| |

Why Any Real Bailout Is Impossible

(September 4, 2007)

Frequent contributor J.B. explains the reasons why no bailout of the mortgage mess

is even possible: the scale of the debt is simply beyond reach of even the Federal government's

vast borrowing ability.

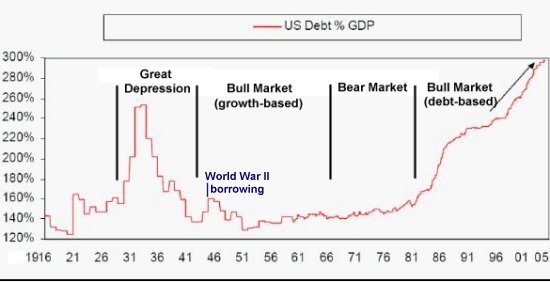

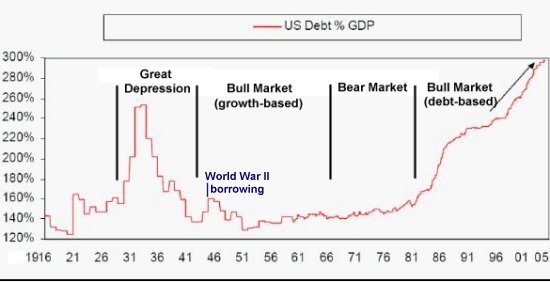

Here are a few thoughts on U.S. debt as a percentage of U.S. GDP.

Hold on to your seat because it is scary.

12/31/2006 Debt= $44.549 Trillion12/31/2006 GDP= $13.450 Trillion= 331.2%

1. The computation of GDP has been severely manipulated in the same way that unemployment has.

I would think that GDP is overstated by 10% to 15%. Accordingly, the steepness and height of the

increase in debt is understated.

2. The debt to GDP really started soaring in 1930 after the stock market crash. Just think what

will happen currently if we move into a severe recession and GDP starts dropping. Of course the

government might just really start cooking the stats.

3. Another item that is not on this graph but which is on another is the 50 year average of debt

to GDP is 1.9 times, but that includes the run up years. If you look at the 50 years before 1986

debt to GDP was running at about 1.5 times.

4. If you use this data you can compute how much debt and assets are out of whack (technical term).

Use 1.9 time $13 trillion, 1.9 times $13 trillion reduced by 15% (overstatement of GDP discussed

in 1), 1.5 from 3 times $13 trillion and lastly the 1.5 times $13 trillion reduced by 15%.

Compare this to the amount of debt outstanding of 44.5 trillion and you calculate debt needs to

drop 19.8, 23.5, 25 or 27.9 trillion, respectively, to get back into a normal range.

5. In summary, for debt to get back into a historical range in the US it needs to drop somewhere

in the range of 19.8 to 27.9 trillion. The other side of the balance sheet is the asset side so;

a similar amount needs to come out of there. That gives you an idea of how much housing and

stock prices as well as other assets need to drop to get back to a historical norm.

6. This shows you why, unless the Federal government started throwing trillions at the problem,

both the federal government and the Federal Reserve are helpless in facing the problem. The

ideas being thrown out are kind of like 10 fire fighters peeing on a 1,000 acre forest fire to

put it out.

7. Unfortunately the best is yet to come and no one industry is going to lead the US out of this

for 10 to 15 years.

Thank you for the analysis, J.B. Here is my two-cents summary: more debt or restructured

debt does not make an insolvent nation, company or family solvent again. The only way to make

an insolvent nation, company or family solvent again is to write off all the debt as unrecoverable--

creditors get zero or a few cents on the dollar at best. That's the cycle, and it cannot be

nullified by additional debt or accounting hat-tricks.

Thank you, Richard W., ($25) for your surprising and generous donation to this humble site.

I am greatly honored by your support and readership.

All contributors are listed below in acknowledgement of my gratitude.

For more on this subject and a wide array of other topics, please visit

my weblog.

copyright © 2007 Charles Hugh Smith. All rights reserved in all media.

I would be honored if you linked this wEssay to your site, or printed a copy for your own use.

|

|