|

| articles | forbidden stories I-State Lines resources my hidden history reviews | home | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Writing/Film Dear Aspiring Writers: The Worst Advice You'll Ever Read A Literary Look at I-State Lines Spirited Away: Decay and Renewal An American Poem (Robinson Jeffers) Taoist Chinese Poems The Nelson Touch "It's all about oil, isn't it?" Kurosawa's High and Low A Bountiful Mutiny Howl's Moving Castle Thailand's Iron Ladies Trois Colours: Red The Thin Man: Thoroughly Modern Movies Why My Book Is Better Than the DaVinci Code Iranian Films: The Mirror Piratical Nonsense A Real Pirate Movie: Captain Blood 2005-06 archives 2007 archives Recommended Books American Identity American Identity Literary Contest Winners, 2006 (fiction and essays) Hapas: The New America Can You Tell What I am? Part I Can You Tell What I am? Part II Only in America Self-Reliance Your Tattoo in 50 Years The American House and Frank Lloyd Wright Cultural Commentaries On Hatred and Anti-Americanism Anti-Americanism Part 2 Anti-Americanism Part 3 French-Bashing Germany: We All Have Problems, But... Kroika! Chronicles This Blog Sells Out Doom and Gloom Sells The Kroika Mascot-"Auspicious Pet" Wal-Mart and Kroika Kroika and Starsbuck Take a Hit Kroika Ad 1 Kroika Ad 2 Kroika Ad 3 Kroika Ad 4 Kroika Makes Bid for Oreo (April 1) Unfolding Crises: Asia China: An Interim Report Shanghai Postcard 2004 Corruption and Avian Flu: China's Dynamic Duo Exporting the Real Estate Bubble to China Is the Bloom Off the China Rose? China Irony: Steel, Marx & Capital Curing The U.S. and China's Dysfunctional Relationship China and U.S. Inflation Trade with China: Making Out Like a Bandit Whither China? Will the Housing Bust Take Down China? China's Dependence on Exports to U.S.; Is China About to Pop? 2005-06 archives 2007 archives Battle for the Soul of America Katrina, Vietnam, Iraq: National Purpose, National Sacrifice Is This a Nation at War? A Nation in Denial Why Is This Such a Tepid Time? That Price Isn't Cheap, It's Subsidized The Most Hated Company in America U.S. Fascists Seek Ban on Cancer Vaccine The Truth About Christmas American Dream or American Nightmare? 2006 Sea Change Obesity and Debt Immigration Ironies U.S. Healthcare: Working Toward a Real Solution A Drug Industry Running Amok Where There Is Ruin 2005-06 archives 2007 archives Financial Meltdown Watch What This Country Needs Is a... Good Recession Are We Entering the Next Age of Turmoil? Why Inflation Appears Low Doubling Down on 5-Card No-See-Um A Rickety Global House of Cards Are Japan and Germany Truly on the Mend? Unprecedented Risk 2 Could One Rogue Trader Bring Down the Market? Worried about Inflation? Stop Measuring It Economy Great? Bah, Humbug Huge Deficits and Huge Profits: Coincidence? Who's The Largest Exporter? Three Snapshots of the U.S. Economy Loaded for Bear Comparing Nasdaq to Depression-Era Dow Who's Buying Treasury Bonds? And Why? Derivatives: Wall Street Fiddles, Rome Smolders Financial Chickens Coming Home to Roost Is the Stock Market on the Same Planet as the Economy? The Housing-Recession-Oil-Healthcare Connection Could We Have Deflation and Inflation At the Same Time? What We Know, What We Can Safely Predict Bankruptcy U.S.A.: Medicare, Greed and Collapse Sucker's Rally A Whiff of Apocalypse Where There Is Ruin II: Social Security 2005-06 archives 2007 archives Planetary Meltdown Watch The Immensity of Global Warming Sun Sets on Skeptics of Global Warming Housing Bubble Watch Charting Unaffordability A Monster of a Housing Bubble A Coup de Grace to the Economy Hidden Costs of the Housing Bubble Housing Bubble? What Bubble? Housing Bubble II Housing Bubble III: Pop! Housing Market Slips Toward Cliff Housing Market Demographics Housing: Catching the Falling Knife Five Stages of the Housing Bubble Derailing the Property Tax Gravy Train Bubbling Property Taxes Have You Checked Your Property Taxes Recently? Housing Bubble: Where's the Bottom? Housing Bubble: Bottom II The Housing - Inflation Connection The Coming Foreclosure Nightmare 1 How Many Foreclosures Will Hit the Market? Housing Wealth Effect Shifts Into Reverse Housing Bubble Bust Will Take Down the Global Economy The New Road to Serfdom: A Negative-Equity Mortgage The Housing-Savings-Recession Connection After the Bubble: How Low Will It Go? After the Bubble: Rents and Housing Values Why Post-Bubble Rents Matter After the Bubble: How Low Will We Go, Part II Housing: 10% Decline May Trigger Financial Ruin How to Buy a $450K Home for $750K Inflation and Housing: Calculating the Bust The Growing Financial Risks of the Housing Bubble Construction Defects: The Flood to Come? Construction Defects Part II Who Gets Hammered in the 2007 Housing Bust Real Estate Bust: The Exhaustion of Debt What Happens When Housing Employment Plummets? One More Hole in the Housing Bubble: Insurance Financial Kryptonite in a "Super-Strength" Housing Market Three Secrets to Unloading Property Today Welcome to Fantasyland: Housing's "Soft Landing" Why Is the Median House Price Still Rising? Why Median Prices Appear to be Rising? The Root Cause of the Housing Bubble Housing Dominoes Fall Twilight for Exurbia? Phase Transitions, Symmetry and Post-Bubble Declines Housing's Stairstep Descent 2005-06 archives 2007 archives Oil/Energy Crises Whither Oil? How much Is a Gallon of Gas Worth? The End of Cheap Oil Natural Gas, Naturally High Arab Oil Money and U.S. Treasuries: Quid Pro Quo? The C.I.A., Oil and the Wisdom of Crowds The Flutter of a Butterfly's Wings? A One-Two Punch to a Glass Jaw Running Out Of Oil vs. Running Out of Cheap Oil 2005-06 archives 2007 archives Outside the Box How to Make a Favicon Asian Emoticons In Memoriam: Winky Cosmos The Wheeled Vagabonds Geezer Rock Overload Paying for Web Content Light-As-Air Pancake Recipe In a Humorous Vein If Only Writers Had Uniforms Opening the Kimono Happiness for Sale: Jank Coffee Ten Guaranteed Predictions for 2010 Why My Book Is Better Than the DaVinci Code My Brand Management Stinks Design Follies The New Jank Coffee Shop Jank Coffee, Upscale Tropic Style One-Word Titles Complacency Nostalgia Lifespans Praxis Keys to Affordable Housing U.S. Conservation & China Steve Toma, Me & Skil 77s: 30 years of Labor Real Science in the Bolivian Forest Deforestation and Sustainable Forestry The Solar Economy (book) The Problem with Techno-Fixes I Love Technology, I Hate Technology How To Blow off Web Ads and More 2005-06 archives 2007 archives Health, Wealth & Demographics Beauty of the Augmented (Korean) Kind Demographics and War The Healthiest Cold Cereal: Surprise! 900 Miles to the Gallon Are Our Cities Making Us Fat? One Serving of Deception Is Obesity an Inflammatory Response? Demographics & National Bankruptcy The Decline of Europe: A Demographic Done Deal? Are the Risks of Obesity Overstated? Healthcare: Unaffordable Everywhere Medication Nation The New Disease We Just Know You've Got Can You Can Tell Which Pill Is Fake? Bankruptcy U.S.A.: Medicare, Greed and Collapse The 10 Secrets to Permanent Weight Loss 2005-06 archives 2007 archives Landscapes Selling the Landscape The Downside of Density Building Heights and Arboral Roots Terroir: France & California L.A.: It's About Cheap Oil The Last Redwood Airport Walkabouts Waimea Canyon, Yosemite, Camping & Pancakes Nourishment The French Village Bakery Ideas What Is Happiness? Our Education System: a Factory Metaphor? Understanding Globalization: Braudel Can You Create Creativity? Do Average People Know More Than Their Leaders? On The Impermanence of Work Flattening the Knowledge Curve: The "Googling" Effect Human Bandwidth and Knowledge Iraqi Guangxi Splogs, Blogs and "News" "There is no alternative to being yourself" Is There a Cycle to War? Leisure, Time and Valentines Is the Web a Giant Copy Machine? Science Matters Anti-Missile Defense: Boost Phase Vulnerability History The Strolling Bones: Rock of Ages Bad Karma: Election Fraud 1960 Hiroshima: First Use All the Tea in China, All the Ginseng in America Friday Quiz Pet Obesity The Origins of Carbonara Organic Farms Oil and Renewable Energy Human Diseases Wine and Alzheimers Biggest Consumers of Chocolate 2005-06 archives 2007 archives Essential Books The Misbehavior of Markets Boiling Point (Global Warming) Our Stolen Future: How We Are Threatening Our Fertility, Intelligence and Survival How We Know What Isn't So Fewer: How the New Demography of Depopulation Will Shape Our Future The Coming Generational Storm: What You Need to Know about America's Economic Future The Third Chimpanzee: The Evolution and Future of the Human Animal The Future of Life Beyond Oil: The View from Hubbert's Peak The Party's Over: Oil, War and the Fate of Industrial Societies Twilight in the Desert: The Coming Saudi Oil Shock and the World Economy The Solar Economy: Renewable Energy for a Sustainable Global Future The Dollar Crisis: Causes, Consequences, Cures Running On Empty: How The Democratic and Republican Parties Are Bankrupting Our Future and What Americans Can Do About It Feeling Good: The New Mood Therapy Revised and Updated Recommended Books More book reviews Archives: weblog April 2007 weblog March 2007 weblog February 2007 weblog January 2007 weblog December 2006 weblog November 2006 weblog October 2006 weblog September 2006 weblog August 2006 weblog July 2006 weblog June 2006 weblog May 2006 weblog April 2006 weblog March 2006 weblog February 2006 weblog January 2006 weblog December 2005 weblog November 2005 weblog October 2005 weblog September 2005 weblog August 2005 weblog July 2005 weblog June 2005 weblog May 2005 What's New, 2/03 - 5/05

|

|

Why China's Growth Is Not Sustainable May 31, 2007 There is a quasi-religious belief in some circles that China's current boom will last for decades. For those who seek facts rather than faith, consider the following excerpts from National Geographic's current article China's Instant Cities: (emphasis added) From 2000 to 2005, Lishui's population went from 160,000 to 250,000, and the local government invested 8.8 billion dollars in infrastructure for the region it administers. During those five years, infrastructure investment was five times the amount spent in the previous half century. In money terms, what was once 50 days' work is now done in one.Allow me to summarize: local governments must rip off peasants and fuel a speculative real estate bubble in order to fill their coffers. They currently have no other choice. This is the very epitome of unsustainability: a fiscal policy guaranteed to spark social outrage and guaranteed to bring on a speculative bubble's collapse. If it is now your religion that China's boom will extend for decades, then your faith is resting on some very tenuous threads of reality. These are just a few of many such pressing questions regarding the sustainability of the system.

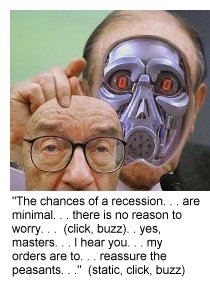

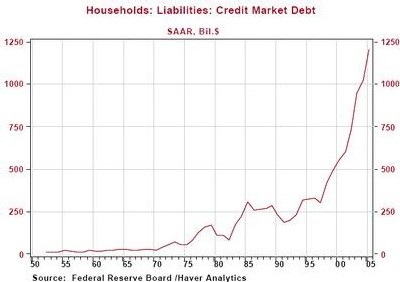

Frequent contributor U. Doran sent in two links describing the unsustainability of the Shanghai stock market: China Crash - domino effect on US markets (great charts) Shanghai stock bubble compared to Nasdaq bubble (stunning charts) Longtime correspondent Albert T. sent in this link describing the cooling real estate market in Shanghai: Shanghai eases land restrictions for foreigners: Concerned about a slowdown of contracted foreign investment, the Shanghai municipal government has eased restrictions to lure foreigners to invest in property development again, in a reversal of an earlier policy aimed at cooling down the real-estate sector.Albert summarizes the situation thusly: This is an interesting development. I smell a bubble bursting, and they need the final sucker to bail out the speculators (everyone).When everyone is a speculator playing with borrowed money, it's a mania/bubble, regardless of the nation or the era--and all mania/bubbles end the same way. If you need further evidence that the bubble in the Shanghai stock market is a mirror of the bubble in Shanghai real estate, consider this tidbit from Shanghai slump as China cools markets: An indicator of the widespread speculation gripping the Shanghai exchange came last month with a Chinese government website reporting that one in 10 maids in the city, China's financial capital, had quit their jobs to take up trading full time.When maids are quitting to play the stock market and local governments are relying on flipping stolen land to speculators, the mania/bubble is clearly about to burst. Maybe afterward, when people have lost their fortunes and their anger knows no bounds, then a more sustainable model of development will arise. Thank you Riley T. ($30.00) for your second generous and very unexpected donation. I am greatly honored by your ongoing support (and dystopian wit). All contributors are listed below in acknowledgement of my gratitude. If you found value here, perhaps you'd like to Your readership is greatly appreciated with or without a donation. Why Interest Rates Will Have to Rise May 30, 2007 This may be one of the most important entries of the year. I admit, it's not truly earth-shattering like the news of which airhead starlet has been arrested this week for a DUI on the Pacific Coast Highway, but since it's about money on a global scale, it might be of some interest (pun intended). Let's go through the standard reasoning about interest rates. One school of thought believes that the bursting of the global debt bubble will lead to deflation, and this will cause the Federal Reserve to lower interest rates in order to keep the bubble (borrow and spend) economy pumped up. The other school of thought foresees inflation or even hyper-inflation as the inevitable result of a hyper-inflationary monentary policy (easy lending, low rates, endless funds available for lending). To save what's left of the dollar, the Fed will eventually have to raise interest rates. What if both scenarios are missing the point? What if interest rates will have to rise regardless of inflation or deflation or the slowing economy? Let's start with a chart, courtesy of www.brillig.com (the debt clock). This is an inflation-adjusted depiction of the U.S. National Debt--the debt which has accumulated from years of massive deficit spending and borrowing from foreign entities. (The comments in black are mine.)

Do you notice the tiny little difference between the previous Bull Market era of prosperity (1946-1966) and the current era of "prosperity"? Hmm, this is a tough one. . . could it be those decades of massive, explosive deficits? What kind of "prosperity" requires borrowing trillions of dollars to sustain it? Can it even be called "prosperity" if a significant driver was borrowed money? Even during the "non-prosperous" Bear Market era of stagflation in the 70s, the nation didn't borrow much more than it had during boom times (adjusted for inflation, which rose in the late 70s and early 80s). For a comparison of that era and our own, let's turn to correspondent Mark P.'s recent observations: (emphasis added) I was reading this article on rising gasoline prices and started to think about the past, particularly the late 70s when I was a kid.Mark's commentary led me to this conclusion: the debt is already so large, the Treasury will soon have no choice but to raise long-term interest rates. To see why, let's look at another chart:

Notice how the Chinese central bank has ramped up its purchase of U.S. Treasuries to what is clearly an unsustainable rate. Before we go on, let's recall a few key points: The cliche repeated in the mainstream media is that China continues buying hundreds of billions of U.S. bonds every year as a "safe" investment." How "safe" is an investment which has lost 1/3 of its value in the past 5 years? (The dollar Index has fallen from 120 in 2002 to 82.) We all know the real reason China has been pouring the vast majority of its foreign reserves into Treasuries--to support low interest rates and therefore the purchasing power of the dauntless "borrow and spend" American consumer. The larger question is: how sustainable is a debt machine dependent on the fortunes and good will of one's trading partners? What could cause the Chinese to cease new purchases or to even start selling Treasuries from their horde of $1.3 trillion? (It's rising by about $125 billion a quarter.) Once the Chinese either decide to stop supporting the U.S. debt machine, or find they no longer can do so regardless of their desire, the market for low-interest rate Treasuries dries up. Yes, the Gulf states are big buyers, too, but there is no evidence they can double or triple their bond purchases to cover what China currently buys. How vulnerable are we? Very. One solution is to stop running deficits of $300 - $400 billion a year; that would be $400 billion less debt we need to find buyers for. But which of our elected officials would have to courage to cut $400 billion in spending? The real problem is the debt is already unsustainably large. Even if we as a nation stopped spending more than the government collects, the existing debt constantly rolls over and has to be refinanced. If money dries up globally, we are in a real pickle. With a negative savings rate, does anyone seriously believe we can fund our own deficit? And here's one more "follow the money" line of thought. Who gets hurt if the Treasury refuses to support the plummeting bond/dollar by raising interest rates? Joe Sixpack? Not really. How much does Joe Sixpack buy that is made in Europe or Japan? The Japanese nameplate vehicle he buys is actually made in the U.S.; only the profit is repatriated to the home country. If he travels outside the U.S., then the weak dollar will hurt his purchasing power--but how often does Joe Sixpack go to Europe or Japan? (Recall that the Chinese yuan is pegged to the dollar and does not fluctuate much even as the dollar tanks.) As for food--it's mostly priced in dollars. Ditto oil/energy, so a plummeting dollar will have little effect on Joe's purchase of these commodities (unless OPEC starts pricing oil in euros. Then it's Katie Bar the Door.) No, the big losers in a bond/dollar collapse are the wealthy. As documented here many times (via links to the Wall Street Journal), the top 5% of U.S. citizens own about 2/3 of all the stocks, bonds and real estate in the country. If the bond and/or dollar drops through the floor, their holdings will be worth a lot less globally--and the wealthy of the world are global players. So ask yourself: if our patsy trading partners are no longer willing or able to gamble all their surpluses on the dollar and Treasuries, or we have finally worn out our welcome in China and the Gulf so that politicians/bankers in those regions decide to stop supporting low interest rates in the U.S., then will our politicians really care about Joe Sixpack losing his bubble-priced home? The short answer is no. They will care about the wealthy, who fund their campaigns. Joe Sixpack doesn't even bother to vote (U.S. voter turnout is barely 40%; in the recent French election, turnout was 85%.) Yes, there will be tearful speeches and a lot of hot air expended about poor Joe, but when push comes to shove, the Treasuries have to be sold--there is no Plan B--and the wealthy's holdings in dollars will have to be defended. Joe Sixpack? Sorry pal, suck it up; you blew it signing that adjustable rate mortgage and paying bubblicious prices and tapping all your equity with a home equity line of credit. Too bad you believed all that mainstream media shuck and jive about interest rates staying low forever. Thank you Abrey M. ($25.00) for your generous and quite unexpected donation. I am greatly honored by your support. All contributors are listed below in acknowledgement of my gratitude. If you found value here, perhaps you'd like to Your readership is greatly appreciated with or without a donation. What to do about Health Care? May 29, 2007 Here is the one essay you need to read this year about healthcare in the U.S. It will change your perspective, for it offers contexts and solutions I've read nowhere else. I asked frequent contributor Michael Goodfellow to write down the many healthcare-related ideas we've shared via email, and he's written this perceptive, thought-provoking essay: What to do about Health Care? Here is the first paragraph: Charles asked me to write something about the health care system in the U.S., but before I do that, I should add a few words about my own situation. The opinions below could be read as a rant by some overpaid techie who has never been sick a day in his life. Sadly, that is not the case. I sustained a spinal chord injury at age 7, and have spent the rest of my life in a wheelchair. Long-term paralysis leads to other complications, and so I now have multiple serious conditions. I have seen more than my share of the health care system.For another "real world" window on our healthcare system, please read yesterday's entry, "The Test of a Nation." After pondering this critically important issue, you might enjoy an amusing serving of witty parody, Memo to the next UK Prime Minister by Protagoras. The Test of a Nation May 28, 2007 A Memorial Day thought: The test of a nation's commitment to its Armed Forces veterans is two-fold: how they are treated during a war, and how they are treated five, ten and twenty years later. With some 60% of Iraq War veterans experiencing some form of PTSD (post-traumatic stress disorder), I have to wonder if we as a nation will abandon the vets as soon as the war winds down, as occured after Vietnam. I hired many Vietnam vets when I was a builder in the early 1980s, not because they were vets (I didn't ask) but because they were looking for work. A number had psychological problems relating to their service in Vietnam; these problems included extreme withdrawal, outbursts of rage, and inability to concentrate. Others were drifting through their 30s, camping at the beach, while one set of brothers took their Mom with them wherever they found work. I rented a camper on the jobsite for their Mom and paid her a small sum to keep an eye on things. (She was one tough cookie; by her own choice she was armed, as she knew how to handle firearms.) Would the guys have been troubled even if they hadn't served "a one-year hike through the jungle" (one's apt description of his 'Nam duty as an infantryman)? Perhaps. Would the Veterans Administration facility on Oahu (Honolulu) provided sustained treatment for them? Perhaps. Did they even consider going in for treatment? Perhaps not. What I do know is that we as a nation shunned these vets, underfunded the VA system, and generally ignored PTSD or "blamed the victim" (aw, those guys are just whiners, etc.). I fear that once hostilities in Iraq wind down (for whatever reasons), the nation will quickly avert its eyes from the individuals who paid the price internally for their service and rush to cut the VA (and military readiness) budgets as the recession bites deeply into tax revenues. I hope we won't repeat the tragic cycle of postwar denial and abandonment suffered by many Vietnam-era vets, but I am not confident that our nation will choose to spend money to support our vets long after the war is over. I fear the powerful constituencies protecting entitlements (Medicare, etc.) and pork projects will raid the VA budget to protect their own turf. For you see, vets are not politically powerful; those who are suffering often do so privately. And you can be sure the puffed-up pundits who have glorified the war will be the first to forget the vets who actually served. Continuing on the theme of responsibility: Knowledgeable correspondent Nurse Dorothy offers an "in the trenches" reaction to the May 24 entry on health and healthcare. I believe her comments are extremely important, and speak to issues which are virtually ignored in the mainstream media and the halls of Congress. Here is the chart she refers to:

This is in regards to March 24th Health and Bankruptcy article. I know it's a little late in responding, but I just came off of a four day stretch at work. In that article there is a purple circle which says "I want a pill, blame someone else for my ill health". That statement screamed at me because it's so true. I have the perfect example.Thank you, Nurse Dorothy, for "plain speaking" to an issue we as a nation refuse to address: personal responsibility. Those of us who know working physicians and/or administrators in the "healthcare delivery systems" (i.e. hospitals and providers) know the medical malpractise system is utterly broken. Yet at the same time, I wonder if a class-action lawsuit might not be the only weapon vets will have to channel funding to the VA when its budget is slashed to protect more politically powerful government-funded fiefdoms. Responsibility is two-fold: as a nation, we are responsible for the care of those who served, especially those who served in combat. We must keep in mind two things: service is voluntary, and the orders to go to war come from our civilian, elected government, not the Pentagon or senior military officers. Therefore we as a people sent them to war, and we are duty-bound to take care of them, regardless of the war's outcome. As individuals, we are responsible for our own health. It will come down to this, readers: we can either fund our VA hospital system, or we can pay for irresponsible civilians like Nurse Dorothy's trigger-finger-on-a-lawsuit patient. There won't be enough money for both, and we as a nation will have to choose who gets our support. My vote will always be for full VA funding, above all else--even\ my own Medicare benefits, should there be any left when I qualify. Today, and every day, my thoughts are of our friends who are serving in Iraq. Words fail me; just look at this photo.

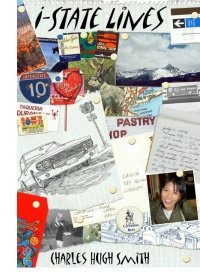

Thank you Michael S. ($25.00) for responding to my Memorial Day offer of a signed copy of my novel I-State Lines. I am greatly honored by your support. All contributors are listed below in acknowledgement of my gratitude. This Week's Theme: Why The Truth Can't Be Told Memorial Weekend Amazing Offer In keeping with this weekend's great theme--no, not sacrifice for the nation and liberty--you know it's "two days only! Blow-out savings!" marketing and sales-- I am offering an incredible value here relating to a numerologically significant event. In an astonishing show of support, 99 of you stalwart generous readers have donated money to this site in the past two months. Others have sent me boxes of their favorite peanut butter (after I noted the difficulty in finding an honest peanut butter unadulterated with hydrogenated palm oil or high-fructose sugar), a music CD by a favorite local musician, and a beautiful handcrafted wind chime designed to celebrate the U.S. Constitution.  In the spirit of blatantly cheesy marketing which dominates this weekend, I am offering the 100th

person who donates cash to the site a free collector's copy of my novel I-State Lines,

which is suitable for holding down paper on your desk or propping up a wobbly table. Please note

that the book costs me $10 from my publisher (yes, surprisingly, a highly honored small publisher

of literary fiction,

The Permanent Press of New York) and $2.13 media mail shipping.

In the spirit of blatantly cheesy marketing which dominates this weekend, I am offering the 100th

person who donates cash to the site a free collector's copy of my novel I-State Lines,

which is suitable for holding down paper on your desk or propping up a wobbly table. Please note

that the book costs me $10 from my publisher (yes, surprisingly, a highly honored small publisher

of literary fiction,

The Permanent Press of New York) and $2.13 media mail shipping.

If you read fiction, you'll enjoy browsing their current and past offerings on their website; you'll probably find something which fits your tastes in their selections, which often win literary prizes. Recently published works include the true story of a Boston Madam (yes, that kind of Madam), several family dramas, a Cold War story and a mystery set on Long Island. The actual value of my book may vary, depending on your acceleration and tire pressure; when viewed in a mirror, it may appear larger than in real life. Fluctuations in polarity may result during reading. Side effects include drowsiness; do not operate large complex machinery while reading. It's kind of cool to have a book personally inscribed by the author on your shelf; at least as a reader, I think so. For it creates an authentic connection between a mass-produced object (the book), the person who made it (the author) and the reader/owner. Those kinds of connections are rare in a "consumer society" where the value of an object is generally reduced to its price, utility and/or brand status. No wonder so many people feel dissatisfied and alienated; the more they shop, the more they buy, the more they own, the less they actually get. The objects they buy/own are simply grist for an empty cycle of buying, storing and then selling/giving away/disposing in the local landfill. There's not much connection left between the people who make objects of not-entirely visible value and the people who value them. If you're sick to death of marketing and hype but can't resist this fantastic, one-of-a-kind offer for the 100th reader who wildly abandons reason and sends in a donation, then Your readership is greatly appreciated with or without a donation. The Coming Bankruptcy of Government May 25, 2007  Waste and the Federal government are basically synonymous. The list is basically endless,

but just to hit the highlights:

Waste and the Federal government are basically synonymous. The list is basically endless,

but just to hit the highlights:

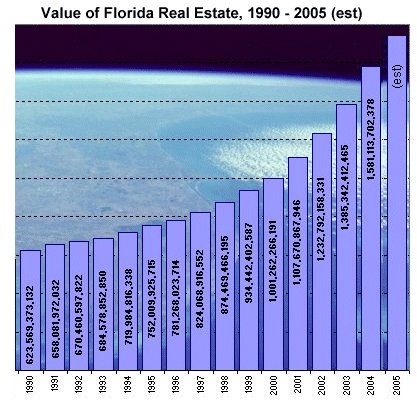

The above chart shows where all this is heading: national bankruptcy. Expenses (entitlements, Homeland Security, Defense, interest on debt) are rising far faster than income (tax payments) and will soon skyrocket beyond any hope of borrowing to fill the gap. In other words, blah blah blah. Nobody cares--yet. So let's turn our attention to local government, which is also teetering on insolvency nearly everywhere even at this peak of "prosperity." By local government I mean not just cities, counties and states but also school districts, municipal water systems, university systems, housing authorities and the vast array of other governmental bodies which live wholly or partially off tax receipts. For an aperitif, let's take a quick look at a few examples of the waste, fraud, "gaming the system" and insanely optimistic financial projections which are built into local government. Extra pay, perks continue to flow despite scandal; U.C. Officials override rules to give more than $1 million to 70 execs. Dead Tenants Get Low-Income Housing; City Blames Staff. The Berkeley Housing Authority has paid rent on at least 15 units where tenants are dead—as much as two years of rent on the deceased, failed to inspect units where substandard conditions exist, and allowed ineligible family members to “inherit” a unit ahead of others on the waiting list.Allow me to summarize: A city agency has been "troubled" i.e. incompetent, fraud-ridden, etc. for five long years before the city finally takes action. Then the employees and managers are rewarded for their fraud and incompetency with lifetime employment and rich lifetime benefits. Predictably, the public employee union is already threatening action against the city. Service Employees International Union 1021 officials said Wednesday they are seeking legal advice regarding the council action, as it may have violated workers’ contracts.In other words: there is simply no level of fraud or incompetency which public employee unions will not defend to the bitter end. Frequent contributor Albert T. sent in this story about a 65,000-employee public pension plan which is finally facing the realities of slower stock and bond market returns. The stupendous under-funding of public pensions is a little-noticed iceberg we as a nation are about to hit. The holiday's over: Regents' plan to reinstate contributions to pension plan is a watershed event for UCRP and its members Nationwide, the New York Times reported, "state and local governments owe their current and future retirees roughly $375 billion more than they have committed to their pension funds" by one estimate; that number balloons to $800 billion, it wrote, "if America's state pension plans were required to use the same methods as corporations." Public-employee pension funds are not covered by federal pension law, held to a uniform accounting standard, or protected by the PBGC; instead they're governed by boards with relatively little oversight, and must appeal to the taxpayers to fill the gap if they end up in the red.Many eyes on the pension prize: UC Regents' plan to restart contributions to the UC Retirement Plan (UCRP) in July 2007, following a 16-year "holiday" during which UC and its employees did not pay into the pension fund.Allow me to summarize the situation nationwide: The outsized gains in the stock and bond markets in the 90s infused managers of public pension funds with the irrational exuberance that such returns were now "normal" and could be counted on indefinitely. Therefore, most pension plans inserted wildly improbable annual returns in their projections. Alas, 16% annual returns turned out not to be normal but a brief aberration. In those heady days, so great were the returns that public employees didn't even have to contribute a dime to their own pension plans. Now they are up in arms because they actually have to contribute a small (1%-2%) amount of their salaries to their own pension plans. The debate now rages between those who want the pension fund to be "actively managed," which generates hundreds of millions in fees for outside financial management firms, or "passively invested" in index funds. Albert made this point about "actively managed" funds: Actually funny a little since we are on the topic there was an article review I did for one of my classes on an article from journal of finance about fund management. Basically 80% of funds fail to cover their fees and perform worse than the benchmark they pick. Only 10% of funds cover their fees with returns in excess of the benchmark. There was one funny thing in that paper: basically about 120+ funds did -5% per year or less but by luck alone only 60+ funds should have... So the others are there due to "skill".What nobody in the public pension world seems to address is the possibility--or even the extreme likelihood--that annual returns on their funds could be a negative number for years to come. Everyone seems to have forgotten that stocks and bonds can actually drop in value for years. What happens when the fund drops 16% per year for a few years, rather than grows by 16%? Longtime contributor Harun H. neatly summarized a similar "unvirtuous cycle" of declining tax receipts facing local governments: Despite a stock market setting “new highs” even states are struggling to make ends meet. What happens as property values continue to collapse forcing a downward readjustment of property taxes causing a drop in tax receipts followed by a sharp increase in unemployment causing an even greater drop in tax receipts, followed by sharply decreasing corporate earnings due to fall off in consumption causing an even greater decrease in tax receipts.Just how painful this cycle will be can be ascertained by looking at the phenomenal growth in property values (and thus property tax receipts) local governments have enjoyed. For example, Florida:

There is one more massive piece in the coming cycle of declining tax receipts: the destruction of small business. Correspondent Brian H. files this report, which all of us self-employed /small business proprietors can instantly relate to: It’s not just healthcare, it’s all the endless mind-numbing rules by our beloved nanny-state government.Every year we pay over $1,000 "city business license" for the stunning privilege of operating a legitimate business in this city. This is a percentage of gross income, not net, meaning if you are losing money, the city doesn't care: you pay them first out of gross income. This kind of "junk fee" which returns absolutely no benefit, and which seems to rise by leaps and bounds every few years (the city just raised another small-business tax by about 30%) is rife in local government. And do you know the predictable result? Small businesses are closing, going out of business. If you don't think this is a reality, you need to get out more. And with the loss of those tax receipts, you also lose jobs. The media loves to focus on big corporations, but the real engine of employment growth is small business. Once you strangle that sector with rules, fees and taxes, then you've strangled both your tax and employment base. Astute observer/correspondent Riley T. sent in a report which nicely summarizes the two issues of unaffordable/underfunded public pensions and the wearing down of small businesses: I know this will sound crazy but I wonder if there really is something in the water. No one seems to care about what's going on. I can't find anyone I know personally that can even imagine that something could go wrong. A good friend has a navy pension, a California state pension and Social Security it is impossible to get him to even think that something might go wrong. I have a nephew who had saved up $6500 and he used every penny to buy a juke box.So why don't we read more about these issues? We can only speculate, but the fact that the print media itself is largely unionized may have something to do with the limited coverage of public pension plans and local government fraud/waste/gaming the system. Since the reporters and editors are union members, their sympathies rather naturally reside with public employees, not with the small businesses which ultimately support the local government with direct taxes and the jobs which also generate taxes. Now let me state yet again that many public employees I know are hard-working, conscientious people whose offices are chronically understaffed. The problem is that the system--the agencies and their unions--enable or even encourage incompetent/lazy workers to "game the system" to milk maximum pension and retirement benefits. And what kind of work ethic and productivity do you engender when employees know they can never be fired, no matter how much they rip off the public they supposedly serve? To claim this is not a pervasive, deeply eroding problem is to simply be in denial. So when will these issues gain attention? When local governments start declaring bankruptcy to get out from contracts that are no longer affordable, when pension plans fail, and when tax receipts plummet. But we're not there quite yet; perhaps 2008 will be the first year of reckoning. Until then--The Truth Can't Be Told. Except perhaps on page B-27, every once in a while, without charts, graphs or splashy headlines, just a boring little sidebar no one notices. Thank you Michael M. ($16.00) for your unexpected and generous donation. I am greatly honored by your continuing support. All contributors are listed below in acknowledgement of my gratitude. If you found value here, perhaps you'd like to Your readership is greatly appreciated with or without a donation. This Week's Theme: Why The Truth Can't Be Told Health, Healthcare and Bankruptcy May 24, 2007 If I were a small-business employer, I wouldn't hire myself. Why? I'm over 50. Maybe I'd hire myself for cash, more or less like a day laborer; but as an employee with healthcare and other benefits? Are you insane? The healthcare premiums are over $1,000 a month. Would I hire a guy or gal with three kids? Heck no, same reason. Bennies cost too much. Would I hire a diabetic or person with chronic health conditions? No way. Would it make financial sense for me to hire a no-benefits contract worker, or a "non-legal" worker for cash? Absolutely. Some readers have pointed out that employee healthcare costs are not an issue to global companies like Exxon, but the truth is large multinational corporations have been shedding jobs in the U.S. in favor of foreign-based workers for years. This is largely the result of global reach--it only make sense to grow your workforce where your markets are also growing--but I doubt Intel et. al. are entirely impervious to rising medical and pension costs in the U.S. For a snapshot of an ailing U.S. company in an ailing industry, consider these "legacy costs" for auto maker Chrysler: In for an overhaul. Cerberus Capital Management, a New York private equity firm, will pay $7.8 billion for the iconic automaker, with almost all of that going to recapitalize Chrysler.That $30/hour isn't wages--the Japanese aren't paid $10/hour and the U.S. worker paid $40/hour. It's the "overhead" costs for medical insurance, pensions, vacation, sick-leave, etc. It's painfully obvious that the only way Chryler will survive is if the $18 billion in pension obligations and the ongoing billions to pay for generous healthcare and other benefits are slashed/eliminated. The heading-for-bankruptcy "healthcare" system in the U.S. is the elephant in the room no one wants to talk about when it comes to "saving or creating jobs" in the U.S. Capitalism can be boiled down to this: capital will flow to the highest returns. Once the burdens of healthcare, sick leave, etc. become too onerous then capital will leave for higher-return climes and businesses. So let's get real. The decision for global corporations isn't between jobs in the U.S. and China--it's between expanding the workforce in China or India, Vietnam, Poland, Brazil, etc. It's also inaccurate to keep talking about cost, as if the problem with healthcare in the U.S. was simply money. It isn't. It's an entire system of ill-health:

I have discussed the packaged food industry's game of shuck-and-jive when it comes to labeling the food you're eating: "organic" peanut butter loaded with hydrogenated palm oil, the high-fructose sugar laden bottled beverage which contains "two servings" as a way of making the calorie count look reasonable, and on and on. Pet food is much more accurately labeled than human food. I have also discussed how our built environment is not condusive to walking and biking--the easiest ways to get some exercise. The waste, fraud and poor results which result from a litigious, ill-informed, profit-driven society's attempts to "fix" poor health with pills and surgery is too well documented to be worthy of elucidation. Everybody knows this but no one wants to make the sacrifices/trade-offs necessary to get past these barriers. So we're left arguing about how to pay for a broken system which is heading off a cliff of fiscal insolvency. Rather than talk about reality--that the broken, inefficient, ever-more-costly "healthcare" system is a key driver in why good jobs are disappearing in the U.S., we argue about details--the classic "rearranging the deck chairs on the Titanic"--as if a cost-based debate will solve poor diet, unhealthy food, sedentary, passive "consumer" media-centric lifestyles, greedy pharmaceutical companies, public hospitals hovering on the brink of financial disaster, and a host of other ills of our system too long to even list here. So why can't we have an honest discussion of the many causes of this catastrophe? The answer is profit: the immensely profitable web of the food industry, the doctor-owned clinics, the drug companies, the paper-pushers who bilk Medicare, the public "healthcare" companies, etc. If the system were revolutionized to make health an incentive rather than the current system in which ill-health is "the profit center," then all the profitable apple carts would be overturned. And that is Why The Truth Can't Be Told. Here's one more chart for your review:

Thank you Jon H. ($50.00) for your unexpected and extremely generous donation. I am greatly honored by your continuing support. All contributors are listed below in acknowledgement of my gratitude. This Week's Theme: Why The Truth Can't Be Told Ugetsu: Greed Is Not Good May 23, 2007 One of the great pleasures of studying another culture in depth--its language, geography, history, literature, food and film--is the discovery of universal truths through a different lens.  With that flourish, I introduce the 1954 Japanese film

Ugetsu

With that flourish, I introduce the 1954 Japanese film

UgetsuOne reason is the movie's haunting visuals (in glorious black and white); once you've seen the film a few times, you may be hard-pressed to pick your favorite sequence; mine is the two "heroes" deathly quiet voyage across the mist-bound lake. But the deeper reason why this is such a compelling and unforgettable movie is its unerring depiction of the destructive force of human greed. Greed is a "standard-issue emotion, human being 1.0"--we all know the sensation of desiring wealth, power and prestige. What's changed is that where greed was once a Mortal Sin, it is now an unalloyed Good Thing. Just for your review, here are the seven deadly/mortal/cardinal sins: It doesn't take a theology student to note the over-arching theme of greed/unlimited desire for more than one's fair share in this list; what is pride but the desire to display the results of your greed? What is envy but thwarted greed? What is lust but sexual greed? What is gluttony but greed for food? Just how greedy has our culture become? Item 1 for the prosecution: hedge fund managers are making up to $1 billion each (average is $360 million for the top 10): Who's Getting Alpha? (February 15, 2007) Item 2 for the prosecution: LUXE POPULI: Spending for luxury items is increasing four times as fast as overall expenditures as ordinary Americans go for the gold. It's instructive to consider the $1 billion some financial manipulator earned for producing no goods or services with someone who is worth a $1 billion as a result of creating goods and services which generate jobs, value and tangible wealth--say, Steve Jobs. Leaving aside his personality--by most accounts abrasive, abusive and volatile by turns--let's recall what created Mr. Jobs' great wealth: the desire to build something which was "insanely great." This he went on to do, with plenty of help from PARC, Mr. Wozniak and many others. Nonetheless, his zeal was not purely financial greed. This used to be the Standard Issue American Dream: to create great wealth via hard work or innovation or some combination of the two. This vision quest has now been reduced to pure greed for wealth or status by any means. Many observers find this "greed is good" ethos best represented by the Reagan-era film Wall Street Hmm--sound familiar? Examples abound in all cultures. Look no further than the Chinese stock market mania currently playing out in the Shanghai Composite. For a chart of that madness, go to Mish's recent post (recommended by U. Doran). One consequence of the "greed is good" mentality which has infected the entire globe is that we are essentially eating our seed corn by feasting today. In the U.S., one way common manifestation of this is the extraction of most or all of the equity (savings/wealth) from one's house via home equity lines of credit (HELOC) or mortgage equity withdrawals (MEW) to spend or "invest" (speculate). Schahrzad Berkland, proprietor of the California Housing Forecast describes the phenomenon succinctly: You're right on with the MEW (mortgage equity withdrawal). My realtor friend who lives on the water in (San Diego), has gone through tax records and found lots of MEW among her neighbors. Some of her neighbors almost paid cash for their homes 10-20 years ago, and then took out $1 mil loans! One of the people with a $1 mil MEW drives a $150K sports car. I suspect they used that money for investing...why would someone who was frugal their whole life all of a sudden go on a spending spree though? Maybe some of the money went for investment property?Back to Ugetsu. I won't ruin the film for you--well worth renting, and yes, it's subtitled, but you'll soon forget that--but the heart of the story is two brothers' desire to get rich in a time of civil strife by leaving their poor but loving families. The fundamental illusion--that wealth will bring happiness--is illustrated with a supernatural story element which will take you by surprise. Alas, the brothers discover the hard way that greed brings not happiness but destruction of all that was good in their lives, all that mattered, all that was valuable, all that was genuine. When will we re-discover this as a culture/people/species? We all know why Greed Is Currently Good: because consumer and speculative greed is immensely profitable. And that is Why The Truth Can't Be Told. Check out 10 new readers' commentaries on a wide variety of topics, and their many excellent link and film recommendations--just click on Readers Journal in the upper right sidebar. Also read "Memo to the next UK Prime Minister," a tongue-in-cheek proposal on a topic near and dear to all of us--taxation. Thank you Anton L. ($40.00) for your unexpected and very generous donation. (And you bought a copy of my novel, too!) I am greatly honored by your continuing support. All contributors are listed below in acknowledgement of my gratitude. This Week's Theme: Why The Truth Can't Be Told The Future Shortage of Energy May 22, 2007 Longtime contributor Riley T. checked in recently with a cogent summary of Peak Oil and its consquences: I would like to start with my observations about how humans process information. When something enters the mind the first thing we do is compare it to similar things from our past, then we compare the new thing to the similar things and look for differences. We compare and discriminate to process new information. If we treated all new information as unique we would over load and brain freeze ( technical term ). This works most of the time.

Frequent contributor U. Doran just happened to send in a link describing the decline of Saudi Arabia's largest oil field: Depletion Levels in Ghawar, Saudi Arabia (Updated) He also recommended a wide-ranging essay which ties Peak Oil into a larger context of human folly: Busy Bee Bugaboo and another Unsuspected Agent of Doom. And this coverage of looming resource wars over oil: China and USA in New Cold War over Africa’s Oil Riches Darfur? It’s the Oil, Stupid... Correspondent Michael Goodfellow recommended a fascinating piece on energy and politics: Media Ignore European Energy Politics to Advance Global Warming Alarmism. Michael selected the following passage as being worthy of note: Swiss experts expect first shortfalls in electric power supply to occur within the next five years. And the energy department in Bern is already busy working on a so-called cut-off plan. Electricity suppliers are already counting on periodic power cuts to entire towns and industrial zones within the next years. Today we cannot begin to imagine twelve hour power cuts in entire cities like Zurich or Frankfurt.  Michael also sent along this story on the decline of the U.S. oil industry,

A Wildcatter Pounces .

Michael also sent along this story on the decline of the U.S. oil industry,

A Wildcatter Pounces .

And now, connect the above dots to this story: High gas cost won't drive away buyers of big SUVs After 2-year slump, demand rebounds. And that is Why The Truth Can't Be Told-- at least not by the mainstream press or broadcasting empires. Thank you Rebecca T. ($20.00) for your unexpected and quite generous donation. I am greatly honored by your support. All contributors are listed below in acknowledgement of my gratitude. This Week's Theme: Why The Truth Can't Be Told Why China Is Being Scapegoated May 21, 2007  We're tackling a big topic today with lots of charts: Why Congress is scapegoating

China. Here's the issue in a nutshell. We all know the U.S. runs a big trade deficit with

China, a deficit which is growing. (As this chart shows, we also maintain a deficit with

Japan, Germany, the EU and virtually every other trading nation.)

We're tackling a big topic today with lots of charts: Why Congress is scapegoating

China. Here's the issue in a nutshell. We all know the U.S. runs a big trade deficit with

China, a deficit which is growing. (As this chart shows, we also maintain a deficit with

Japan, Germany, the EU and virtually every other trading nation.)

The problem, our astonishingly stubborn elected officials believe, is that China's currency, the renminbi or yuan, is undervalued. China pegs the yuan to the dollar; a few years ago it was 8.25 to the dollar, and now it's under 8. Congress apparently believes those who say the yuan is undervalued by 40%--meaning it should be about 5 to the dollar. If this came to pass, then Black and Decker would instantly move their factories from China back to the U.S. as it no longer made financial sense to have factories in China. This is so wrong-headed it boggles the mind. First, Black and Decker et. al. have factories in Asia because that's their fastest growing market. It makes sense to make stuff there--and many of the components are made there, too. Second, wages in China could rise 40% (via the currency devaluation Congress so keenly desires) and that would mean the factory wage of $200 per month would rise to $280--compared to an average U.S. wage of $3,000 (don't forget the mandated benefits and healthcare). Did anyone notice that unemployment in the U.S. is at multi-decade lows of 4.5%? Is "saving jobs in America" really our most pressing issue? And how does devaluing the yuan actually "solve" that problem? All it does is make Chinese products 40% more expensive to U.S. consumers.  If you're making widgets in China, are you moving the factory back the America now? No, you're squeezing your

Chinese suppliers to find 30% cuts in production costs, or moving the factory to Vietnam, where the

average wage is $150/month. As this chart reveals, U.S. corporate profits have been on an

absolute tear during the rise of the trade deficit with China, skyrocketing to the unprecedented height

of $1.3 trillion--fully 10% of total U.S. GDP. Gosh, do you think there's a connection?

If you're making widgets in China, are you moving the factory back the America now? No, you're squeezing your

Chinese suppliers to find 30% cuts in production costs, or moving the factory to Vietnam, where the

average wage is $150/month. As this chart reveals, U.S. corporate profits have been on an

absolute tear during the rise of the trade deficit with China, skyrocketing to the unprecedented height

of $1.3 trillion--fully 10% of total U.S. GDP. Gosh, do you think there's a connection?

Of course there is. You know that $200 iPod that's made in China? Well, about $20 stays in China, because the factories assembling the iPod are owned by Apple, and many of the components are made in factories owned and operated by Taiwanese, Korean and Japanese corporations. China owns very little of the supply chain for the iPod. Manufacturing in hyper-competitive China is a low-profit venture; as I have posted here before, BusinessWeek stated that average profit margin for manufacturers in China is 1%-3%. Did Steve Jobs become a corporate god by generating profit margins of 2%? No. The real meat of the money--the $180 of the retail price--goes to Apple (huge profit margins), the wholesalers /distributors, and the retailers--all in the U.S. But does Congress even "follow the money" in the real world? Clearly, no. With a gracious thank-you to Mish, here is a link to Stephen Roach, Economist for Morgan Stanley, stating that Congress is in no mood to listen to reality; across both parties, politicos have already decided the solution to America's ills: Past the Point of No Return. Correspondent James C. recently contributed this observation to the Readers Journal:

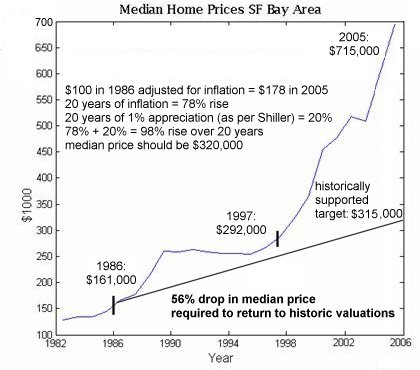

I have some strange measures of the American consumerism patterns. I count self storage buildings in the areas that I travel and also monitor how many bags of trash people take out on trash day. (I have never claimed to be normal) There is some virtue to this kind of study. One has to purchase, and then throw away, a lot of stuff to have 5-6 bags of trash at the curb each week. Our household consists of my wife and myself. We usually have one bag of trash each week. Across the street is a household consisting of a husband and wife and they generally have at least 5 bags of trash. Are they 5 times as happy as Barbara and I?As this chart reveals, Americans are saving not just zero, but actively spending money they don't have--a negative savings rate. The only other instance where Americans drew cash from savings was during the Great Depression. But we're living in a time of "prosperity," remember?  So where is all this wealth that consumers are spending so freely coming from? From

the extraordinary rise of real estate values in the U.S. As this chart shows, real estate

assets as a percentage of U.S. GDP has reached unprecedented heights. (That's a phrase which gets

repeated here often.)

So where is all this wealth that consumers are spending so freely coming from? From

the extraordinary rise of real estate values in the U.S. As this chart shows, real estate

assets as a percentage of U.S. GDP has reached unprecedented heights. (That's a phrase which gets

repeated here often.)

To view charts showing unprecedented consumer debt accrual via re-financing ( a.k.a. "the housing ATM"), please scroll down to the entry of May 11.  Lest you think U.S. consumers are profligate wastrels while Congress is a gleaming tower

of fiscal virtue, consider this chart. Yes, that's bankruptcy looming on a national scale--

mandated expenditures (entitlements like Social Security and Medicare, and debt on the national

interest) will soon balloon so far above tax receipts that even the profligate borrowers in

Congress and the White House will be unable to borrow enough money from the rest of the world to

fund the gap.

Lest you think U.S. consumers are profligate wastrels while Congress is a gleaming tower

of fiscal virtue, consider this chart. Yes, that's bankruptcy looming on a national scale--

mandated expenditures (entitlements like Social Security and Medicare, and debt on the national

interest) will soon balloon so far above tax receipts that even the profligate borrowers in

Congress and the White House will be unable to borrow enough money from the rest of the world to

fund the gap.

The problem isn't the (often American or Japanese/ Taiwanese/ Korean-owned) factories in China or the yuan--it's that Americans save nothing and spend borrowed money lavishly. If you need proof, please read LUXE POPULI Spending for luxury items is increasing four times as fast as overall expenditures as ordinary Americans go for the gold. But like the distracted yuppie parent who can't bear to rein in their bratty, irresponsible child's excesses, Congress dares not tell the American public that they need to spend less and save more. But Why?  Here's the answer: the bankers would stop making money.

Here's the answer: the bankers would stop making money.

I can already here "free marketers" howling in outrage at my fingering bankers, but let's look at reality as carefully described in last week's BusinessWeek: The Poverty Business: Inside U.S. companies' audacious drive to extract more profits from the nation's working poor. Here's how it works: find people are who are poor credit risks, then offer them some credit--at an outrageous price and profit margin. What choice do they have? Basically none. Federal Reserve data show that in relative terms, that debt is getting more expensive. In 1989 households earning $30,000 or less a year paid an average annual interest rate on auto loans that was 16.8% higher than what households earning more than $90,000 a year paid. By 2004 the discrepancy had soared to 56.1%. Roughly the same thing happened with mortgage loans: a leap from a 6.4% gap to one of 25.5%. "It's not only that the poor are paying more; the poor are paying a lot more," says Sheila C. Bair, chairman of the Federal Deposit Insurance Corp.Did I mention that "you owe us forever" Sally Mae was recently bought by a private equity firm? I wonder why--could it be the debt which even bankrupcty can't trim? And who muscled that bankruptcy law through a complacent Republican-ruled Congress a few years ago? Your friendly U.S. bankers. If you foolishly believe the bankers have no political influence, I advise you to study the bankruptcy laws. Contributor/blogger/attorney Fred Roper can help set you straight on just how pernicious and anti-consumer rights this "bankers law" truly is. And if your naivete needs more bashing, please read this from the S.F. Chronicle Bankers oppose fee, rate limits.  The chart above shows how banks have become extraordinarily dependent on mortgages

for their profits (total earning assets).

The chart above shows how banks have become extraordinarily dependent on mortgages

for their profits (total earning assets).

This chart depicts how housing has become the linchpin for the American homeowner: the value of housing as a percentage of disposable income has skyrocketed to--you guessed it--unprecedented heights. So let's add all this up. Bankers are making vast, unprecedented fortunes selling debt to Americans--mortgages and home equity lines of credit to homeowners, mortgage-backed securities to investors/speculators, and sky-high consumer debt to subprime/low-income consumers. Meanwhile, back at the ranch, American corporations have exploited cheap manufacturing in China to reap record levels of profits--fully 10% of the entire U.S. GDP is corporate profit. The essential ingredient in all this stupendous profiteering is, of course, the American consumer's debt and spending binging. And that's Why The Truth Can't Be Told. If Americans were told that their profligate spending is the problem, and saving more is the answer, then guess what? Fewer loans and debt equals contracting profits for banks, and more savings means contracting sales and profits for U.S. retailers, manufacturers and the entire supply chain. In other words, the profit party stops. So let's blame China instead. Here is the permanent link to this entry: Why China Is Being Scapegoated. Thank you Jonas H. ($50.00) for your unexpected and very generous donation--the first I've received from Down Under. I am greatly honored by your support. (Non-Sequitur/Footnote: the most delightful airline passenger I've ever had the pleasure of sitting next to was a young gal from Oz. Impossible not to love her, her manner of speaking, and her breezy wit.) All contributors are listed below in acknowledgement of my gratitude. If you found value here, perhaps you'd like to Your readership is greatly appreciated with or without a donation. Is This 1972 Redux--or 2000? Or Some of Both? May 19, 2007 First up: some logistics. The Readers Journal has finally been updated, and there's a wide variety of smart thinking on elites, taxes and dirt (seriously). Without healthy, living dirt, we'd all starve. And recovering soil that's been paved over is very difficult. Click on the links to your right for commentary you won't get on namby-pamby mainstream media sites or ideologically "pure" sites that "preach to the choir." Here every thoughtful opinion is welcome--Libertarian, Republican, Democratic, Anarchist, Buddhist, Taoist, Animist, you name it. (I praised Nixon here a few days ago, and you can't get more un-PC than that.) Reader Aaron O. quite rightly asked why I don't have an RSS feed for each full entry, and I need to mention that I've set up a "mirror site" on Blogspot which you can read in its entirety with Google Reader or equivalent. My apologies for not mentioning it sooner. I still hand-code an RSS and Atom summary, but if you prefer to see the whole enchilada, then switch to the Blogspot page, which I update daily. (Some charts are missing, as the formatting is funky. But you can easily click over here to see the charts.) Astute reader Matt V. posed a deeply fascinating question which I'm going to swing at (and probably whiff): While I'm writing you emails, I thought I'd bounce something off of you concerning your thoughts that we're careening toward a depression in the next decade ... Looking around I can't help but agree that these "good times" can't last forever. I'm dumbfounded how housing prices can double in a few years and everyone just accepts it as normal market forces. I keep waiting for tougher times to set in, yet somehow they have lasted without a serious recession since the 1970's. So, I'm in agreement with your writings that things aren't what they seem, and it won't last. I mean, the parallels to the 1920s is startling! However, this little voice in the back of my mind wonders if things won't turn out like anyone expects.I'm going to start my response with a chart:

As we now know, Greenspan's warning was valid. But it took three years for the market madness to reach its final zenith. Every year that the tech euphoria continued, the chorus of doubters/naysayers grew larger. Warren Buffet famously avoided the tech sector, and ended up apologizing to his shareholders in 1999 for not matching the returns reaped by momentum players in that mad year. But the doubters were right--it just took time for a market disconnected from reality to revert to the mean, or cycle back to fundamentals. As for the current fundamentals--please scroll down to the entry of May 11, 2007 for a chilling snapshot of an economy of consumers (70% of the U.S. GDP is consuemr spending) which has been dependent on debt to fuel "prosperity." The consumer's ability to acquire and support ever more debt is clearly nearing the end of a debt-bubble cycle. The only possible outcome is reduction in borrowing/lending, reduction in spending, reduction in GDP and reduction in corporate profits which necessarily means a contraction in price-to-earnings ratios--a fancy way of saying the stock market has to tank as earnings wither. So it seems anticipating a financial return to reality (i.e. a downturn brought on by reduction of lending/borrowing) does not preclude that downturn from happening--though it is always wise to ask: what else might happen? I think the charts posted on May 11 provide little support for any other future but contraction/recession.

Erudite reader Brian H. weighed in with a somewhat related commentary comparing 2007 with 1972: (photo is yours truly in 1972, starving philosophy student) You ever sit back and think which year 2007 is similar to?Interesting parallels. My only suggestion would be to say the stock market is like 1973, at a peak within the secular Bear market which started in 1966 (or in our era, 2000). As noted here in previous entries, this 7-year peak also occured in 1929-1936, as well as 1966-1973. Therefore history suggests the current "new market high" will be the last one for some time to come. I would also note that the 1972 "Christmas bombing" of Hanoi and the mining of Haiphong Harbor finally led the North Vietnamese to the bargaining table. Why? The U.S. had long been wary of triggering Chinese or Soviet involvement in the Vietnam War (even though Russians were piloting supposedly North Vietnamese MIG fighters) and as a result avoided hitting Hanoi or Haiphong Harbor, where a decoy Soviet freighter was always tied up to discourage any such attack. After four years of losses and political intransigence, Nixon and Kissinger finally tired of this "limited war" gamesmanship, and they made the calculation that neither China nor the U.S.S.R. would open a wider war if they went for the North Vietnamese jugular. The North Vietnamese had Soviet SAM-3 anti-air missiles, which knocked down many U.S. B-52s. But the war of attrition was won by the U.S., for with the harbor mined and the re-supply of SAMs cut off, the North Vietnamese soon expended their missiles. At that point they were in danger of losing their capital, their dikes, and whatever infrastructure was being enjoyed by the political elite. Within a matter of days, they basically sued for peace. As a further footnote, the surrender of South Vietnam two years later in 1975 might not have been as preordained as is widely perceived. For the U.S. Congress had cut off funding to the South Vietnamese, a move President Ford could not stop. Without the financial means to fund a military response to the armor (tanks) of the well-supplied North Vietnamese army, then the cut-off of funding was equivalent to surrendering South Vietnam. Was it good policy to cut off funding? Was it "worth it" to fight the war, or end it by ending financial support of South Vietnam? History can't be replayed; maybe the corrupt South Vietnamese regime was doomed, regardless of U.S. airpower or re-supply of weaponry. That is open to debate--a debate made sharper by the current political battle over ending funding of the war in Iraq. Thank you, Matt and Brian, for thought-provoking commentaries. Thank you David S. ($25.62) for your much-appreciated donation--and the explanation that it represented the Nasdaq (2562). Very clever! I now hope the Nasdaq quickly returns to 5,000! Seriously--I am greatly honored by your support. All contributors are listed below in acknowledgement of my gratitude. The Moon's a Balloon--And About to Pop May 18, 2007

The seemingly inexorable rise in the U.S. stock indices is one of Nature's most perplexing mysteries. How does the economy weaken? Let me count the ways... housing is tanking, consumer spending is tanking, even the manipulated/phony consumer price index is rising at nearly 5% a year, gasoline is getting more expensive by the day, job "growth" is utterly bogus--but so what, the market keeps rising anyway. Ever wonder why? Well, here's your answer: so insiders can dump all their shares at the top to unsuspecting buyers who unwittingly believed the phony hype about how leveraged buyouts and the magic elixir of liquidity would support higher stock prices for the foreseeable future. Oh, and the Fed will be lowering interest rates real soon, too . . . For a view of reality as opposed to fantasy, look at the number of shares being bought by insiders (if you're an insider, and you know the stock will be rising, you buy before the public catches on) and insider sales (insiders are selling because why? They know the price will be skyrocketing soon? Hahahahaha.) My good buddy "Huevos" over at "Changos Teahouse of the Almighty" provided this summary of insider buying and selling. This metric is closely watched, because it is obvious that insiders know the prospects of their company and industry better than mere "investors"; thus if they're selling, it does not bode well for future stock market gains. In Wall Street lingo, this is called "distribution." When insiders are buying, it's called "accumulation." This is clearly distribution, on a stupendous scale.

This data makes you ask: if things are so great, why are insiders selling vast quantities of their shares and buying virtually nothing? Even in good times, insiders sell more than they buy, as stock options and grants give them "free shares" to sell. But the ratio of sells to buys is 1-to-1 or 2-to-1 in good times, not 100-to-1 or 200-to-1. Frankly, I think the "buys" in media (32,000 shares, industry-wide), Utilities (106,000 shares, industry-wide), Industrials (496,000 shares, industry-wide), transportation (250,000 shares industry-wide) and technology (1.3 million shares, industry-wide) were mistakes. An insider meant to click "sell" but accidentally clicked "buy"--a mistake that was quickly corrected. The source is Thompson Financial and the Wall Street Journal market data group. Thank you Tommy B. ($5) for your much-appreciated donation. I know it was a sacrifice for you, being a student, and I am greatly honored by your support. All contributors are listed below in acknowledgement of my gratitude. A Short Meditation on Vineyards May 17, 2007