|

| weblog/wEssays archives | home | |

|

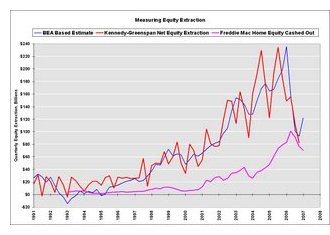

The Home ATM (a.k.a. Equity Extraction) Is Broken (September 10, 2007) First up is astute reader Mark A., writing in response to The Big One Just Hit (September 8, 2007): I think you're right. The ground indeed quakes.Thoroughly chastened, I set off on a search for accurate data on mortgage equity withdrawal a.k.a. MEW. I soon discovered the subject is a thicket in a bog shrouded by fog: nobody really knows how much has been extracted or how those trillions were spent. I have spent endless hours researching this and can now share my map of the bog. The sources of confusion are many. Any data which is self-allocated like this must be taken with a giant grain of salt. Any MEW "allocation" smells strongly of similar studies in which people are asked how many fruits and veggies they ate that week--and in virtually all cases, the actual amounts are far lower than those estimates made by the consumers who sought to "give the appearance of doing the right thing." My own suspicion is that virtually all the MEW funds ended up being spent. Consider an example. Say a homeowner borrowed $50,000 in equity off his primary residence to buy an investment property, i.e. used the cash as a down payment on a speculative real estate purchase, a.k.a. a real estate speculator/flipper. He then states that the MEW was used for "investment." But then when he flipped the investment property, he spent the $100K proceeds on a new truck, a fancy cruise for the family, and various gew-gaws plus a $50K down payment on a condo. Would the $50,000 he spent end up being counted in the MEW statistics? No. Yet fundamentally the money was extracted from the equity of his primary home. Here are some resources I found in trying to sort out the MEW mess:  Measuring Equity Extraction (Calculated Risk blog, 5/22/07)

Measuring Equity Extraction (Calculated Risk blog, 5/22/07)

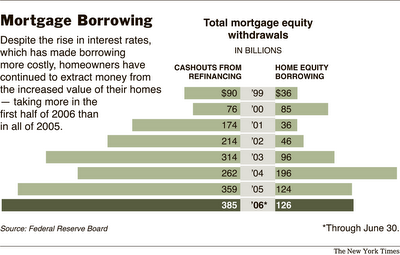

(Click on link or chart to go to Calculated Risk and their larger chart) Home Equity Extraction Still Hot in Q3 (Calculated Risk blog, 1/20/06) Estimated gross equity extractions rose 10% from the previous quarter to a seasonally adjusted $990.6 billion (for Q3 2005), according to an update provided to Investor's Business Daily of a September Federal Reserve study on mortgage originations.This means at the height of the housing bubble, Americans were pulling out roughly $3.5 trillion a year in equity. Yet other figures sourced below suggest the total "free cash" was on the order of $1.4 trillion--less than half this number. So apparently the rest was used to pay off existing mortgage or consumer debt. Here's another excellent depiction of the entire equity-extraction cycle: The Greenspan and Kennedy papers on Equity Extraction from Housing (1990-2006) - A graphic exposition Greg Ip at the Wall Street Journal filed this report: Home-Equity Extraction Eases (Wall Street Journal Economics Blog 6/12/2007) In the first quarter (of 2007), 'home equity extraction' net of fees fell 8% to $449.6 billion at a seasonally adjusted annual rate from the fourth quarter, the lowest since the fourth quarter of 2003 well below the peak of $863.7 billion in the third quarter of 2005. CHS: note that the data on the Calculated Risk entry from other sources places the peak at $990 billion;' clearly, it is an inexact number.)Economics prof Greg Mankiw's Blog (8/31/07) offers this chart and data from the Greenspan report: Free cash generated by equity extraction 2000......553.4 billion dollars 2001......626.9 2002......756.0 2003....1,000.8 2004....1,165.1 2005....1,423.1 2006....1,126.2 Free cash generated by equity extraction: As percent of disposable income 2000...7.69% 2001...8.37 2002...9.65 2003..12.26 2004..13.42 2005..15.75 2006..11.83 (CHS note: doesn't it seem that an extraordinarily large percentage of recent income was generated by MEW?) (Source: Federal Reserve (source: Sources and Uses of Equity Extracted from Homes Alan Greenspan and James Kennedy (March 2007) If you're not confused yet, here are some (low-ball) numbers from the New York Times and a detailed, no-punches-pulled report from the Federal Reserve Bank of Dallas:

Economic Letter—Insights from the Federal Reserve Bank of Dallas (11/06) And for a summary, here is scathing one from the Asia Times, 11/21/06): In 1999, total outstanding household debt was $6.4 trillion. As of the end of the second quarter of 2006 total outstanding household debt was $12.3 trillion.According to the conservative Greenspan/Kennedy data, $6.6 trillion was extracted as free cash from 2000 -2006. That is 8.4% of the entire U.S. GDP in that time period. Here are the GDP data (real, not adjusted, in billions) 2000 - - - - - - 9,817.0 2001 - - - - - -10,128.0 2002 - - - - - -10,469.6 2003 - - - - - -10,960.8 2004 - - - - - -11,685.9 2005 - - - - - -12,433.9 2006 - - - - - -13,194.7 total: 78,689.9 source: Bureau of Economic Analysis Is the Home ATM broken? Well, if home equity loans declined 82% even before the current credit meltdown, how much money do you reckon is being extracted this month? Some number closer to zero than to $100 million is probably a good guess. Other readers checked in with some excellent comments and links on the weekend entry (The Big One Just Hit) which I highly recommend reading: Readers Journal commentaries 9/10/07. Thank you, Wayne D., ($100) for your astonishing donation to this humble site. I am greatly honored by your support and readership. All contributors are listed below in acknowledgement of my gratitude. For more on this subject and a wide array of other topics, please visit my weblog. copyright © 2007 Charles Hugh Smith. All rights reserved in all media. I would be honored if you linked this wEssay to your site, or printed a copy for your own use. |

||

| weblog/wEssays | home |