecution: hedge fund managers are making up to $1 billion each (average is $360 million for the top 10): Who's Getting Alpha? (February 15, 2007) Item 2 for the prosecution: LUXE POPULI: Spending for luxury items is increasing four times as fast as overall expenditures as ordinary Americans go for the gold. It's instructive to consider the $1 billion some financial manipulator earned for producing no goods or services with someone who is worth a $1 billion as a result of creating goods and services which generate jobs, value and tangible wealth--say, Steve Jobs. Leaving aside his personality--by most accounts abrasive, abusive and volatile by turns--let's recall what created Mr. Jobs' great wealth: the desire to build something which was "insanely great." This he went on to do, with plenty of help from PARC, Mr. Wozniak and many others. Nonetheless, his zeal was not purely financial greed. This used to be the Standard Issue American Dream: to create great wealth via hard work or innovation or some combination of the two. This vision quest has now been reduced to pure greed for wealth or status by any means. Many observers find this "greed is good" ethos best represented by the Reagan-era film Wall Street Hmm--sound familiar? Examples abound in all cultures. Look no further than the Chinese stock market mania currently playing out in the Shanghai Composite. For a chart of that madness, go to Mish's recent post (recommended by U. Doran). One consequence of the "greed is good" mentality which has infected the entire globe is that we are essentially eating our seed corn by feasting today. In the U.S., one way common manifestation of this is the extraction of most or all of the equity (savings/wealth) from one's house via home equity lines of credit (HELOC) or mortgage equity withdrawals (MEW) to spend or "invest" (speculate). Schahrzad Berkland, proprietor of the California Housing Forecast describes the phenomenon succinctly: You're right on with the MEW (mortgage equity withdrawal). My realtor friend who lives on the water in (San Diego), has gone through tax records and found lots of MEW among her neighbors. Some of her neighbors almost paid cash for their homes 10-20 years ago, and then took out $1 mil loans! One of the people with a $1 mil MEW drives a $150K sports car. I suspect they used that money for investing...why would someone who was frugal their whole life all of a sudden go on a spending spree though? Maybe some of the money went for investment property?Back to Ugetsu. I won't ruin the film for you--well worth renting, and yes, it's subtitled, but you'll soon forget that--but the heart of the story is two brothers' desire to get rich in a time of civil strife by leaving their poor but loving families. The fundamental illusion--that wealth will bring happiness--is illustrated with a supernatural story element which will take you by surprise. Alas, the brothers discover the hard way that greed brings not happiness but destruction of all that was good in their lives, all that mattered, all that was valuable, all that was genuine. When will we re-discover this as a culture/people/species? We all know why Greed Is Currently Good: because consumer and speculative greed is immensely profitable. And that is Why The Truth Can't Be Told. For more on this subject and a wide array of other topics, please visit my weblog. copyright © 2007 Charles Hugh Smith. All rights reserved in all media. I would be honored if you linked this wEssay to your site, or printed a copy for your own use. |

||

| weblog/wEssays | home |