|

| weblog/wEssays archives | home | |

|

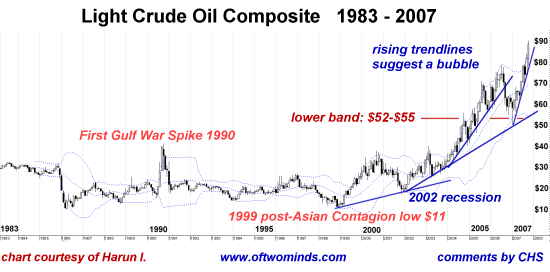

Self-Interest in an Interconnected World (November 29, 2007) We all know the structural rot in the global financial system cannot be papered over forever. But we must also understand the extremely motivated and powerful forces which are doing their utmost every day to prop the rotten structure up. This is why I have been suggesting that the U.S. markets would rally: A Power Not To Be Denied: Santa Claus (November 19, 2007), Speculator or Investor? Does It Matter? (November 26, 2007) and that gold and oil would both reverse and head down Beware of Speculative "Sure Things" (October 29, 2007) Since my recent posts, the Dow Jones Industrial average has risen and gold and oil have begun to slide. Why? First ask the question: who benefits most from stock market euphoria and stable oil prices? Frequent contributor Fabius Maximus offers an excellent overview of the structural rot in his recent entry We have been warned. Death of the post-WWII geopolitical regime, Chapter II. (Scroll down to see Part 1). In the global sense, who has the most to lose if the U.S. economy (and thus its supply chain) withers? OPEC, China and Japan, for starters. Consider China. Although many commentators have observed that Europe is now a larger market for China than the U.S. (note that Europe also has 100 million more residents than the U.S.), the Chinese government's primary goal is to generate work for another 100 million young workers. The ideal situation for China is not to replace sales lost to a collapsing U.S. economy with sales to the EU--it's to add sales from Europe and maintain sales to the U.S. You can't just write off 21% of the global GDP--yes, American consumers are 21% of the global economy--and expect to prosper on a global scale. The same is more or less true of Japan, which remains heavily dependent on the U.S. for sales and profits. As for OPEC, I recommend the book The End of Oil Thare are many excellent books on Peak Oil; I list these in my Recommended Books/Films: Beyond Oil: The View from Hubbert's Peak The Party's Over: Oil, War and the Fate of Industrial Societies Twilight in the Desert: The Coming Saudi Oil Shock and the World Economy The Paradox of Plenty: Oil Booms and Petro-States The Long Emergency: Surviving the End of Oil, Climate Change, and Other Converging Catastrophes of the Twenty-First Century But Robert's book does the best job, in my view, of describing the politics of OPEC. Essentially, OPEC must play a subtle hand of maintaining a Goldilocks oil price: not high enough to foster recession or conservation in the U.S. and the West, but high enough to reap the maximum price the market will bear. What complicates life for OPEC is that not all the world's oil exporters belong to OPEC; thus they have to control price even though they only control about 40% of global production. Just as in any other business, OPEC can lose market shares to others--and that hurts. Roberts ably describes how the oil glut of 1997-99--caused by the recession in the East Asian Tiger economies after the Asian Contagion currency metldowns--brought oil down from $30/barrel to $10, nearly bankrupting oil exporting nations. Recall that this huge decline in oil prices caused Russia to default on its loans, triggering another global financial panic. In response to oversupply and thus plummeting prices, OPEC and especially the Saudis cut production. Saudi production dropped from 8 million barrels per day (BPD) down to 2 million BPD--a drastic cut in revenue and a loss of market share to non-OPEC suppliers. Though I cannot find a report to substantiate this, I have read that the Persian Gulf oil exporters make as much money off their investments in the Western economies as they do from oil. So do Gulf oil exporters care if the U.S. economy founders? You bet. Those in charge of those Gulf economies recall very clearly what happened when recession cut oil demand and non-OPEC suppliers boosted supply: oil fell to $10/barrel, and OPEC had to endure extreme losses of income and market share to regain control of prices. Since then, the OPEC strategy has been maintain market share, by pumping more oil if necessary. It seems like a wise strategy for a cartel which controls only 40% of global production: use whatever leverage you have to maintain a balance of demand and supply. Now we find a Santa Claus Stock Market Rally in full swing, triggered by a Gulf state investment in teetering Citicorp (C). From a global view, the $7 billion investment is chickenfeed: the Gulf states investment cash is estimated to top $1.2 trillion, and of course the various powers that be in those nations already own hundreds of billions of global bonds, stocks and real estate. Let's say the Gulf states decided to sink $100 billion into faltering U.S. financial assets. That would amount to a mere 10% of ready cash. Let's also say they decided to informally write off the entire $100 billion as money down a bottomless pit. A bad investment, you say? Not so fast. Imagine, if you will, that the $100 billion successfully stemmed the tide of financial collapse which seems ready to engulf tottering banks and lenders in the U.S., Europe and perhaps even Asia. Would the Gulf oil exporters reap long-term gains from the turnaround? Yes, they would--on a vast scale. Let's say a global recession would cut oil to $20/barrel. How much money would exporters lose compared to the present, when they are getting $90/barrel? Let's do the math: OPEC production is roughly 30 million barrels a day out of 84 million BPD globally. $70/barrel ($90 - $20 = $70) times 30 million = $210 million/day or $76 billion a year. Let's also grant that a meltdown in the U.S. economy would cost Gulf state owners of assets at least a few hundred billion in losses. Now if they "save" the U.S. from a deep recession, not only do they make an extra $75 billion a year from oil, they also maintain the value of their other investments and perhaps gain a few billion here and there in dividends, bond coupons and capital gains. In other words: forget which players in the U.S. are hoping to stave off financial disaster: look at the power players beyond the border whose economic well-being is inextricably bound up with that of the U.S. Let's consider China again. China's stability and prosperity depend on exporting manufactured goods. China has successfully employed tens of millions of once-dirtpoor agricultural workers in its rise to "the world's workshop." Now if a severe U.S. recession lowers demand, how many Chinese workers lose their jobs? Let's guess 10 million. That would not be welcome news to the Chinese leadership, who are seeking 20 million new jobs a year, not 10 million lost jobs. Although I don't have any studies to back this up, I believe it is standard knowledge in sociological circles that widespread social discontent arises not from poverty, but from heightened expectations being thwarted. China's leadership is no doubt aware that the rising expectations of its citizens for a better life has created a powderkeg of potental discontent. Now if 50 million people decide they're tired of being cut out of the wealth, or that the jobs they were implicitly promised have vanished, then even a 5 million-person Army will be unable to control the ensuing turmoil. So put yourself in the place of China's leadership: what's more important, a lousy $100 billion dumped into the flailing U.S. dollar and economy, or widespread social unrest caused by a deep recession in the U.S.? There's no contest, really; you dump the $100 billion without much of a qualm because the stakes are much higher than "return on investment" or any other financial metric. Since oil exporting nations depend on oil revenues to pay for their rising populations' social services and subsidies for cheap gasoline and food, then the stakes are high for them, too. If you consider the risks faced by oil exporters and China, then you come to understand why they cannot just stand idly by as the U.S. slips toward recession. They stand to lose as much or possibly much, much more than any U.S. player.

Why has oil pulled back from $100/barrel? We all know tight supplies, the weak dollar and a hefty "risk premium" are blamed for the quick run from $70 to $99/barrel; have those conditions really changed, or was the run-up pure financial speculation? Regardless of whether the huge increase was just oil futures trading higher or fundamental supply and valuation issues, it doesn't take much imagination to guess that U.S. consumers might notice $100/barrel oil. Was $100/barrel oil a "line in the sand"? As a benchmark, it would be hard to deny its headline significance. Inflation and recession seem to go along with talk of $120/barrel oil, and so it behooves the oil exporters to get oil back down to $75/barrel or so, where nobody complains and the profits are immense. Let's see if that's what happens over the next few weeks/months. Footnote: Fabius Maximus recently posted an interesting look at Peak Oil: When will global oil production peak? Here is the answer! Thank you, Doug B., ($50), for your extremely generous contribution to this humble site. I am greatly honored by your readership and support. All contributors are listed below in acknowledgement of my gratitude. For more on this subject and a wide array of other topics, please visit my weblog. copyright © 2007 Charles Hugh Smith. All rights reserved in all media. I would be honored if you linked this wEssay to your site, or printed a copy for your own use. |

||

| weblog/wEssays | home |