Where Is the First Helicopter Drop of Money Likely to Land?

October 13, 2015

So what's left in the toolbag of central banks and states to stimulate recessionary economies if QE has been discredited? The answer: Helicopter Money.

We all know helicopter money of some kind is coming as the global economy spirals into recession. Quantitative Easing (QE)--the monetary stimulus of distributing newly created central-bank money to private banks--has been discredited, as even cheerleaders and apologists now admit it has only widened wealth and income inequality.

So what's left in the toolbag of central banks and states to stimulate recessionary economies if QE has been discredited? The answer: Helicopter Money.

Gordon T. Long and I discuss Helicopter Money in this video program: who is likely to receive the first drops, and who will be the ultimate winners and losers.

Gordon leads off by covering how money is created by central and private banks, i.e. how money is lent into existence.

Next, we discuss how helicopter money works: central states issue bonds (new debt) to fund helicopter drops of free money to stimulate demand for goods and services, and central banks buy the bonds with freshly created money.

This monetizing of state debt by the central bank is the engine of helicopter money. When the central state issues $1 trillion in bonds and drops the money into household bank accounts, the central bank buys the new bonds and promptly buries them in the bank's balance sheet as an asset.

The Japanese model is to lower interest rates to the point that the cost of issuing new sovereign debt is reduced to near-zero. Until, of course, the sovereign debt piles up into a mountain so vast that servicing the interest absorbs 40+% of all tax revenues.

But the downsides of helicopter money are never mentioned, of course. Like QE (i.e. monetary stimulus), fiscal stimulus (helicopter money) will be sold as a temporary measure that quickly become permanent, as the economy will crater the moment it is withdrawn.

The temporary relief turns out to be, well, heroin, and the Cold Turkey withdrawal, full-blown depression.

So where will the first drops of helicopter money land? How about the student loan Titanic, which is already bow down after hitting the iceberg of reality?

Or how about some big fat tax credits, politicos' favorite form of helicopter money?

Gordon and I discuss the possibilities in Is Helicopter Money to Follow QE (35:47 video, with Gordon T. Long).

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Charles C. ($50), for your monstrously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, William K. ($50), for your enormously generous contribution to this site -- I am greatly honored by your support and readership. |

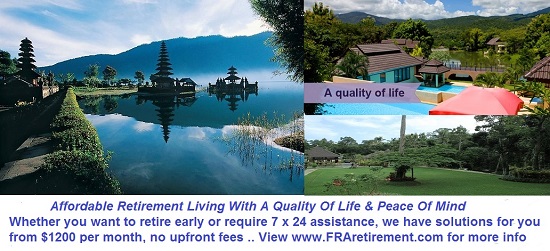

Discover why Iím looking to retire in a SE Asia luxury resort for $1,200/month.